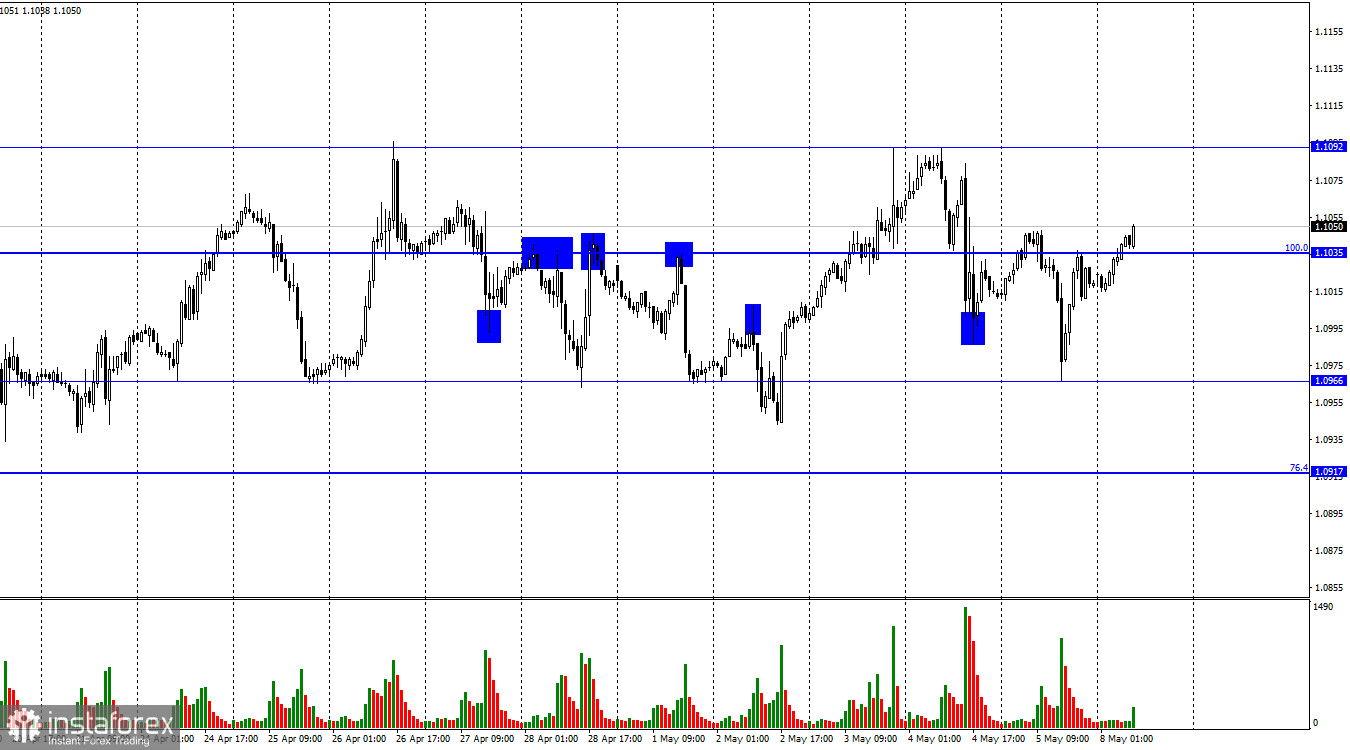

Hello, dear traders! On Friday, the EUR/USD pair dropped to the level of 1.0966, bounced from it, returned to the 100.0% Fibonacci level located at 1.103, and closed above it. Thus, the growth can continue on Monday with a target of 1.1092. The pair has been hovering within the levels of 1.0966 and 1.1092 for 10 working days already.

A sideways movement indicates that bulls and bears are currently in balance. Last week, the news background was quite strong, but neither bulls nor bears managed to use it for their own benefit. This week, the macroeconomic calendar is not rich in events, so the likelihood that the sideways movement will continue is high. On Monday, a report on industrial production in Germany was released. The indicator contracted by 3.4% in March. Traders expected to see a decline of 1.3%. Thus, bears had a good chance to enter the market, but the EUR/USD pair did not react to this report at all. To be fair, it is worth noting the low importance of this report.

