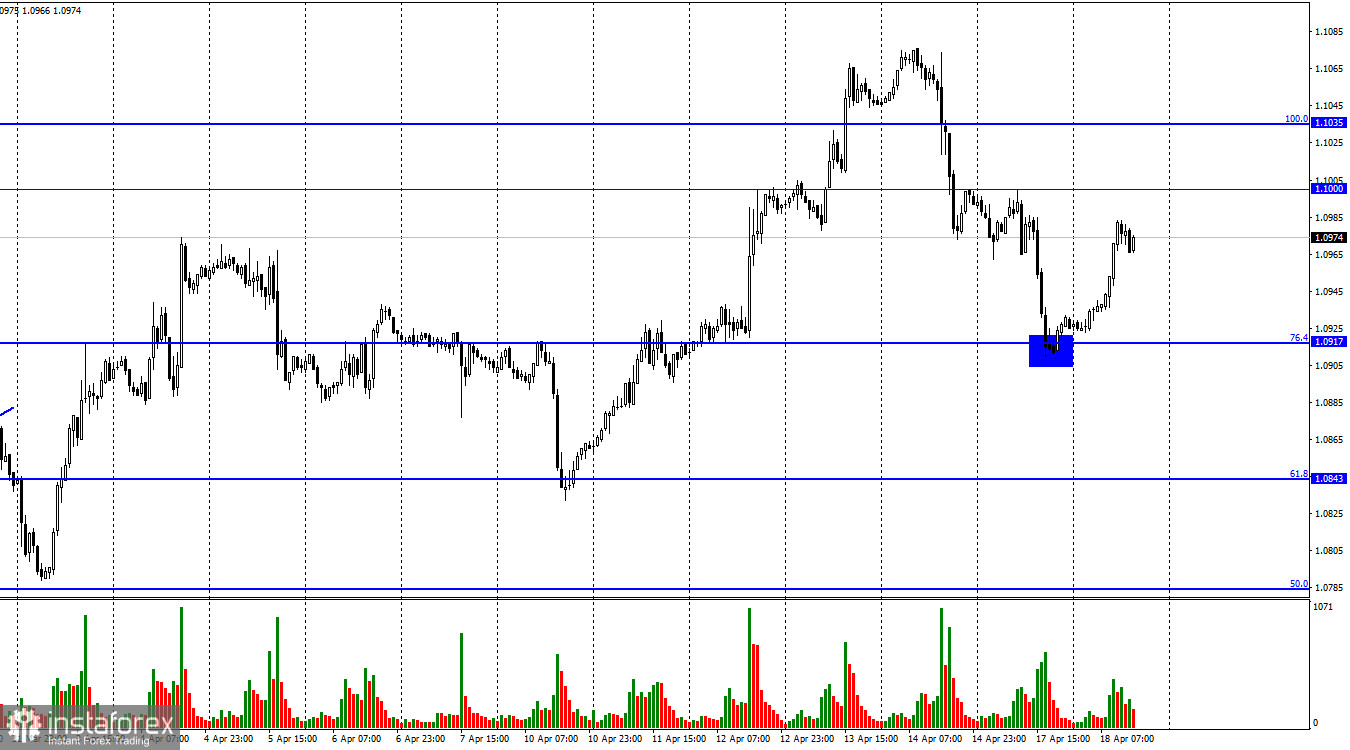

On Monday, the EUR/USD pair fell to the corrective level of 76.4% (1.0917), rebounded, and rose towards the 1.1000 level. A rebound of the pair's exchange rate from this level would favor the US currency and lead to a resumption of the fall toward the 1.0917 level. If the quotes consolidate above 1.1000, the chances of continued growth will increase.

The informational background on Monday and Tuesday was relatively weak. Yesterday, nothing was notable in the economic events calendar, and today we observe the same picture. However, traders have shown from the beginning of the week that they will not sit on the sidelines and are set for active work. It is difficult to say what caused the pair to fall on Monday and rise on Tuesday, as no factors contributed to the rise or fall. I assume the pair fell yesterday within the correction against last week's rise and rose today within the correction against the fall on Friday and Monday. After all, corrections are completed, the main movement should resume, which could now be downwards. It is worth paying attention to the higher timeframe charts, where the pair also needs correction. This necessity may make bears trade more actively in the coming weeks. The US currency has fallen enough lately to expect a slight rise. The US economy is good, and the Federal Reserve plans to tighten monetary policy. So why should the dollar continue to fall? All recent economic data has been at a decent level. There were bad reports, but there were also good ones. As for the ECB, the market is currently divided on opinions: some believe the interest rate will increase by 0.50% in May, and some believe it will increase by 0.25%. Since there is no consensus, there is no support for the euro.

