This morning, the price of crude oil continued its trajectory from yesterday and developed upside momentum. Prices are rising but at a moderate pace. However, we can't say that the pace is slow. The main driver at the moment is the anticipation of financial reports from oil and gas companies.

Very soon, the final reports will be published. Some analysts point out that the majority of large companies may demonstrate positive dynamics. This stimulates traders' interest and creates a favorable background for an uptrend in oil.

Thus, on Friday morning, global oil prices are showing an increase and are unlikely to reverse anytime soon as there is enough strength to continue growth.

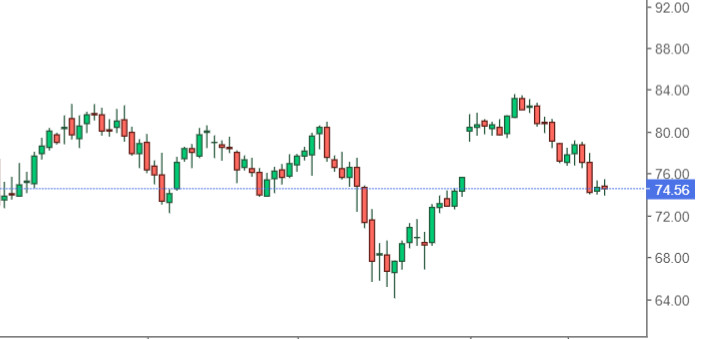

Brent crude oil futures for July went up by 0.77% on the London Exchange, approaching a new level of $78.82 per barrel. However, this is still quite close to the minimum values. Oil is struggling to move away from these levels and may soon succeed in this.

The price of WTI light crude oil futures for June delivery on the New York Exchange also showed reasonable growth. It gained 0.66% and moved to around $75.25 per barrel. These are quite decent results for this oil grade.

Oil prices have been rising for the past two days. Earlier, crude oil had recorded a negative trend, which significantly reduced its value. However, it managed to cope with this thanks to fairly positive economic signals. The main news data contributed to growth rather than decline, allowing oil to emerge from the crisis. Nevertheless, it is still too early to talk about significant strengthening. For now, the energy market cannot move far from the minimum values recorded in recent months.

The main hope of investors is focused on the financial performance of large oil and gas companies. If their revenue increases, the oil sector will receive some support. Then, prices will definitely be able to mark a good increase, and the crisis of recent weeks will be overcome.

It is worth noting that the reports of the largest oil companies in some countries are due to be published today. In particular, this concerns Australia, Italy, and the United States.

Another crucial factor for the oil market is the US macroeconomic data that was published yesterday. According to it, US GDP for the first quarter of this year increased, with a fairly decent growth of 1.1% on an annualized basis. However, this reading still does not reach the preliminary forecasts of experts, who claimed that the increase would be no less than 2% on an annualized basis.

On one hand, economic growth is evidence of some stabilization of the situation. On the other hand, its pace may prompt the main financial regulator to abandon the idea of raising the interest rate. It should be noted that in just a few days, another meeting of the Federal Reserve is scheduled where the main agenda will be the change in the key rate. Market participants are waiting for the signals from the US Fed to choose a further direction.

In addition, investors have also evaluated the GDP data in the eurozone and in particular countries. This can also somewhat affect the commodity. At the very least, in the case of positive changes, market sentiment will improve together with risk appetite.

Another factor pressuring oil is the assessment of consumer sentiment which is traditionally provided by the University of Michigan. It serves as a benchmark reflecting the degree of confidence of American households in the country's economy. According to preliminary forecasts, the index is expected to increase in April, reaching approximately 63.5. The previous indicator was recorded at 62 points which came in line with the forecasts. Most likely, the same will happen this time.

Nevertheless, the main fear of the markets now is the high risk of a recession that can be caused by a rate hike in the US. These concerns do not allow oil prices to break free from the narrow range and finally overcome the mark of $80 per barrel. Once this happens, prices will be able to gain momentum and rise even higher.