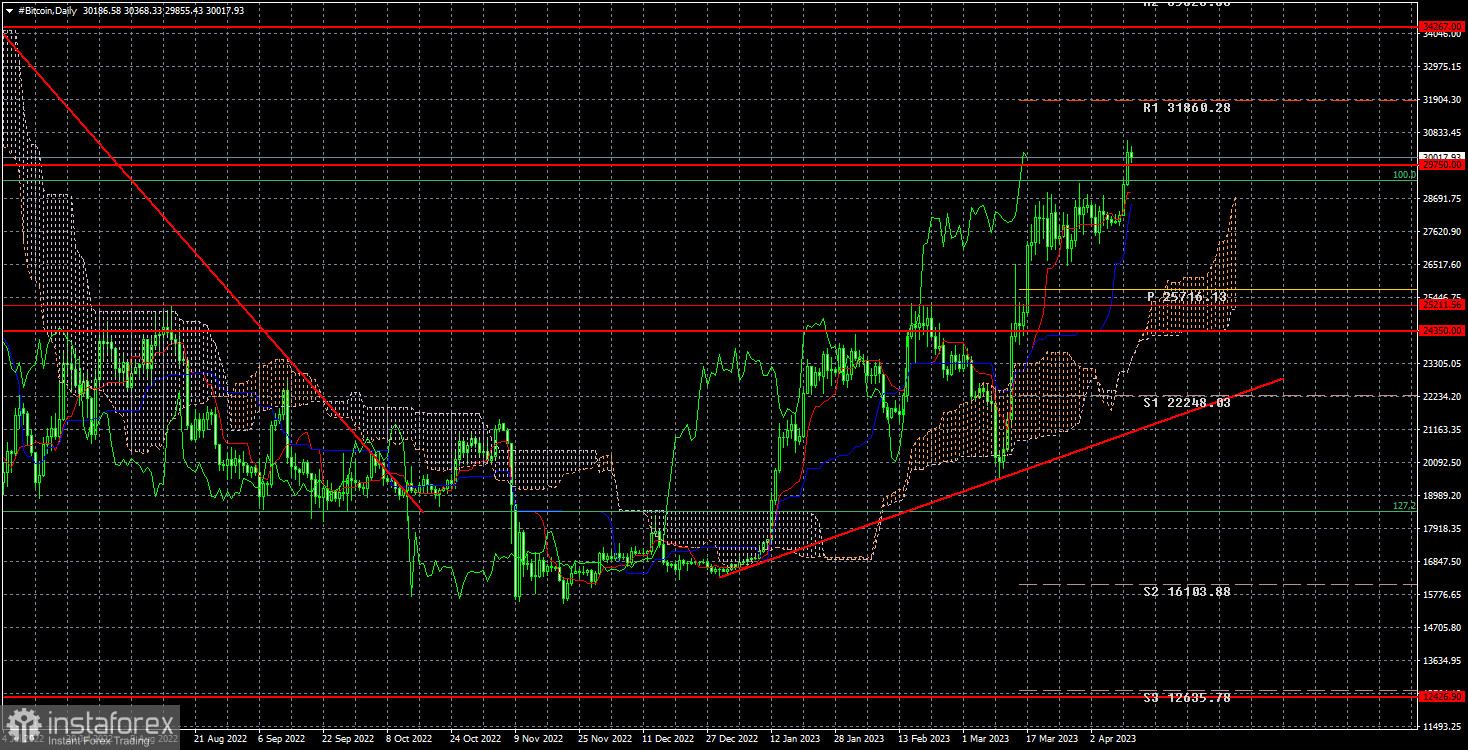

Bitcoin has risen $29,750, as we predicted. The price has settled slightly above the mark, but this is enough for traders to start taking profits. The uptrend continues, with the ascending trendline remaining intact. Therefore, as long as the price is above $29,750, we stay bullish, targeting $34,267. If quotes settle below the mark, we may exit long positions and sell with smaller targets.

Notably, Bitcoin has established a certain pattern and keeps following it. The coin skyrockets and then trades in a flat trend for a few weeks/months. So, the cryptocurrency rose sharply yesterday after staying sideways for about a month. Undoubtedly, it was a reaction to the US inflation report, which is about to be published shortly. A couple of days ago, we said that a sharp decline in the consumer price index could further boost demand for Bitcoin and further reduce the chance of at least one more rate hike by the Fed. The faster the regulator ends the tightening cycle, the sooner it will begin the rate-cutting cycle. Many experts say that the first rate cut could be announced by the end of this year. Such a fundamental backdrop may support risk assets. It is no secret that data can be priced in by the market in advance. This is precisely what is happening to Bitcoin right now.

A correlation with inflation was revealed in January when a sharp slowdown in consumer prices triggered a significant increase in the world's premier cryptocurrency. With inflation in focus today, figures are expected to decrease to 5.2%, down by 0.8%. Although results are yet to be delivered, the market has already priced them. Even if inflation slows down less than expected, nothing will change. Bitcoin is unlikely to pull back down immediately, unlike the US dollar, which may post modest gains in case of a smaller decline in the consumer price index. In fact, the weaker greenback has also contributed to growth in BTC in recent weeks. After all, Bitcoin is valued in US currency. The cheaper the dollar gets, the higher BTC goes. In the meantime, Bitcoin has already soared by 100% from its lows at around $15,000. So, the market is now in the need of a bearish correction.

In the 24-hour time frame, BTC broke another important level of $29,750, so traders could hold long positions with the target at $34,267. There have been no signs of a correction yet. If the price settles below $29,750, it will be a signal to sell and a sign of a looming correction. However, we are unlikely to see a significant fall in BTC value because of the current uptrend and the ascending trendline.