Overview :

A trend in the EUR/USD pair was argumentative as it was trading in a narrow sideways channel, the market showed signs of instability. Amid the previous events, the price is still moving between the levels of 1.0636 and 1.0780. Resistance and support are seen at the levels of 1.0780 (also, the double top is already set at the point of 1.0780) and 1.0636 respectively. Therefore, it is recommended to be cautious while placing orders in this area.

So, we need to wait until the sideways channel has completed. The current price is seen at 1.0691 which represents a key level today. The level of 1.0725 will act as the first resistance today. Consequently, there is a possibility that the EUR/USD pair will move downside.

The structure of a fall does not look corrective. In order to indicate a bearish opportunity below the spot of 1.0725 - 1.0748, The level of 1.0725 coincides with 61.8% of Fibonacci, which is expected to act as a major resistance today. Since the trend is below the 61.8% Fibonacci level, the market is still in a downtrend.

Also, it should be noted that : - Buying happens in a long amount of time. - Selling happens in a short amount of time. - Buy inexpensive and sell expensive. Overall, we still prefer the bearish scenario. Hence, if the pair fails to pass through the level of 1.0725, the market will indicate a bearish opportunity below the strong resistance level of 1.0725.

Sell deals are recommended below the level of 1.0725 with the first target at 1.0670. If the trend breaks the support level of 1.0670, the pair is likely to move downwards continuing the development of a bearish trend to the level 1.0636 so as to test the double bottom at the hourly chart. The market is still in an downtrend.

We still prefer the bearish scenario. In case a reversal takes place and the EUR/USD pair breaks through the support level of 1.0636, a further decline to 1.0603 can occur, which would indicate a bearish market. Overall, we still prefer the bearish scenario, which suggests that the pair will stay below the zone of 1.0725 today.

Currently, the price is moving in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in a bullish trending market. The price is still above the moving average (100) and (50). Therefore, if the trend is able to break out through the first resistance level of 1.0785, we should see the pair climbing towards the daily resistance at 1.0808 to test it. It would also be wise to consider where to place stop loss; this should be set below the second support of 1.0687.

If the trend breaks the support level of 1.0670, the pair is likely to move downwards continuing the development of a bearish trend to the level 1.0636 so as to test the double bottom at the hourly chart. The market is still in an downtrend. We still prefer the bearish scenario. In case a reversal takes place and the EUR/USD pair breaks through the support level of 1.0636, a further decline to 1.0603 can occur, which would indicate a bearish market. Overall, we still prefer the bearish scenario, which suggests that the pair will stay below the zone of 1.0725 today.

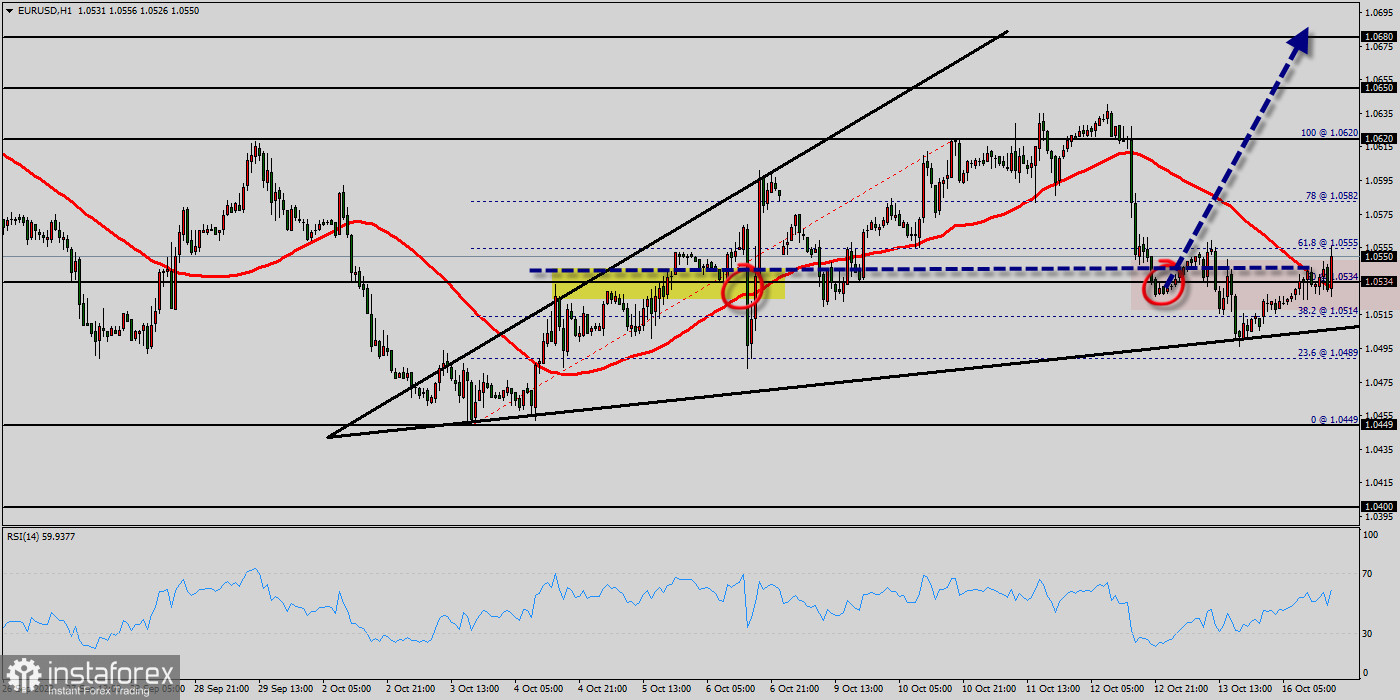

The EUR/USD pair broke resistance at 1.0543 which turned into strong support yesterday. This level coincides with 50% of Fibonacci retracement which is expected to act as major support today. Equally important, the RSI is still signaling that the trend is upward, while the moving average (100) is headed to the upside. Accordingly, the bullish outlook remains the same as long as the EMA 100 is pointing to the uptrend. This suggests that the pair will probably go above the daily pivot point (0.9958) in the coming hours.

The EUR/USD pair will demonstrate strength following a breakout of the high at 1.0604. Consequently, the market is likely to show signs of a bullish trend. In other words, buy orders are recommended above 1.0604 with the first target at 1.0620. Then, the pair is likely to begin an ascending movement to 1.0650 mark and further to 1.0680 levels. The level of 1.0680 will act as strong resistance, and the double top is already set at 1.0680. On the other hand, the daily strong support is seen at 1.0534. If the EUR/USD pair is able to break out the level of 1.0534, the market will decline further to 1.0449 (daily support 2).