GDP data from the UK exceeded expectations, showing impressive growth for the period of three months. Industrial production also declined less than expected, which, coupled with falling US inflation, led to a rise in pound. That is why yesterday's buy signal for GBP/USD at the level of 1.2495 resulted in an increase of about 25 pips. Traders also need to pay attention to the upcoming labor market report from the US and data on producer prices, which will be released today. A decrease in the latter will inevitably lead to another surge in the pair.

GBP/USD

For long positions:

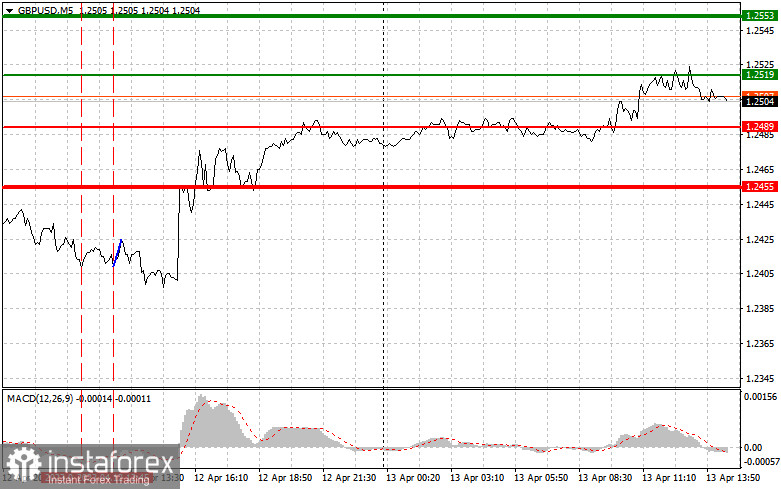

Buy pound when the quote reaches 1.2519 (green line on the chart) and take profit at the price of 1.2553 (thicker green line on the chart). However, before buying, make sure that the MACD line is above zero and is starting to rise from it.

Pound can also be bought at 1.2489, but the MACD line should be in the oversold area as only by that will the market reverse to 1.2519 and 1.2553.

For short positions:

Sell pound when the quote reaches 1.2489 (red line on the chart) and take profit at the price of 1.2455. However, before selling, make sure that the MACD line is below zero and is starting to drop down from it.

Pound can also be sold at 1.2519, but the MACD line should be in the overbought area as only by that will the market reverse to 1.2489 and 1.2455.