Euphoria won't do any good. At the height of the Liz Truss government crisis, the pound nearly fell to parity against the U.S. dollar. Now it is the best performing G10 currency since the beginning of the year. There has been a reassessment, Britain's economic outlook no longer looks as bleak as before, and the Bank of England intends to continue its cycle of monetary policy tightening. Unlike the Fed, which is about to end it. But what if the markets are wrong?

In fact, the assessment of the future of the UK economy has changed from terribly bad to just bad. The latest GDP statistics show that Britain is stagnating—its economy did not grow in February amid 10.4% inflation. Chief Economist Huw Pill noted that the latest macro statistics are disappointing. And this man surprised the markets with overly aggressive "hawkish" rhetoric just a few days earlier.

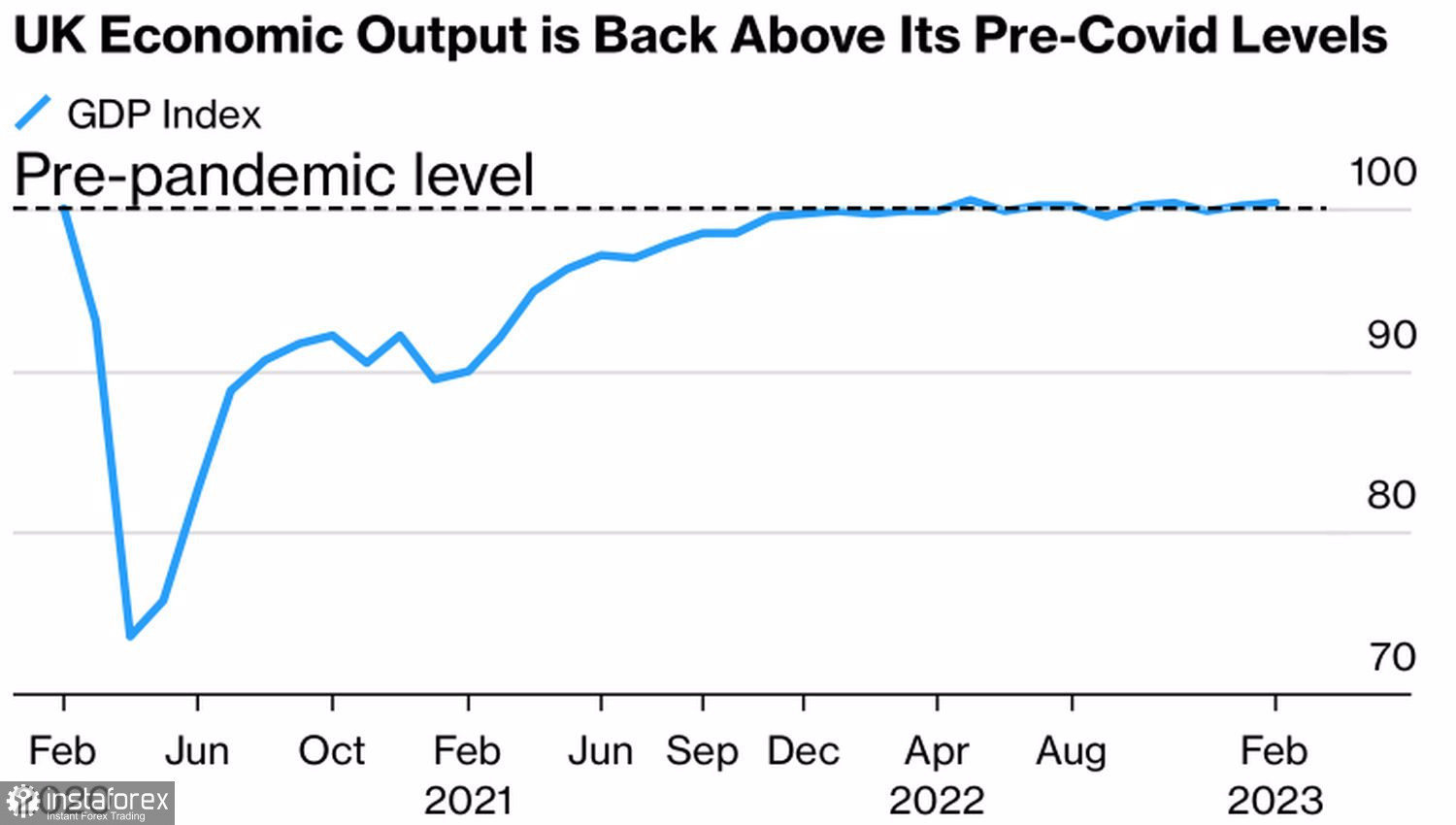

Dynamics of the British economy

The IMF may be right: the country will plunge into recession. Although the decline will not be 0.6% as previously expected, but 0.3%, it doesn't change the essence. How can a weak economy have a strong currency? Is the futures market's forecast of an 80% probability of a 25 bps repo rate hike to 4.5% in May too high? Bloomberg believes the Bank of England will have reasons to pause if new UK statistics disappoint.

