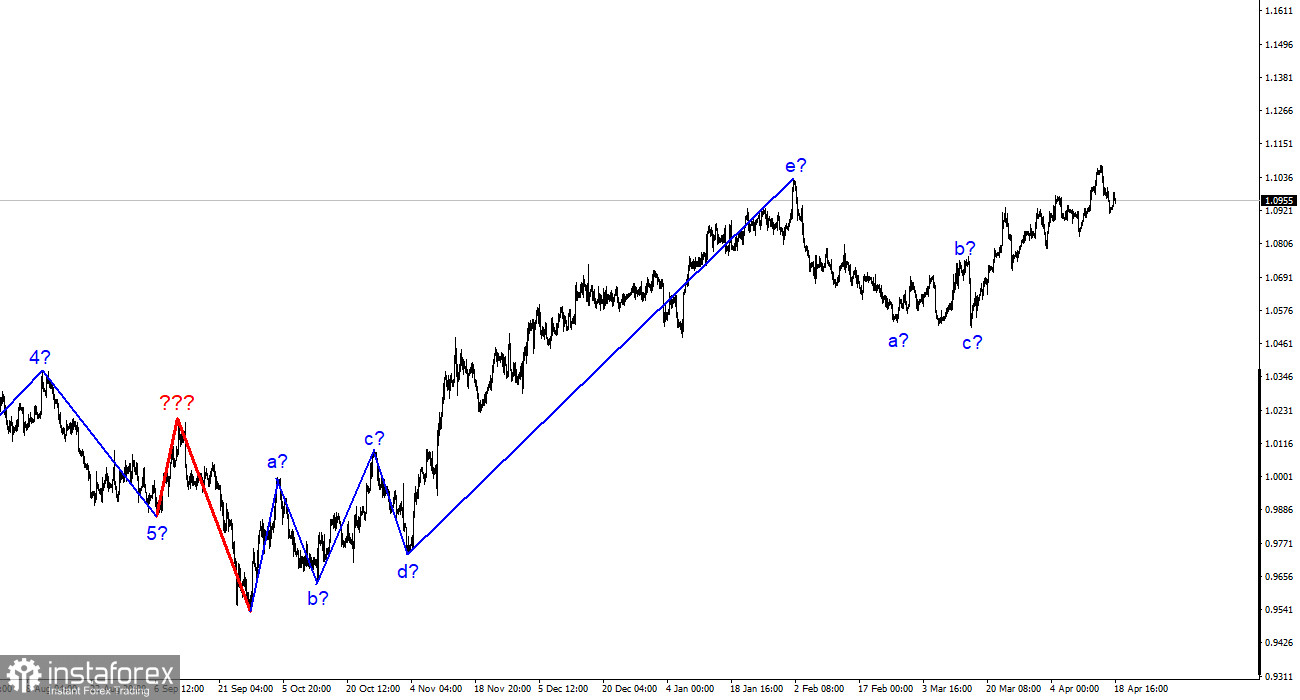

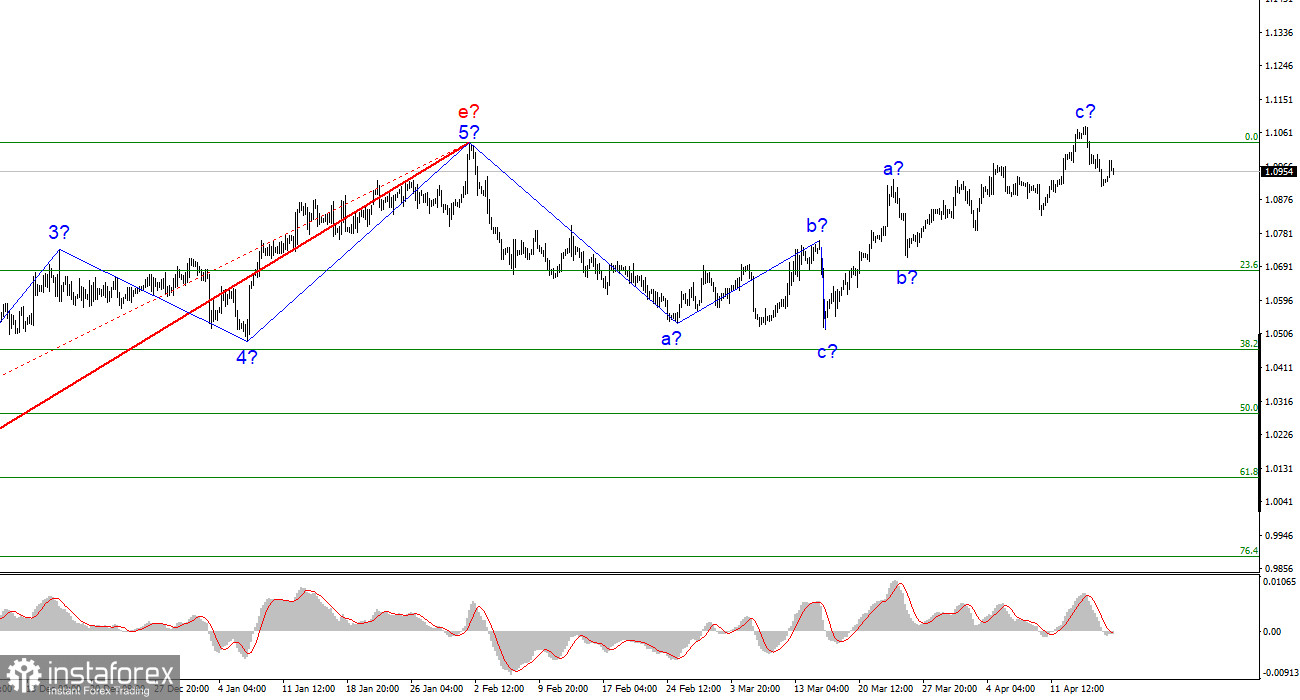

The wave markup of the 4-hour chart for the euro/dollar pair continues to get more complicated due to the latest rising waves. These waves could be an independent upward section of the trend (since the last downward movement can be considered three-wave and completed), and they could also already be finished if it takes on a three-wave appearance. Thus, the wave picture for the euro can become very complex, and it isn't easy to work with it now. At the current positions, the formation of an upward set of waves could be completed as the peak of the third wave went beyond the peak of the first. We saw the same thing in the last downward formation. At the same time, there are other options for wave analysis. For example, a full-fledged five-wave (but also corrective) structure. It is advisable to rely on the scenario with a decrease in the pair because the ascending three-wave movement looks complete and finished. Therefore, a new downward three-wave movement may begin now, and the unsuccessful attempt to break through the 1.1030 mark indicates the market's readiness for sales.

Christine Lagarde made several important statements.

The euro/dollar pair rose by 35 basis points on Tuesday. The amplitude of the pair's movements was not too high, which is unsurprising since the news background is virtually absent. There were no important statements or reports yesterday or today. Thus, all the movements of the last two days can be considered "noise." Wave markup now gives an excellent chance for my readers to enter the market with sales. If the formation of an upward set of waves is complete, then a new downward three-wave movement has begun. You will agree; entering the market at the beginning of the movement is excellent. If this assumption is incorrect, a stop loss can be placed above the 0.0% Fibonacci level.

