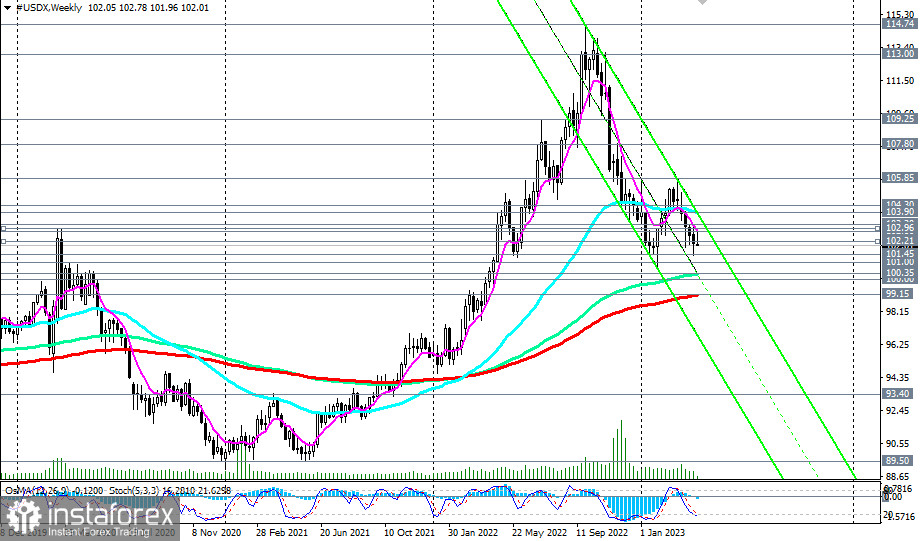

The dollar outlook is worsening, and its DXY index (CFD #USDX in the MT4 terminal) is trading in a short and medium term trend zone, declining to the key support levels 100.35 (144 EMA on the weekly chart), 100.00, 99.15 (200 EMA on the weekly chart).

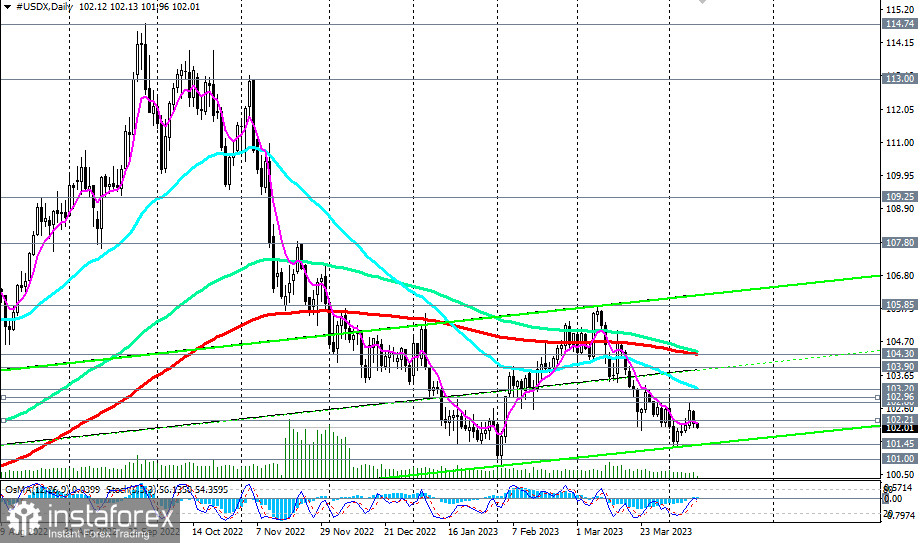

A breakdown of the local support at 102.00 and then at 101.45 will trigger a further decline in DXY. And a breakdown of the 99.15 support level will significantly increase the risks of breaking the global bullish trend of the dollar, which still remains in the global bull market zone, above the 93.40 support level (200 EMA on the monthly chart).

Alternatively, DXY will resume growth. The reason for the resumption of long positions on it may be the breakdown of an important short-term resistance level at 102.21 (200 EMA on the 1-hour chart).

But only a breakdown of the 104.30 resistance level (200 EMA on the daily chart) will once again bring DXY into the medium-term and long-term bull market zone.

Overall, the downward trend prevails, which gives preference to short positions.

Support levels: 102.00, 101.45, 101.00, 100.35, 100.00, 99.15, 99.00

Resistance levels: 102.21, 102.80, 102.96, 103.00, 103.20, 103.90, 104.30, 105.00, 105.85, 107.00, 107.80, 109.25