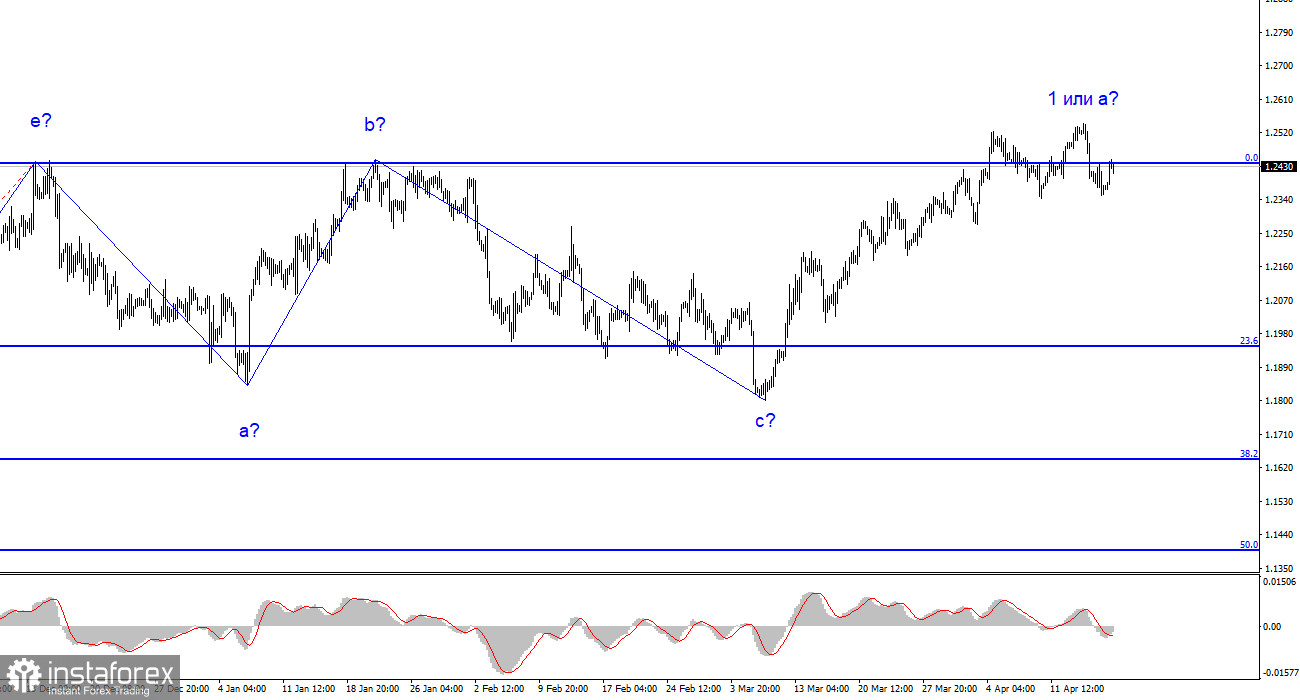

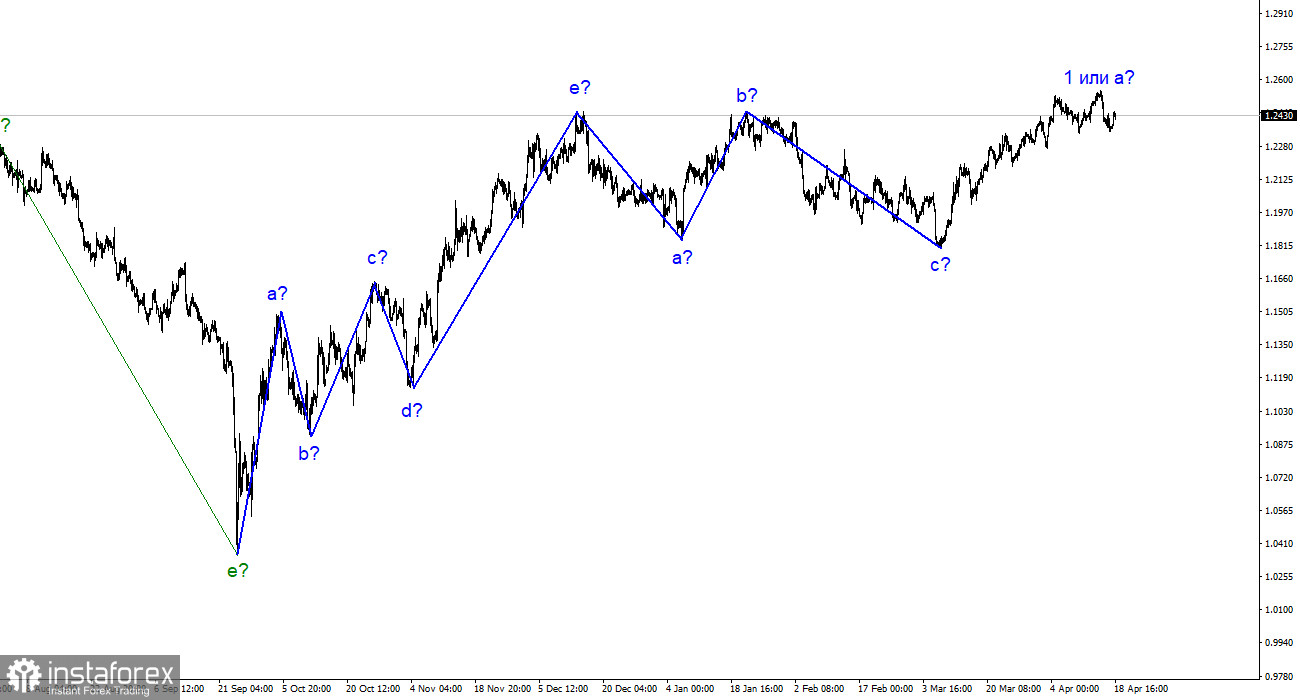

The wave markup still looks complicated for the pound/dollar pair because it does not resemble a classic corrective or impulsive trend section. Since the current upward wave has exceeded the peak of the last wave b, the entire downward trend section consisting of waves a-b-c can be considered complete. Although it is very weakly similar to the trend section for the same period in the euro currency, it should be acknowledged that both pairs have built three-wave downward wave sets. If this assumption is correct, a new upward trend section has begun for the pound. Since I can identify only one wave since March 8th, there is every reason to assume that forming a new trend section will take a long time. Both pairs should build similar wave formations. If this is indeed the case, then wave 2 or b for the pound may be extended, and at the same time, a downward three-wave set can be built for the euro. Thus, I expect a deep wave b, as with the previous three-wave set. Therefore, the pair's decline can be expected to reach the 1.1850 mark or slightly higher.

The pound rejoiced in the rise of unemployment.

The pound/dollar pair rate increased by 50 basis points on Tuesday, although there were virtually no reasons for the market to raise demand for the British currency. A statistics package was released in the United Kingdom, which was the only one today. Therefore, the market could react to it on Tuesday. However, the nature of this package and the pound's movement did not coincide. The demand for the pound began to rise immediately after the release of the statistics, but it is very difficult to consider two out of three reports as positive for the pound. The unemployment rate in February rose from 3.7% to 3.8%, and