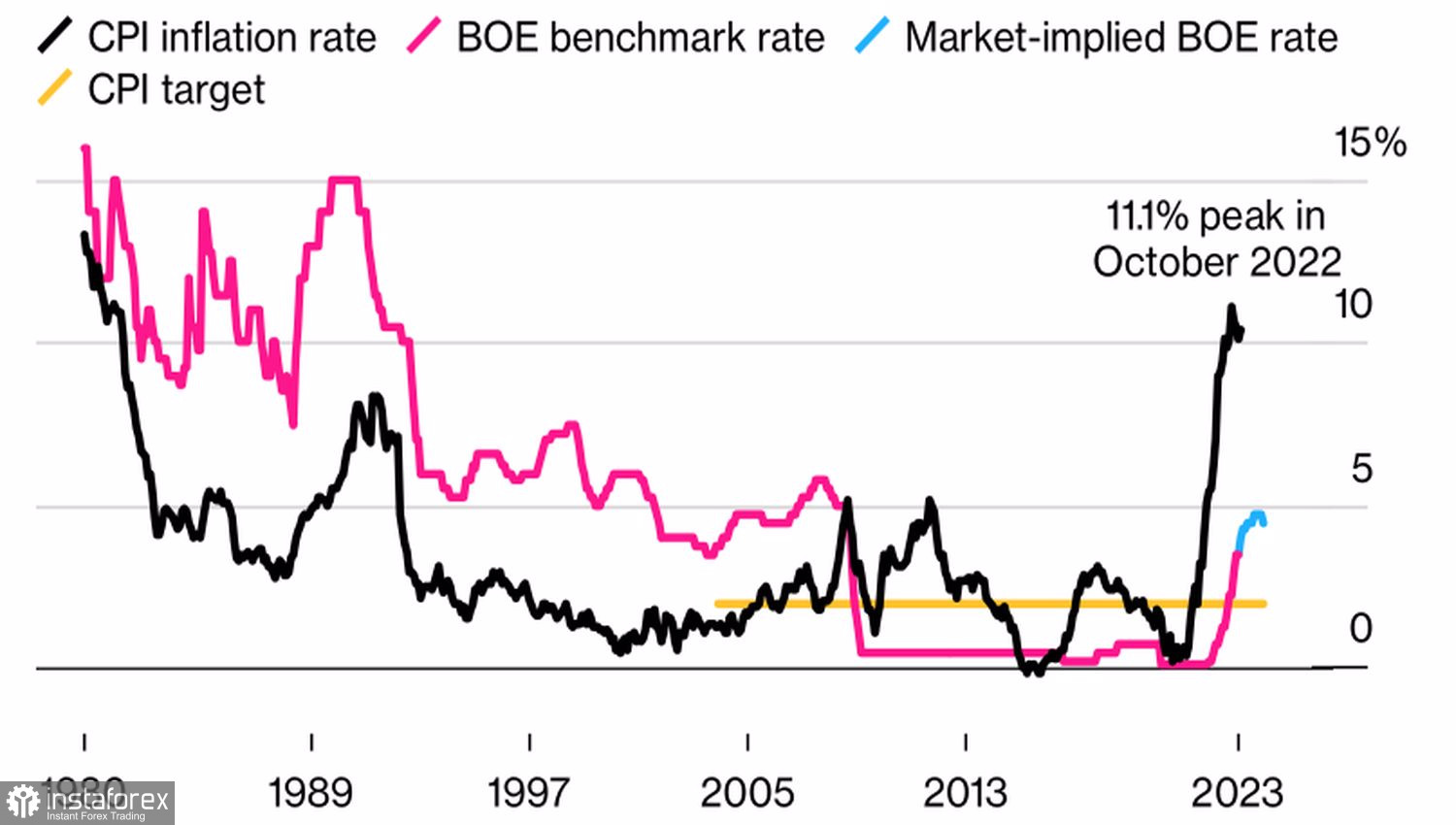

In this regard, data releases on the labor market, inflation, retail sales, and business activity are fundamentally important for sterling. The economic calendar is as full as ever, and investors seeking hints about the BoE's next steps will be watching closely. Signs of a cooling labor market, inflation slowing to the Bloomberg experts' predicted 9.8%, and weakness in retail sales and PMI could cost the GBPUSD bulls dearly.