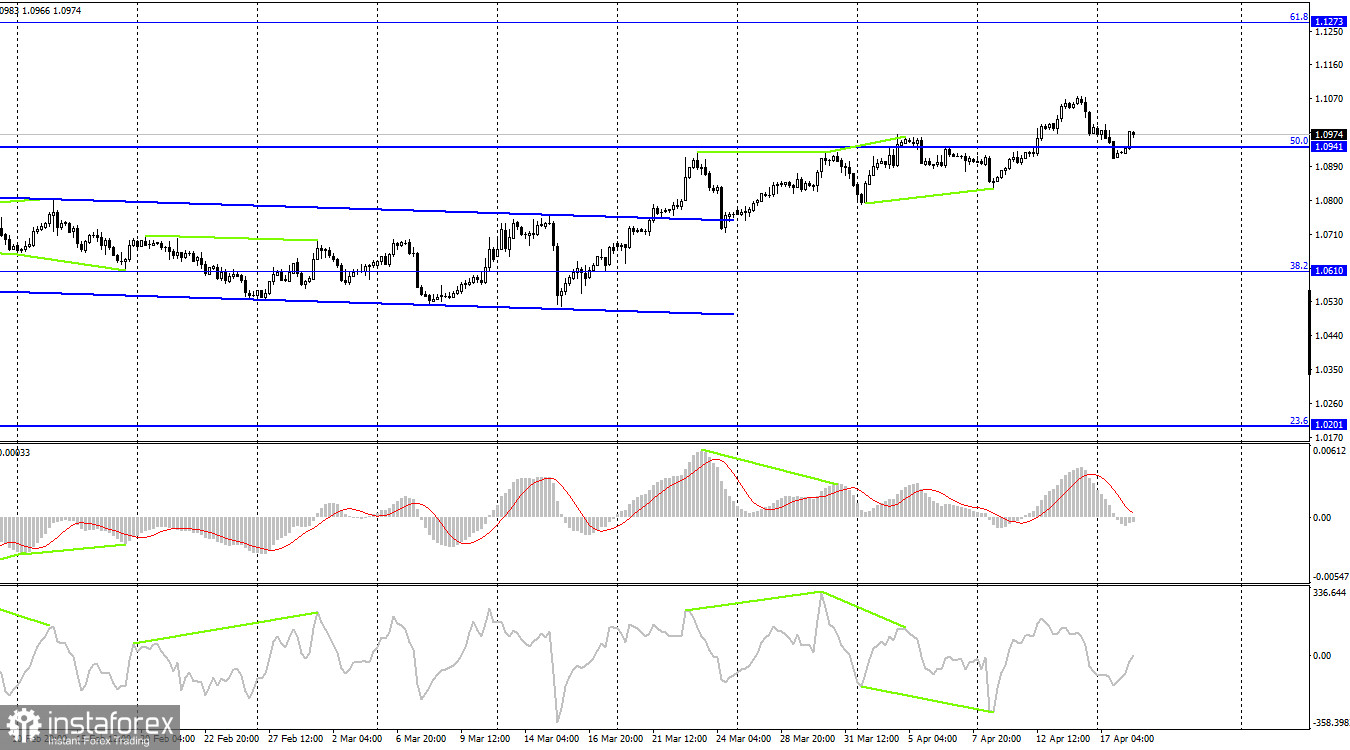

On the 4-hour chart, the pair has consolidated above the sideways range, which allows us to count on further growth toward the corrective level of 61.8% (1.1273). Consolidation above the corrective level of 50.0% (1.0941) also increases the chances of further growth. The "bullish" divergence on the CCI indicator also favored the euro. No new divergences are currently observed.

