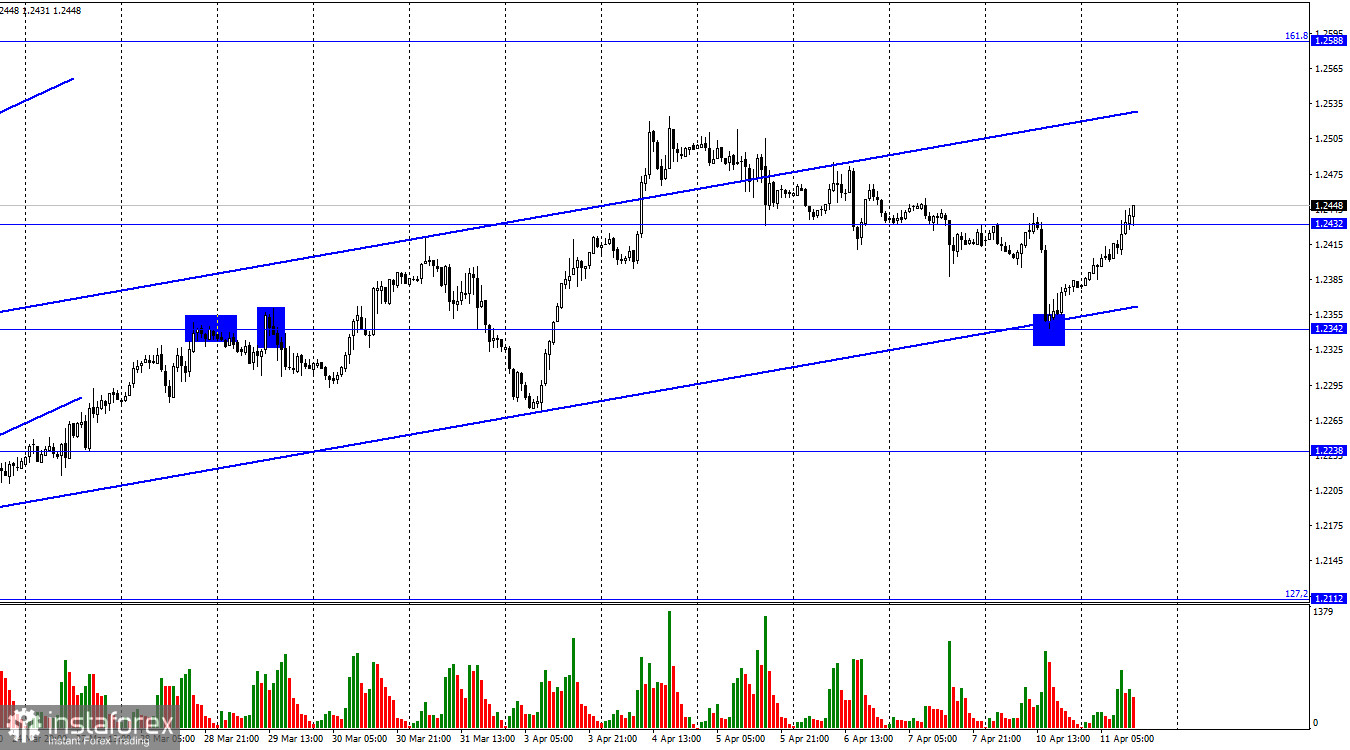

On Monday, GBP/USD dropped to the lower line of the ascending channel and the 1.2342 level on the 1-hour chart. A rebound from these levels initiated a new rise in the British pound. At present, the sterling has reached the 1.2432 level. GBP/USD will go deeper only if the price closes below the ascending channel, which currently characterizes the traders' sentiment as bullish.

