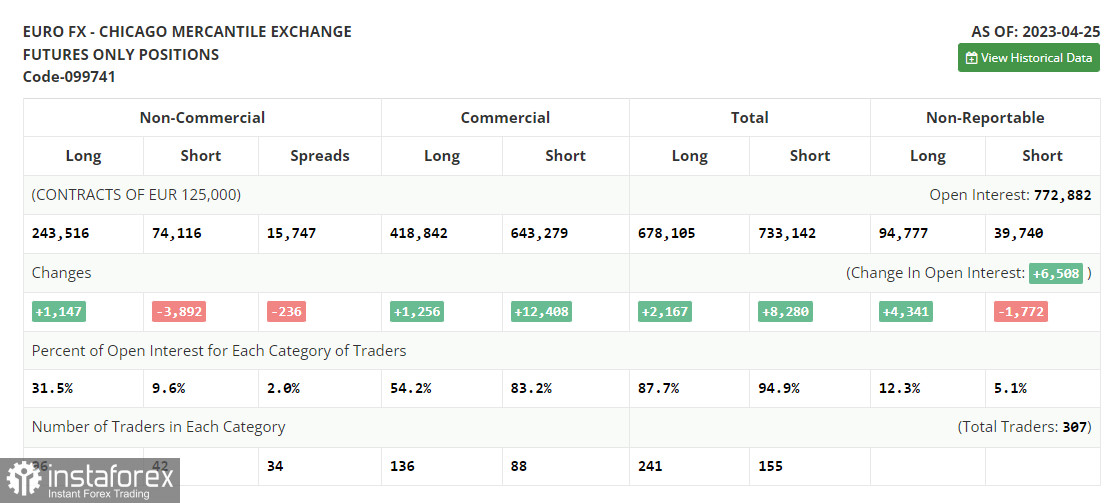

Before discussing the outlook for EUR/USD's movement, let's take a look at what happened in the futures market and how Commitment of Traders' positions have changed. The COT report (Commitment of Traders) for April 25 logged an increase in long positions and a decrease in short positions. Despite some market moves ahead of the Federal Reserve meeting, where rates will definitely be raised by 0.25%, traders are not in a hurry to get rid of long positions on EUR/USD as they expect more aggressive policy update from the European Central Bank. The risk of a recession in the US and a faster slowdown in the economy, along with problems in the banking sector, also allow traders to bet on the growth of risky assets in the medium term, which plays on the side of the euro buyers. The COT report indicates that non-commercial long positions rose by 1,147 to 243,516, while non-commercial short positions declined by 3,892 to 74,116. As a result, the total non-commercial net position went up last week to 144,892 against 139,956 a week earlier. EUR/USD closed last week lower at 1.1006 from the closing price of 1.1010 in the previous week.

What is needed to open long positions on EUR/USD

Today, the euro's trajectory will entirely depend on the data on business activity in the manufacturing sector of the Eurozone countries and the Eurozone Consumer Price Index for April this year. An increase in the indicator will leave no chance for the European Central Bank, which will have to raise interest rates further aggressively. In theory, this move is bullish for the euro. If the data shows a deceleration in consumer inflation, especially in the core CPI, the euro will come under selling pressure which is likely to escalate.

In case the market gives a negative response to the reports, it would be nice to see bullish activity around the rather important support level of 1.0967, though I don't take it too seriously as it has been tested three times recently. Only a false breakout there will be a reason to open long positions betting on the pair's recovery and the development of a new bullish trend with an update of the nearest resistance at 1.0999. This is the level where the moving averages are passing playing on the sellers' side. A breakthrough and a top-down test of this range in light of the strong Eurozone's statistics will also suggest buying, allowing for an update of 1.1034 and cementing the hope for a larger upward movement towards the high of 1.1063, where I will lock in profits. The ultimate target will be the area of 1.1094, last month's high.

In the case of EUR/USD goes down and the buyers are not active at 1.0967, which is quite likely, pressure on the euro will intensify. In such a scenario, only a false breakout around the next support level of 1.0940 will be a reason to buy the euro. I will open long positions on EUR/USD immediately on a dip only from the low of 1.0913, or even lower, around 1.0867, with the aim of an upward correction of 30-35 points within the day.

What is needed to open short positions on EUR/USD

The bears are still taking the lead, but it seems that the correction will continue shortly. Even high inflation will not help the European currency to avoid updating monthly lows. In case of growth, the sellers need to make sure to assert themselves around 1.0999, where a false breakout will give a signal to open new short positions. This will lead push the euro down to the area of the nearest support at 1.0967. A breakthrough and consolidation below this level, as well as a reverse test from the bottom up of this level, will provide an additional signal to open short positions in the course of the downward correction. The buyers' stop orders will be triggered, pushing the price to 1.0940. We could expect a breakout of this level only in the second half of the day. The target will be the support level of 1.0913, where I will lock in profits.

In case of an upward movement in EUR/USD during the European session and the absence of the bears at 1.0999, which is quite likely with strong inflation in the Eurozone, the bulls will not regain control of the market, but the pressure on the euro will ebb away. In this case, I recommend traders delay opening short positions until 1.1034. A false breakout there will become a new starting point for entering short positions. I will sell EUR/USD immediately on the rebound from the high of 1.1063 or even higher, from 1.1094 with the aim of a downward correction of 30-35 points.

Indicators' signals

Moving Averages

The instrument is trading below the 30 and 50-day moving averages. It proves that the instrument is still under selling pressure.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case EUR/USD declines, the lower indicator's border around 1.0950 will act as support. Alternatively, if the instrument grows, the indicator's upper border at 1.1025 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.