Dynamics of inflation in Britain

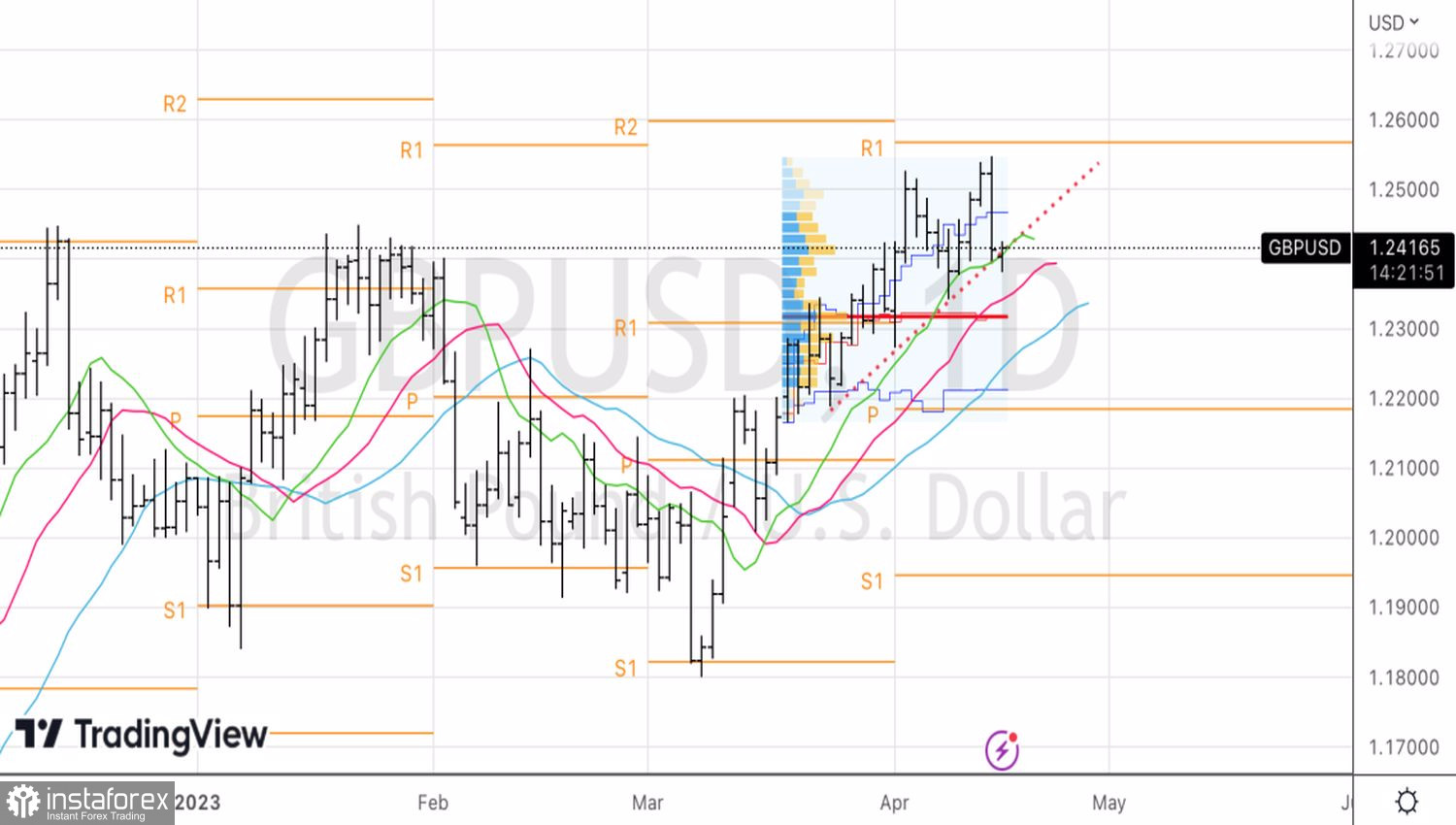

Despite the fact that Nomura, NatWest, and HSBC are set to take the pair up to 1.3, not everyone agrees with this. According to Rabobank, the pound will consolidate in the range of $1.2–1.26 over the next six months, as the reduction of short positions makes it vulnerable to the emergence of new cracks in the UK economy. The market has no momentum to continue the GBPUSD rally.

Credit Agricole even predicts the pair to fall to 1.23, suggesting that the market is overly optimistic about the idea of a dovish Fed reversal and overly pessimistic about a recession. The former won't happen in 2023, and the latter will prove shallow and short-lived—if it happens at all. That said, the split within the Bank of England over the advisability of further repo rate hikes makes sterling vulnerable.

Technically, on the GBPUSD daily chart, the "bears" are trying to implement the Anti-Turtles reversal pattern. A decline in quotes below the diagonal support and the green EMA will increase the risks of a correction developing. Updating the local high at 1.2385 is a reason for short-term sales with a subsequent transition to medium-term purchases on a rebound from supports at 1.2355 and 1.2315.