US stock index futures traded quite mixed on Friday as the earnings season kicked off. This will help traders assess how close the Federal Reserve is to the end of its rate hike cycle.

Futures contracts on the Nasdaq 100 rose by 0.5% after adding about 2% on Thursday. S&P 500 index futures remained near the opening price, following a similar strong rally the day before. Signs of cooling inflation in the United States and an increase in the number of unemployed Americans once again heightened expectations that the Federal Reserve would tone down its aggressive approach to interest rate hikes.

Obviously, market participants are pricing in both positive and negative news reports. Any signs of an economic slowdown are expected to lead to subsiding inflation pressures and force the Fed to pause interest rate increases. This will be a good signal for markets and investors.

As I mentioned above, the focus of market participants is on the earnings season in the banking sector. JPMorgan Chase & Co. and Wells Fargo have already reported their earnings. Shares of JPMorgan jumped about 8% in premarket trading after the lender reported an unexpected increase in first-quarter deposits. Wells Fargo's shares were down about 1% in premarket trading after the bank increased reserves to cover losses, including on commercial real estate loans.

Obviously, investors will be cautious about any signs that regional banking shocks have led to a significant tightening of lending standards across the banking system. This will be a defining moment for the sector. As experts note, the focus will be on the outflow of deposits from Western Alliance Bancorp, Comerica Inc., and East West Bancorp Inc., whose shares have suffered greatly. The earnings reports of these companies will be released next week.

Bond traders are betting that the Federal Reserve will cut interest rates by the end of this year. Against this background, the yield on two-year notes remained around 4.0%. The US dollar index plunged to a 12-month low.

Today's macroeconomic calendar includes no less important data on retail sales, which may lead to a shift in investor sentiment. A decrease in retail sales will benefit the stock market as it is a primary sign of subsiding price pressures in the future.

Oil prices have been rising for a fourth straight week amid signs of tightening conditions in the global market and a broadly weaker dollar.

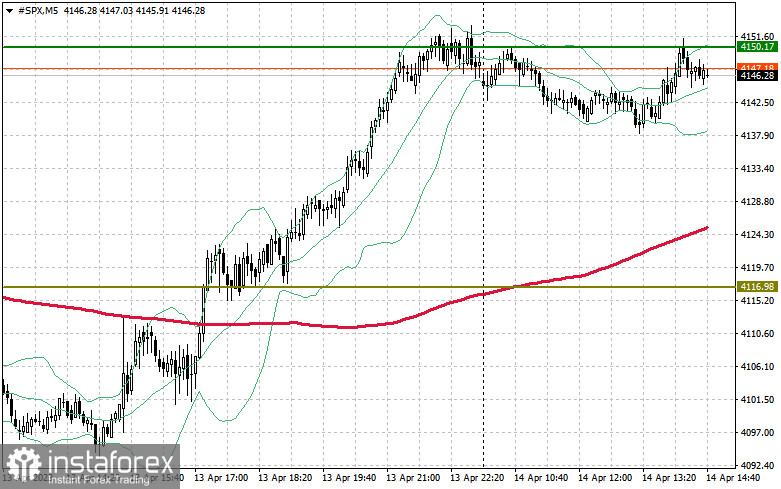

From a technical point of view, demand for risky assets persists. Nevertheless, the S&P 500 will extend gains only after it breaks above $4,150. In this case, the index will head for $4,184. If bulls take control of $4,208, the bullish run will intensify. In case of a decline amid lower demand, buyers should regain control in the area of $4,116 and $4,090. A breakout will quickly drag the trading instrument down to $4,060 and open the way to the mark of $4,038.