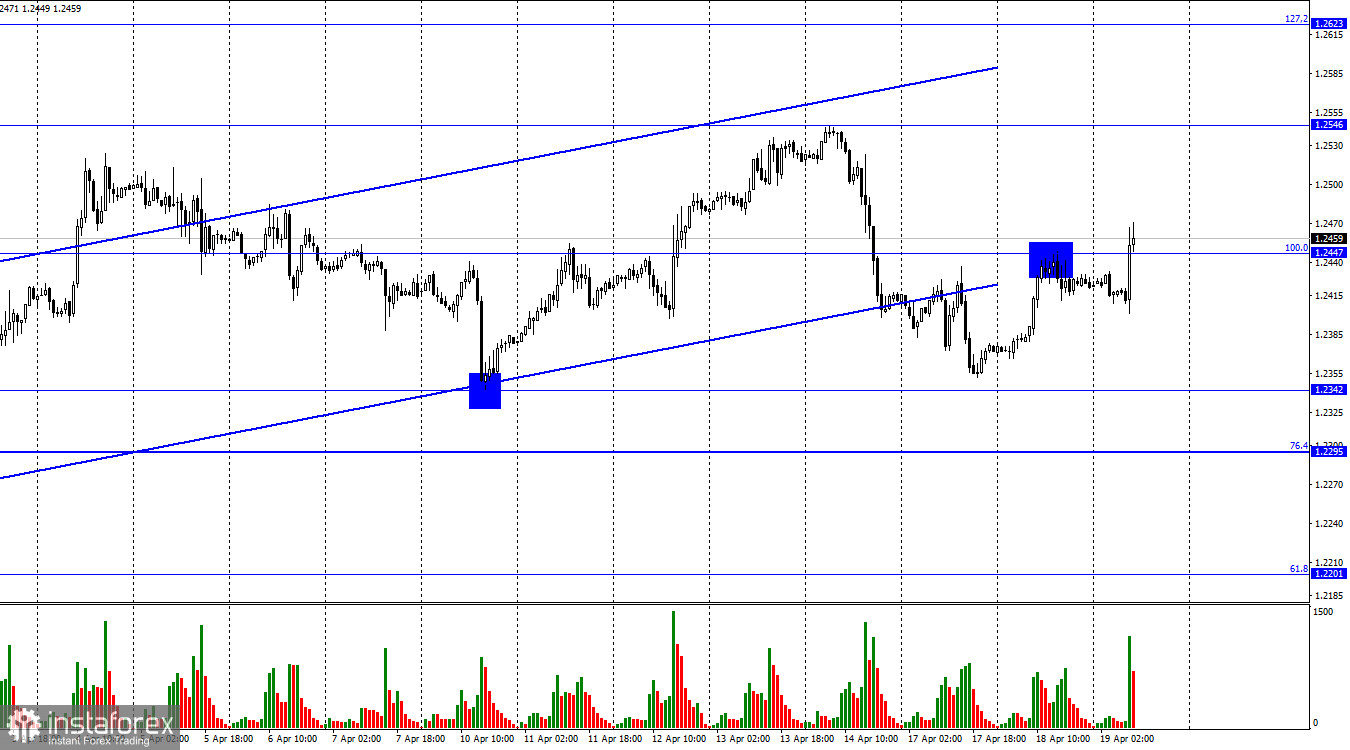

Hi, dear traders! On Tuesday, GBP/USD pair rose to the retracement level of 100.0% at 1.2447 on the H1 chart. The pair's rebound from that level sparked bearish expectations for the pound sterling. However, the UK inflation report, which was released this morning, triggered a new upsurge. If GBP/USD closes above 1.2447, traders will expect the pair to rise towards 1.2546. However, a consolidation below this level will again favor the US dollar.

The UK inflation report has been undoubtedly Wednesday's most important event. Year over year, inflation decreased to 10.1% from 10.4% in March, which is a very small decrease. In the European Union, inflation fell by more than 1.5% in the same month. However, it is worth noting that traders did not expect a rapid slowdown, as forecasts hovered around 10%. GBP found support in this report, albeit weak one, as expectations and reality were nearly aligned. Most importantly, this report will have virtually no impact on the Bank of England's monetary policy. The British regulator has already lowered the pace of interest rate hikes to 0.25% and is unlikely to increase them because inflation is decelerating too slowly. The fact that inflation was not declining quickly enough was clear from the data of the past few months, and in February it even increased. Nevertheless, the Bank of England still raised the rate by only 0.25%, indicating its options for monetary tightening are limited. Thus, it is almost 100% certain that the rate will rise by another 0.25% in May, which is no longer a reason for bullish traders to increase their long positions. It is also worth noting that core inflation did not decrease in March, remaining at 6.2% YoY. Traders were expecting at least a slight slowdown to 6%. However, this factor will not help the British currency, as the Bank of England has made it clear that the most aggressive steps are already behind it.