More important was Klaas Knot's speech on Sunday. The President of the Central Bank of the Netherlands stated that the ECB's interest rate could rise to 5% if inflation showed higher resilience than expected. He supported a rate hike of 0.25% last week, which some economists considered a dovish decision. However, the European regulator could also reduce the pace of rate hikes but increase their duration. With small steps, it will be easier to respond to inflationary and economic changes so as not to overcool the economy. The ECB is forced to closely monitor changes as economic growth has been zero for several quarters.

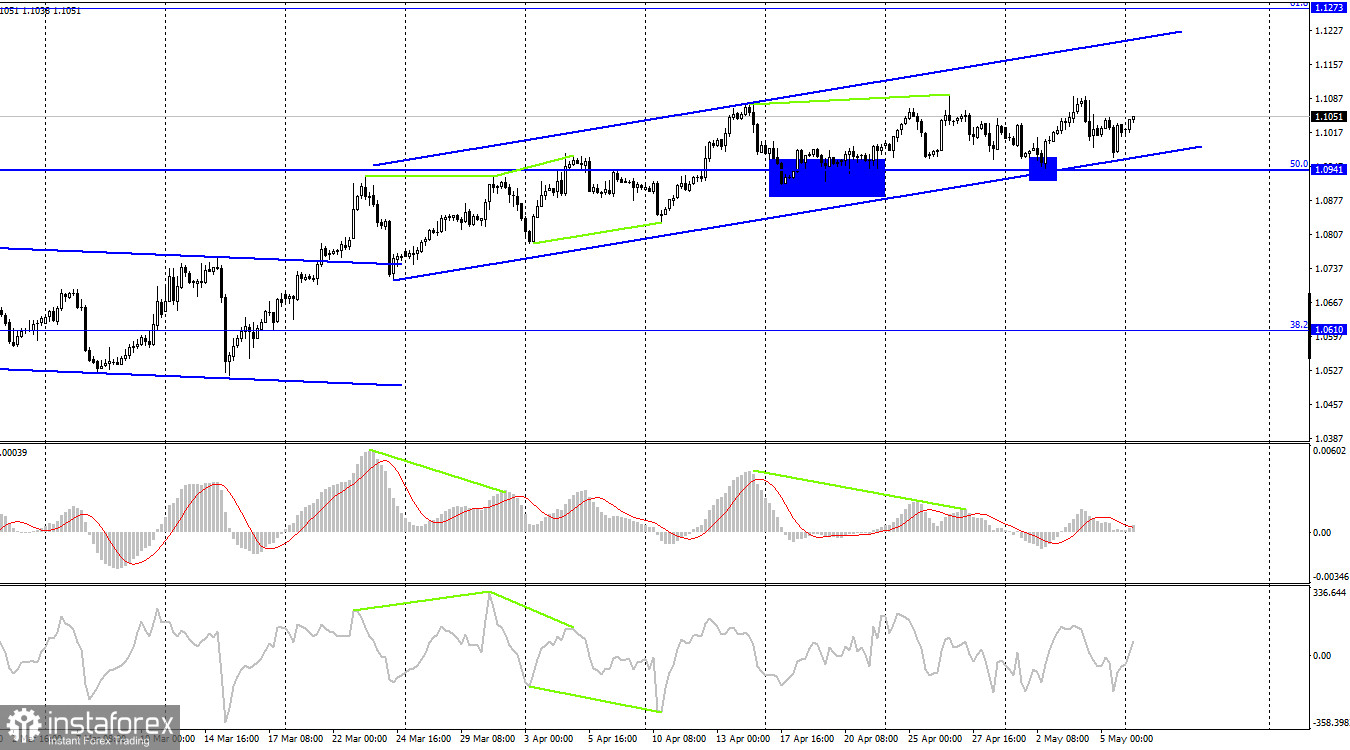

On the 4-hour chart, the pair consolidated above the sideways corridor. Thus, it has every chance to climb to the correction level of 61.8%, 1.1273. A rebound from the correction level of 50.0%, 1.0941, and a new ascending trend corridor may boost the likelihood of a further rise. Consolidation below these two graphical patterns will work in favor of the US dollar and may cause a drop in the pair towards the 38.2% Fibonacci level located at 1.0610.