Yesterday, ECB President Christine Lagarde gave a speech. This time it was not about monetary policy, but it can still be considered important. Lagarde reported that lately, competition between the US and China has significantly intensified, which could lead to a 5% inflation increase and threaten the global dominance of the euro and the dollar. She noted that the US and the European Union depend on China in some crucial areas. For example, America imports 14 essential components for creating electric vehicles, while the European Union is 98% dependent on the supply of rare materials from China. Due to possible disruptions in supply chains, the cost of a particular product may increase, leading to inflation growth. She also noted that demand for the yuan as a reserve currency might increase, but there are no signs of changing the balance in international currencies. The euro did not react to Lagarde's speech; we should wait for important European and US economic data. Ideally, they should support the dollar.

General conclusions.

The upward trend section is formed based on the analysis conducted. Therefore, sales can now be advised, as the pair has ample room for a decline. The 1.0600 targets can be considered quite realistic. With this goal in mind, I advise selling the pair on the MACD indicator's reversals "down" until the quotes successfully attempt to break through the 1.1030 mark, which may not happen.

On the older wave scale, the wave markup of the ascending trend section has taken an extended form, but it is probably complete. We saw five waves up, which most likely represent the a-b-c-d-e structure. The formation of the downward trend section may still need to be finished, and it can take any form in terms of structure and extent.