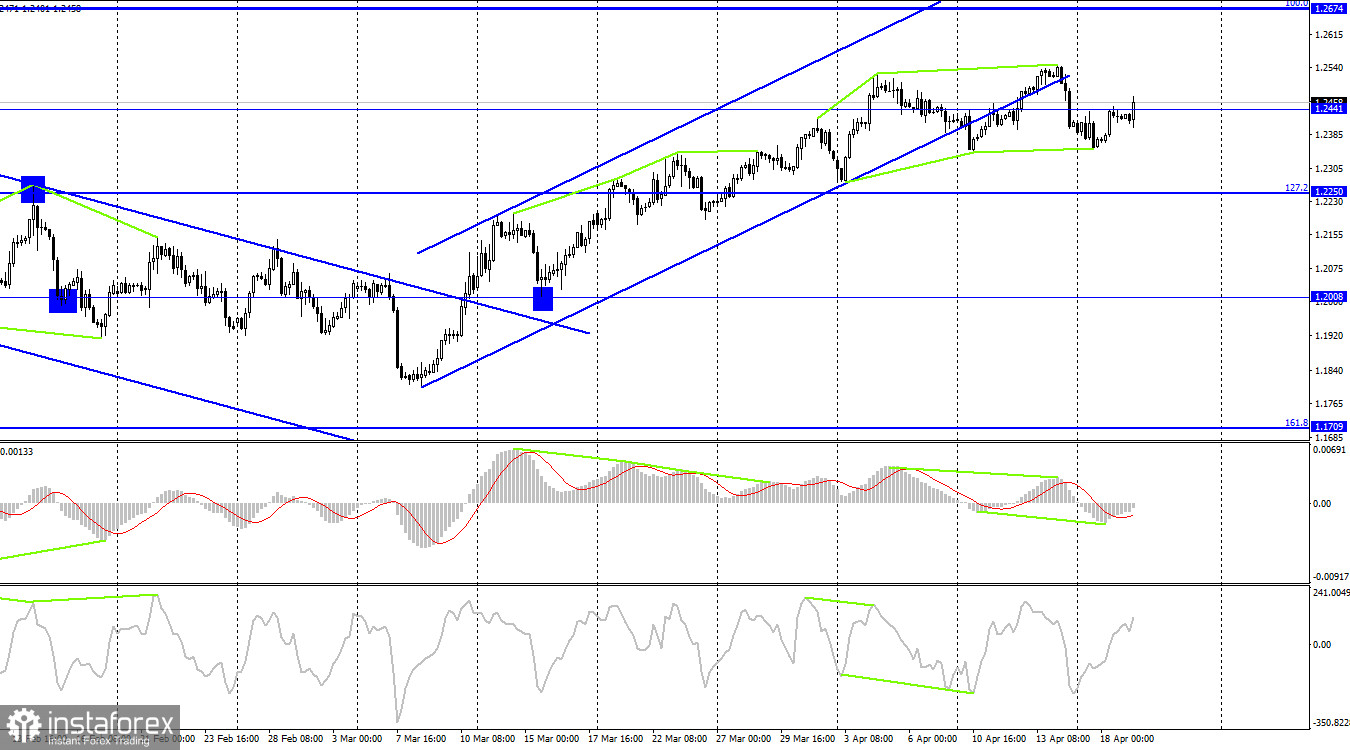

On the 4-hour chart, the pair reversed downwards and consolidated below the ascending trend channel and 1.244. I believe that the exit from the channel is a key signal indicating the sentiment has now become bearish. The bullish divergence allowed the pair a return to 1.2441, but a rebound from it result in GBP/USD resuming its decline towards the Fibonacci 127.2% level at 1.2250. Moving down from two ascending channels is a quite telling sign.