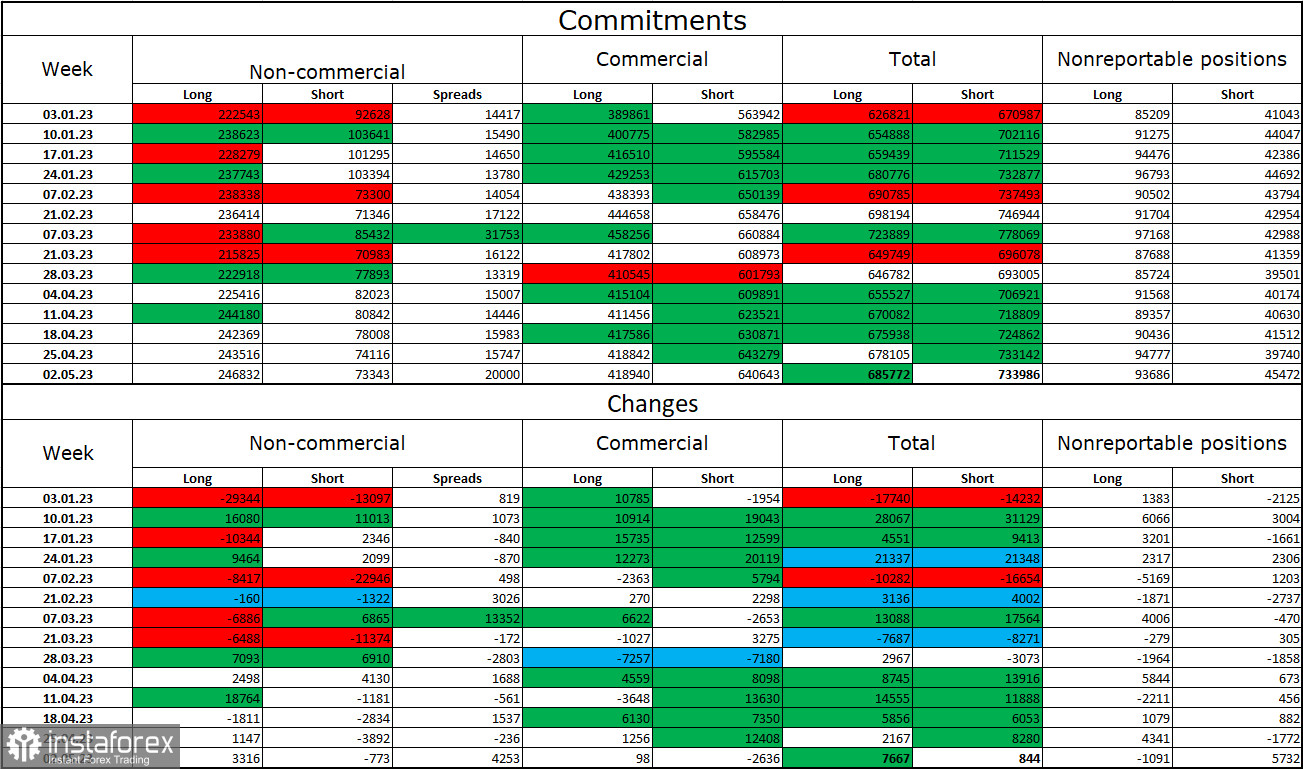

COT report:

During the last reporting week, speculators opened 3,316 long contracts and closed 773 short contracts. The sentiment of major traders remains bullish and continues to strengthen. The total number of long contracts now amounts to 247,000, whereas the number of short contracts is only 73,000. The euro has been growing for more than six months. However, the news flow does not always support the pair. Last week, the ECB lowered the rate hike pace to 0.25%. However, bulls have not yet retreated from the market. The difference between the number of long and short contracts is threefold, which points to the fact that bears will soon enter the market. At present, bulls are controlling the market. However, the situation may change in the near future. In recent weeks, the euro has simply maintained high positions but has not grown further.

Macroeconomic calendar for the US and the EU:

On May 8, the macroeconomic calendar is not rich in events. That is why there will be no influence of the news on traders' sentiment.

Outlook for EUR/USD and tips for traders:

Sell orders could be opened after a bounce from the 1.1092 level on the hourly chart with targets at 1.1035 and 1.0966. Buy positions are possible after a bounce from 1.0966 on the hourly chart with a target of 1.1092. It is also possible to buy in case of a close above 1.1092 aiming for 1.1172.