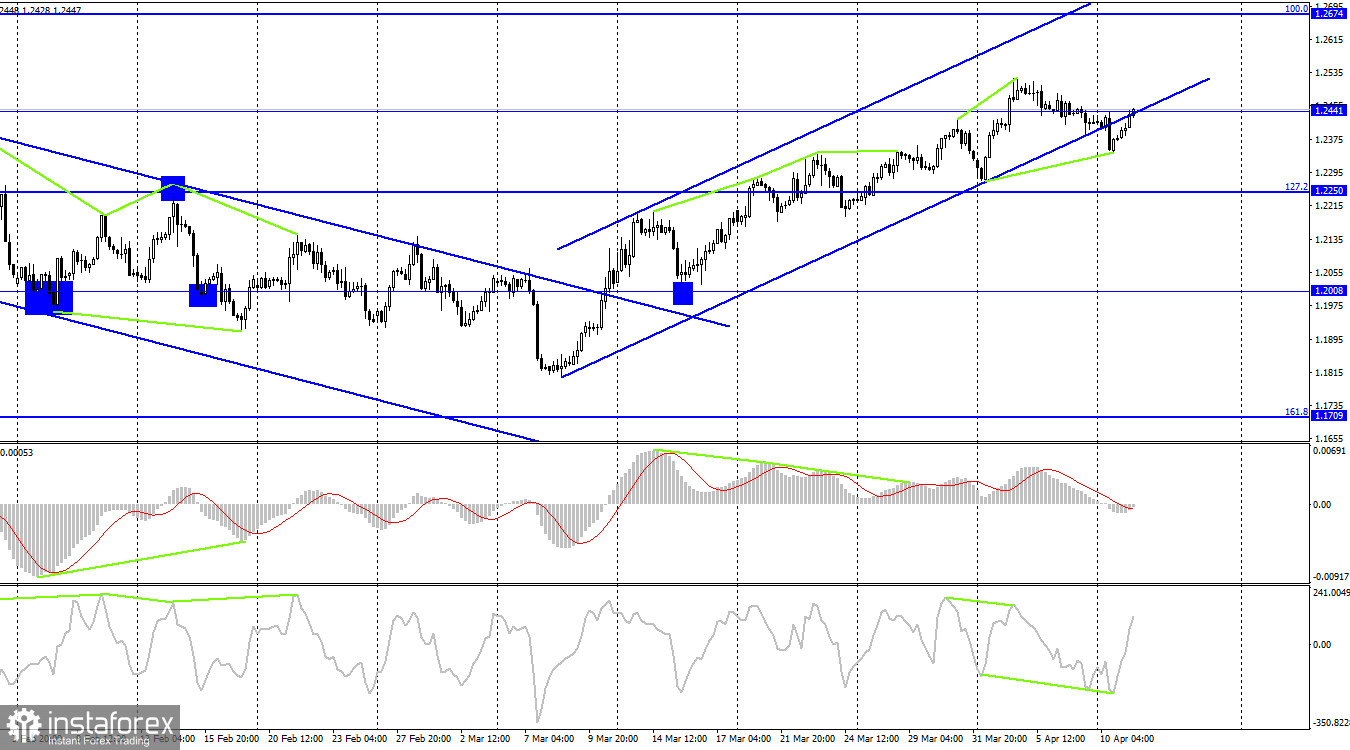

On Monday and Tuesday, the economic calendar was empty. There were no significant reports either in the UK or the US. Therefore, the movements we observed yesterday and today were actually good as the pair could have been trading flat instead. The outlook for the British pound is vague at the moment. If we focus solely on technical analysis, a rise seems more likely. The pair is unlikely to move higher on the 4-hour chart as it has already left the ascending channel. Thus, in the near future, I expect a new test of the lower boundary of the channel on the H1 chart with a close below it. In my opinion, the sterling has already reached its upside potential. The latest reports from the US show that the economy is in good shape, with no hints of a recession. The unemployment rate is stable, and the labor market is consistently adding new jobs. Inflation is decreasing each month, and the interest rate remains at its maximum level and may increase by at least 0.25% this year. I believe this is an excellent ground for the US dollar's growth. The British pound, on the other hand, has significantly fewer factors to support it. At the same time, the pound has been showing impressive growth in recent weeks. I think it will reverse very soon.

On the 4-hour chart, the pair consolidated below the ascending trend channel. However, the bullish divergence of the CCI indicator allowed the price to return to the 1.2441 level. A rebound from this level will favor the US currency. If so, the pair will resume a decline towards the 127.2% Fibonacci level at 1.2250. If the price settles firmly above 1.2441, bulls will be back in the market to resume growth towards the 100.0% retracement level at 1.2674.