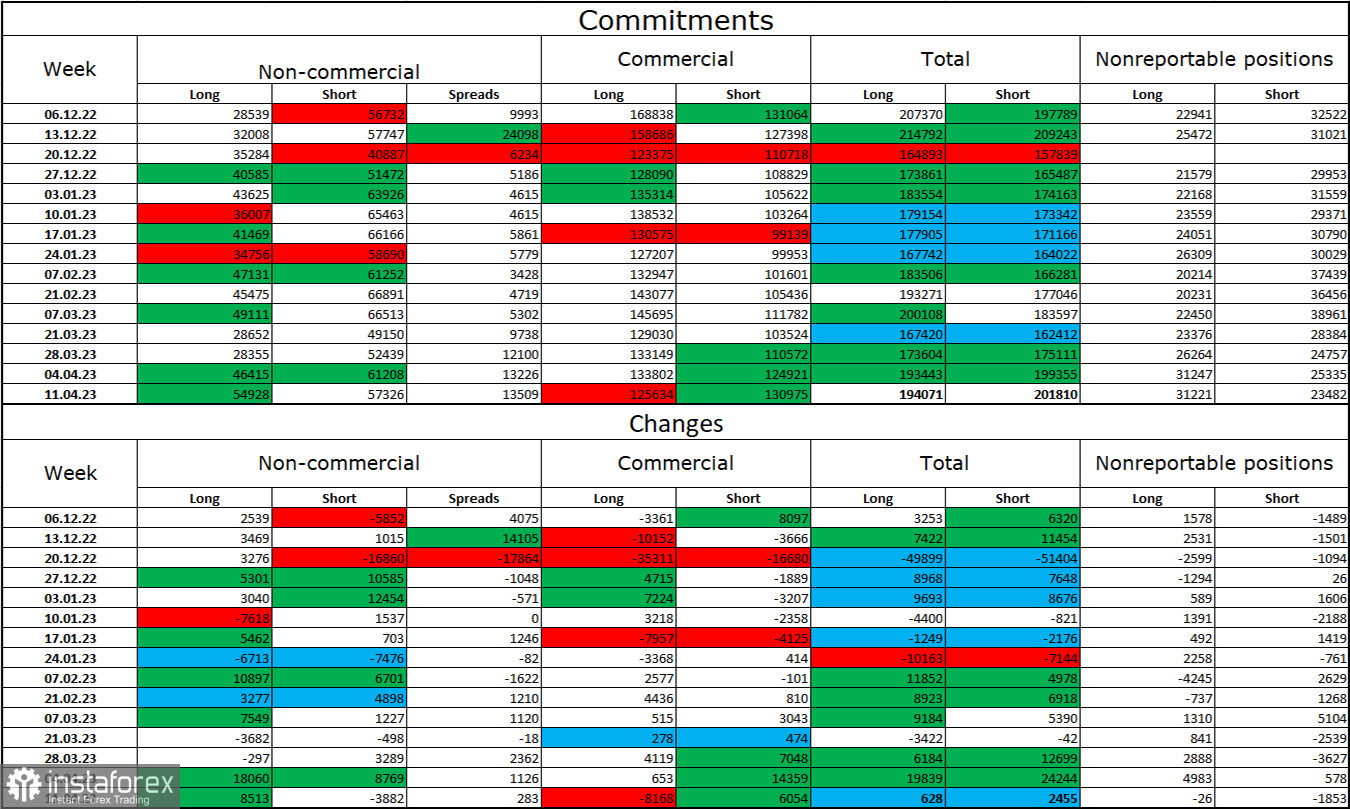

Commitments of Traders (COT) report:

The sentiment of non-commercial of traders changed significantly over the last reporting week. The number of opened long positions increased by 8,513, while the number of short positions increased by 3,882. The overall sentiment of major players remains bearish, and the number of short positions still exceeds the number of long ones, but only slightly. Ironically, at this time, the market sentiment may change to bearish since there are clear sell signals. Over the past few months, the situation has been continuously changing in favor of the pound, but nothing lasts forever. Thus, the pound's prospects remain positive, but a decline is expected in the short term.

US and UK economic calendar:

UK – Consumer Price Index (CPI) (06:00 UTC).

US – Fed's Beige Book (18:00 UTC).

On Wednesday, the economic event calendars each contain one entry for each country. The UK inflation data has already been released, and the Fed's Beige Book will be released later in the evening. The influence of these events on traders' sentiment for the remainder of the day will be weak.

Outlook for GBP/USD:

Short positions should be opened targeting 1.2342 and 1.2295, if GBP/USD bounces off 1.2441-1.2447. Going long on the pound will be possible if the pair closes above 1.2447 on the hourly chart, targeting 1.2546.