Pound continues to rise and could return to April highs after data showed that UK inflation remains high in March. This scenario could put pressure on the Bank of England and convince it to extend further interest rate hikes.

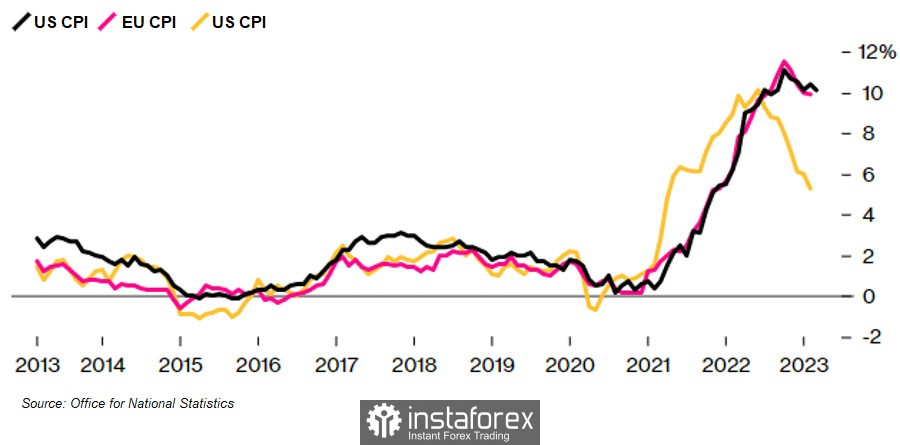

The report by the Office for National Statistics said CPI was up 10.1% compared to the previous year, primarily driven by the massive growth in food prices. Economists had expected the growth rate to slow down to 9.8%.

Earlier, Bank of England Governor Andrew Bailey hinted that a pause might be possible if inflationary pressure declines. However, the released data shows that prices in the UK have greater growth potential than in the US or the eurozone.

Thus, pound jumped against euro, climbing more than 1%. It also remained bullish against dollar, but in order to develop the trend, the quote has to consolidate above 1.2450. That is likely to trigger an increase to 1.2480, or to 1.2520, which is very close to April highs. If the pair falls, bears will try to take control over 1.2410, which will lead to a slide to 1.2380 and 1.2340.

As for the bond market, a collapse was seen, while Treasury yields rose by at least 5 basis points for two- and five-year securities. Traders are now betting that rates will peak at 5% in September this year compared to the current 4.25%.

Clearly, the Bank of England's work to stabilize the situation regarding inflation and price growth is not yet complete. So, to address the main issues, the MPC will need to raise interest rates at the next meeting and then wait for news related to the consumer price index.

CPI in the US and Europe have gradually decreased over several months. In the US, prices rose by 5% in March, which was the slowest growth in almost two years. In the eurozone, the index for the last month dropped to 6.9%, which was the lowest level since February 2022. Today, it is expected to drop to 6.8%.