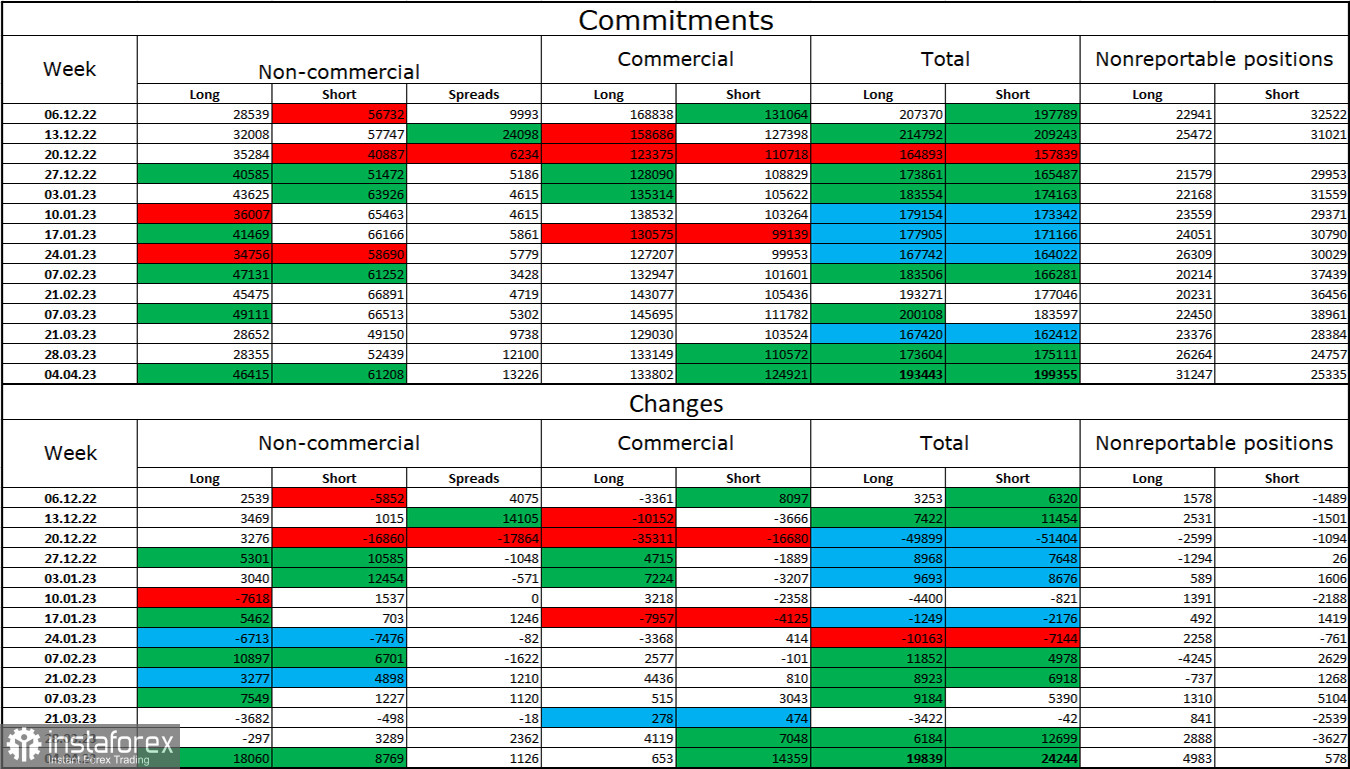

COT report

The sentiment of the non-commercial group of traders changed significantly over the last reporting week. The number of long contracts held by speculators increased by 18,060, while short contracts rose by 8,769. The overall sentiment of major market players remains bearish, with the number of short positions still exceeding the number of long ones. Over the last few months, the situation has been changing in favor of the pound sterling, but the difference between the number of long and short contracts held by speculators remains significant. Thus, the outlook for the pound has been improving although GBP has been trading without significant changes in the last few months. On the 4-hour chart, the price left the descending channel which is why the pound could be strengthening. However, there are many contradicting factors at the moment, and the information background provides little support for the sterling. On the 4-hour chart, the pair may close below the ascending channel.

Economic Calendar for US and UK:

On Tuesday, the economic calendar is uneventful. The influence of the information background on traders' sentiment will be zero today.

GBP/USD forecast and trading tips:

You can sell the pound when the price closes below the ascending channel on the 1-hour chart or in case of a rebound from the 1.2441 level on the 4-hour chart, with the targets at 1.2342 and 1.2250. There was a chance to buy the pound after a rebound from the lower boundary of the channel on the H1 chart. The first target at 1.2432 has been reached.