Trading recommendations

The price tested 1.2615 when the MACD indicator began a new upward movement, which was a confirmation of the correct entry point into long positions. As a result, the pair rose by about 20 pips. After the release of strong statistics data on the US labor market and the collapse of the pound, the first test of the price at 1.2569 came when the MACD went down. That is why it was impossible to sell. Shortly after that, there was another test, when the MACD indicator was in the oversold area. As a result, the market situation developed according to scenario №2 and the pound sterling jumped by more than 60 pips.

A rise in the number of new jobs and a decline in the US unemployment rate in April boosted the dollar. However, that was not enough to stop the uptrend of the pair before the next meeting of the Bank of England. Notably, the regulator is expected to raise the key rate. Since the UK will not publish any report early today, we can expect further growth of GBP/USD and reaching new weekly highs.

Later today, countries will issue only insignificant reports, including wholesale trade sales, wholesale inventories, and employment trends index in the US. The data will not be of great interest to traders. Thus, buyers of risk assets, including the British pound may continue opening long positions.

Signals to buy GBP/USD:

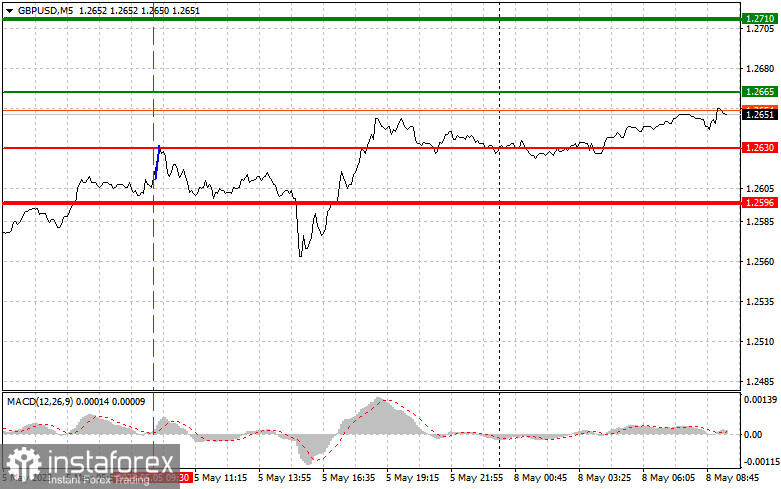

Scenario №1: traders may buy the pound today if the price touches the entry point near 1.2665 (green line on the chart). In this case, the target will be located near 1.2710 (thicker green line on the chart). In the area of 1.2710, I recommend closing buy orders and opening sell ones, expecting a movement of 30-35 pips. Today, traders may bet on a further rise in the pound sterling. Important! Before buying, make sure that the MACD indicator is above zero and is just starting its growth from it.

Scenario №2: Traders may also buy the pound sterling today in case of two consecutive tests of 1.2630 when the MACD indicator is in the oversold area. This will limit the downside potential of the pair and lead to an upward reversal of the market. We can expect an increase to the levels of 1.2665 and 1.2710.

Signals to sell GBP/USD:

Scenario №1: traders may sell the pound sterling today only after the price touches 1.2630 (red line on the chart), which will lead to a rapid decline in the pair. A key target for the sellers will be located at 1.2596, where I recommend closing sell orders and opening buy positions, expecting a movement of 20-25 pips. The pressure on the pound sterling will return in case of an unsuccessful consolidation at the monthly highs. Important: Before opening sell orders, make sure the MACD indicator is below zero and is just starting to decline from there.

Scenario №2: traders may also sell the pound today in case of two consecutive tests at 1.2665 when the MACD is in overbought territory. This will limit the upside potential of the pair and lead to a downward reversal in the market. We can expect a decline to the levels of 1.2630 and 1.2596.

What we see on the trading chart:

A thin green line is a key level at which you can place long positions on EUR/USD.

A thick green line is the target price since the quote is unlikely to move above it.

A thin red line is a level at which you can place short positions on EUR/USD.

A thick red line is the target price since the quote is unlikely to move below it.

A MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions to enter the market. Before the release of important reports, it is better to stay out of the market to avoid sharp fluctuations in the price. If you decide to trade during the news release, place stop orders to minimize losses. Without stop orders, you can lose the entire deposit, especially if you do not use money management and trade large volumes.

Notably, for successful trading, it is necessary to have a clear trading plan. Rash trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.