As soon as Bitcoin started to spread its wings a bit, predictions of its bright future with an astonishing price began to appear. Standard Chartered believes that the crypto winter is over, and by the end of 2024, BTCUSD quotes will reach a new record high of 100,000. The main reasons cited are turmoil in the banking sector, increased demand for risky assets due to the end of the Federal Reserve's monetary tightening cycle, and an increase in mining profitability.

Undoubtedly, "bulls" dominate the crypto market; however, history shows that such predictions should be met with skepticism. For example, Citi in November 2020 claimed that by the end of 2022, Bitcoin would grow to 318,000. In reality, it crashed by 65% by the end of last year. When the token rises, there is no shortage of bold statements.

The main drivers of the BTCUSD rally in 2023 are the positive dynamics of technology company stocks, the banking crisis, expectations of the end of the Federal Reserve's monetary restriction cycle, and the Bitcoin halving that occurs every four years. In particular, JPMorgan believes that the technical change in the blockchain in April 2024 will make the token more expensive to produce and have a psychological effect on the market, resulting in price growth.

Although the economic nature of stocks and Bitcoin is different, investors monitor the dynamics of U.S. stock indices, rightly believing that changes in risk appetite move BTCUSD quotes. At the same time, the leading dynamics of Nasdaq Composite, which has grown 16% since the beginning of the year, over S&P 500 and Dow Jones index, plays into the hands of the cryptocurrency sector leader.

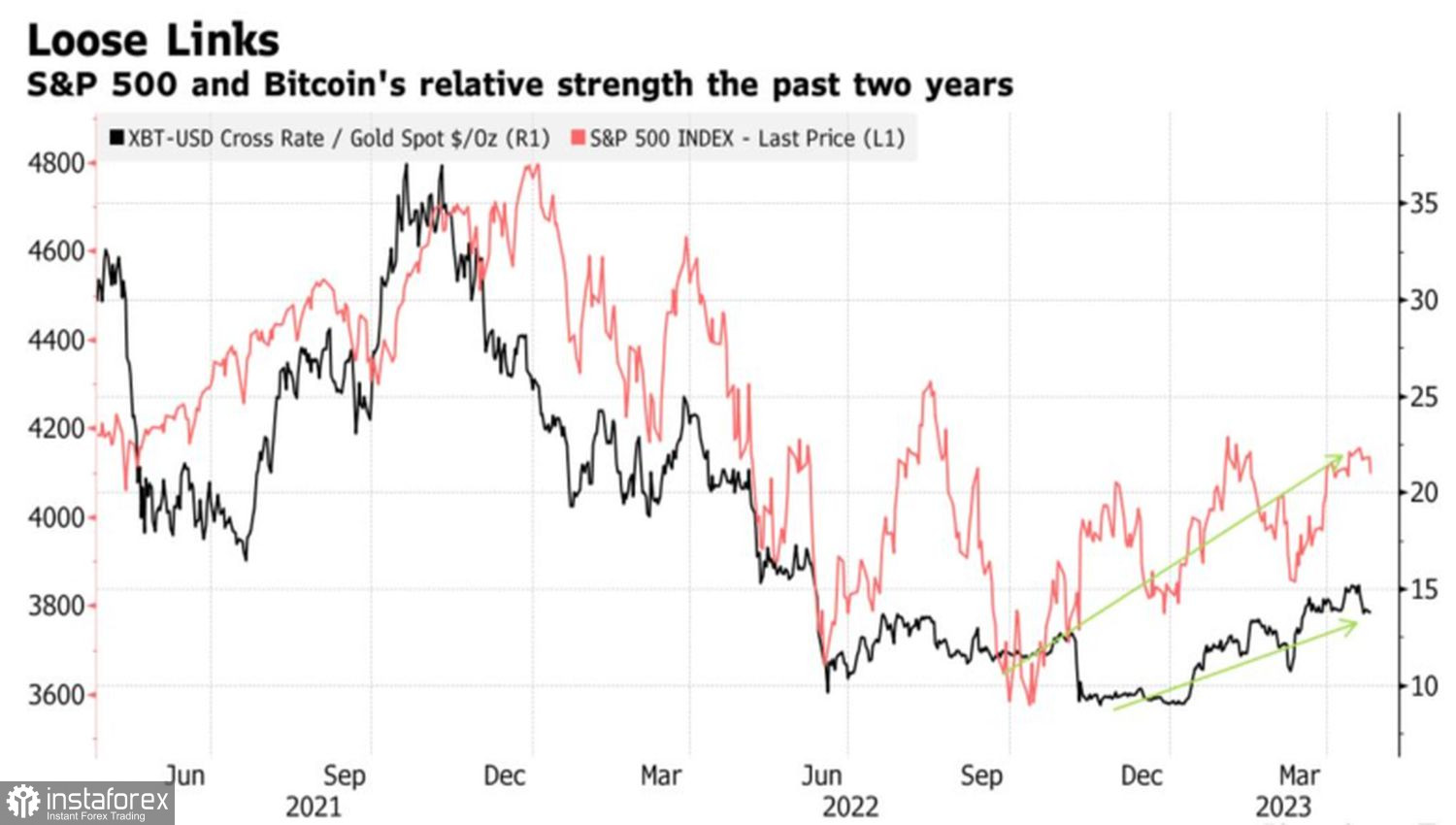

It is considered a risky asset, but some see Bitcoin's main value in its growth as a message that not everything is right in the financial system. In this regard, the token can be seen as a safe-haven asset. Interestingly, the BTCUSD-to-gold ratio closely correlates with the U.S. stock market.