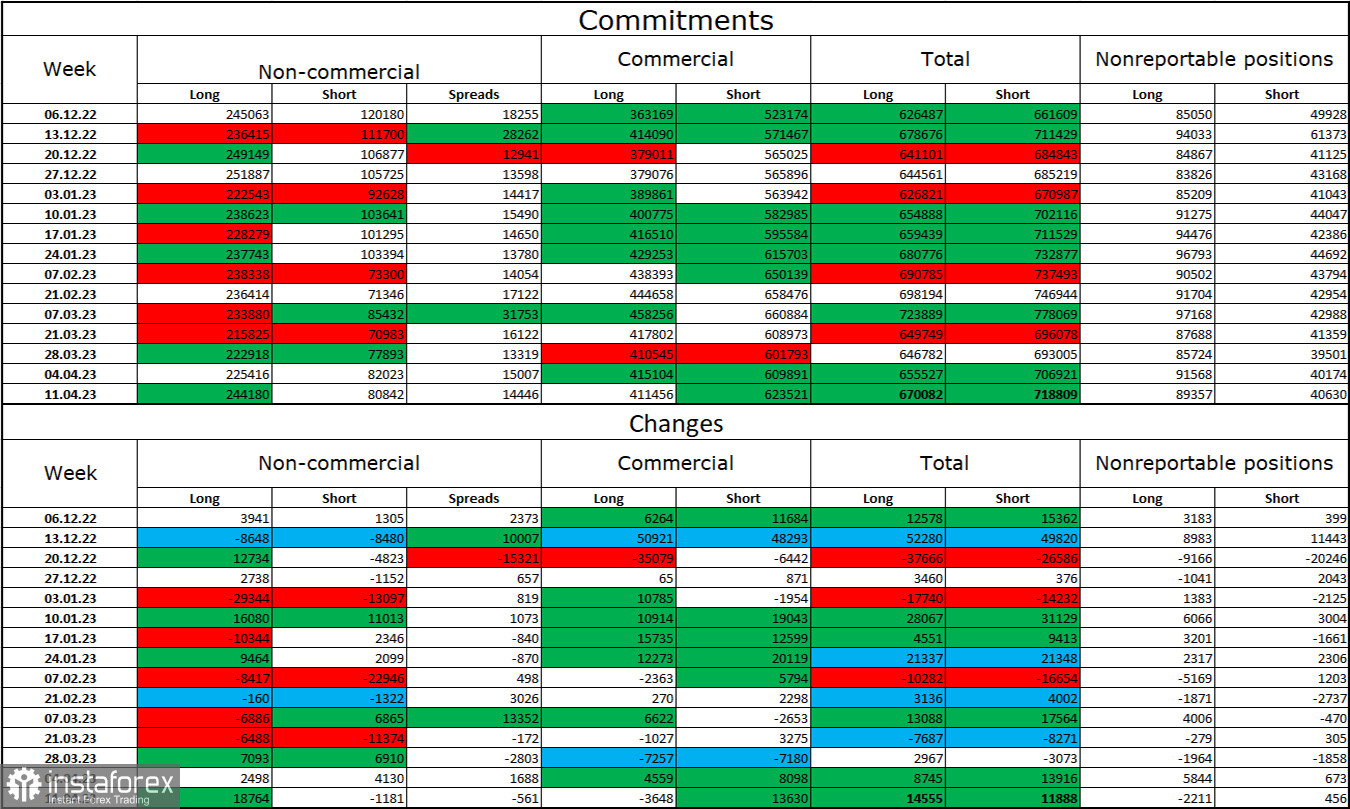

Commitments of Traders (COT) report:

In the last reporting week, speculators opened 18,764 long contracts and closed 1,181 short contracts. The sentiment of large traders remains "bullish" and continues to strengthen generally. The total number of long contracts speculators hold is now 244,000, while short contracts are 81,000. The European currency has been rising for over half a year, but the information background is starting to change, which could lead to a decline in the EU currency. The ECB may reduce the rate hike pace to 0.25% at the next meeting, which could lead to a decline in demand for the euro. The difference between the number of long and short contracts is threefold, indicating the proximity of the moment when bears will become active. For now, strong "bullish" sentiment remains, but I think the situation will start to change soon.

US and EU news calendar:

On April 18, the economic events calendar did not contain any entries. The influence of the information background on traders' sentiment will be absent today, which only upset them a little.

Forecast for EUR/USD and trading recommendations:

New pair sales can be opened on the rebound from the 1.1000 level on the hourly chart with a target of 1.0917. Purchases of the pair were possible on the rebound from the 1.0917 level with a target of 1.1000. This deal can be closed now.