the number of claims for unemployment benefits increased by 28,000 amid much more modest market expectations. Rising unemployment is bad for any economy. Undoubtedly, the Bank of England has raised rates 11 times already, leading to an "economic cooling." Therefore, unemployment should grow, and economic growth should slow down. But it isn't easy to understand how the market considered this information worthy of buying the pair. What we saw today was a coincidence, and demand for the pound will fall in the coming days.

I also want to mention the report on wages. With bonus payments included, wages in February grew by 5.9%, and without bonuses – by 6.6%. Both values were higher than market expectations. How can we not recall the Bank of England's concerns, which believe wages are growing too fast, fueling inflation? If the regulator is right, then inflation may remain high for a long time. After all, 11 rate hikes have not led to a slowdown.

General conclusions.

The wave pattern of the pound/dollar pair suggests the formation of a new downward wave. The wave markup is now ambiguous, as is the news background. I do not see factors supporting the pound in the long term, and wave b may be very deep. A decline in the pair is more likely now, as all the waves in recent times have been approximately the same size. Trading can be done from the 1.2440 mark, which corresponds to 0.0% Fibonacci. Below it – sell with targets 300-400 points lower; above it – cautiously buy.

The picture is similar to the euro/dollar pair on the older wave scale, but there are also some differences. At the moment, the ascending corrective section of the trend is complete. But the three-wave downward section may have already been completed as well. The new ascending trend section can also be a three-wave or horizontal one.