Dynamics of S&P 500 and Bitcoin to gold ratio

An important advantage of Bitcoin is the turmoil in the banking sector. Deposits are flowing out of the system not only into money market funds, but also into the crypto industry. Its assets serve as effective means of settlement and savings. In April, investors may have felt that the banking crisis was over, which triggered a BTCUSD correction, but First Republic's reporting proved otherwise.

Finally, expectations of the end of the Federal Reserve's monetary restriction cycle with a subsequent "dovish" turn is good news for all risky assets, and Bitcoin is no exception.

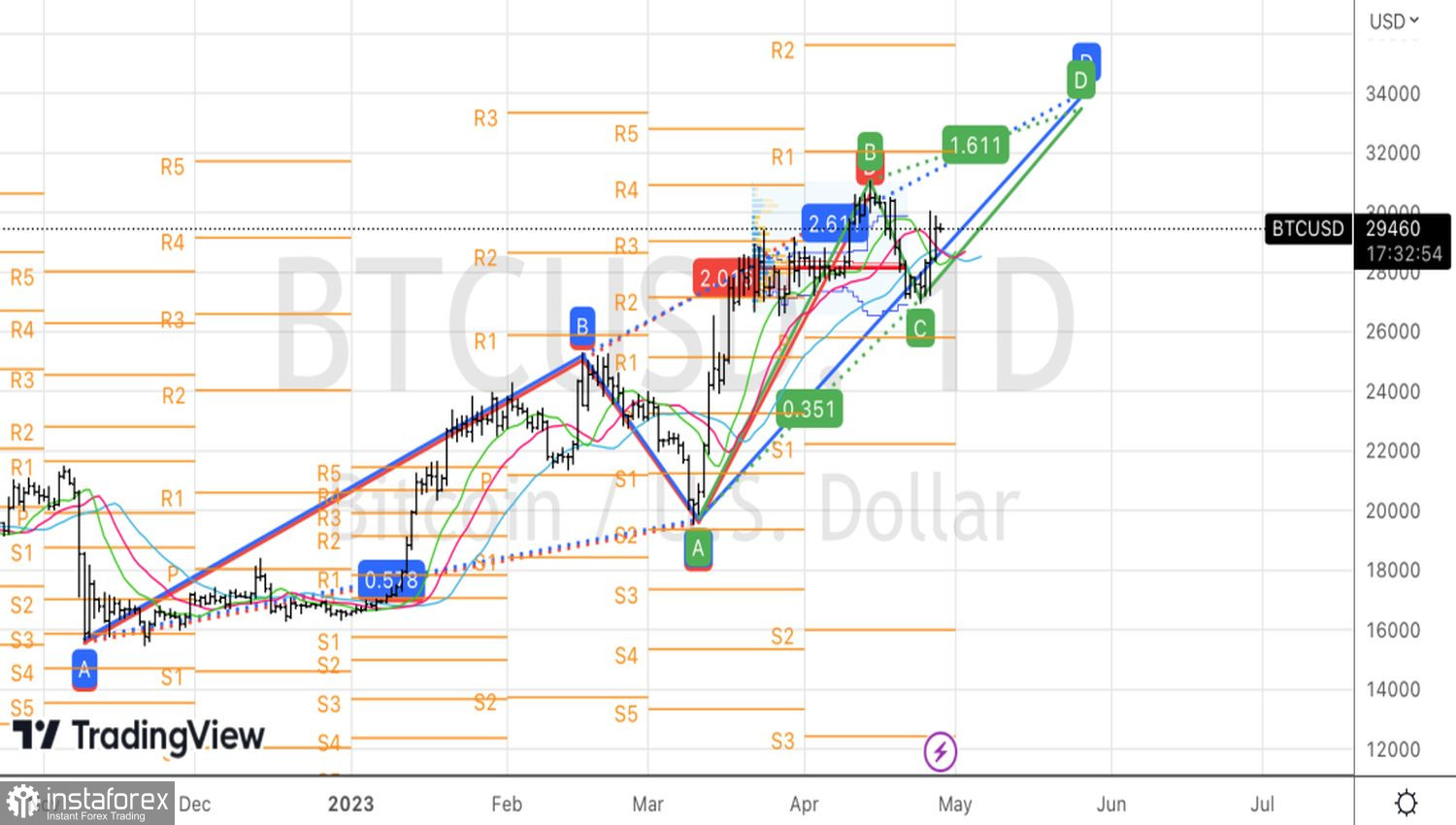

Technically, on the daily chart, the "bulls" for BTCUSD are preparing to restore the upward trend towards targets at 261.8% and 161.8%, according to the parent and child patterns AB=CD after a small tactical retreat. The pullback to 27,200 allowed us to form long positions, and now we will increase them on the breakout of resistance at 29,840.