The euro is struggling to hold onto $1.05 like a drowning person grasping for a lifeline. However, grim prospects for the Eurozone's economy, the divergence in monetary policies between the Federal Reserve and the European Central Bank (ECB), the specter of an energy crisis, and the resurgence of fiscal discipline issues in Italy are creating significant headwinds for the EUR/USD bulls. This allows investors to consider a return of the major currency pair to parity.

While there were hopes earlier in the summer for an acceleration of the Eurozone economy due to a surge in tourism and growth in the service sector, by mid-autumn, it became clear that this had not materialized. Business activity dynamics in both the manufacturing and non-manufacturing sectors suggest a recession. The currency bloc is teetering on the edge between decline and stagflation. Against the backdrop of the U.S. economy's pleasant surprise, this provides a strong foundation for the peak of EUR/USD.

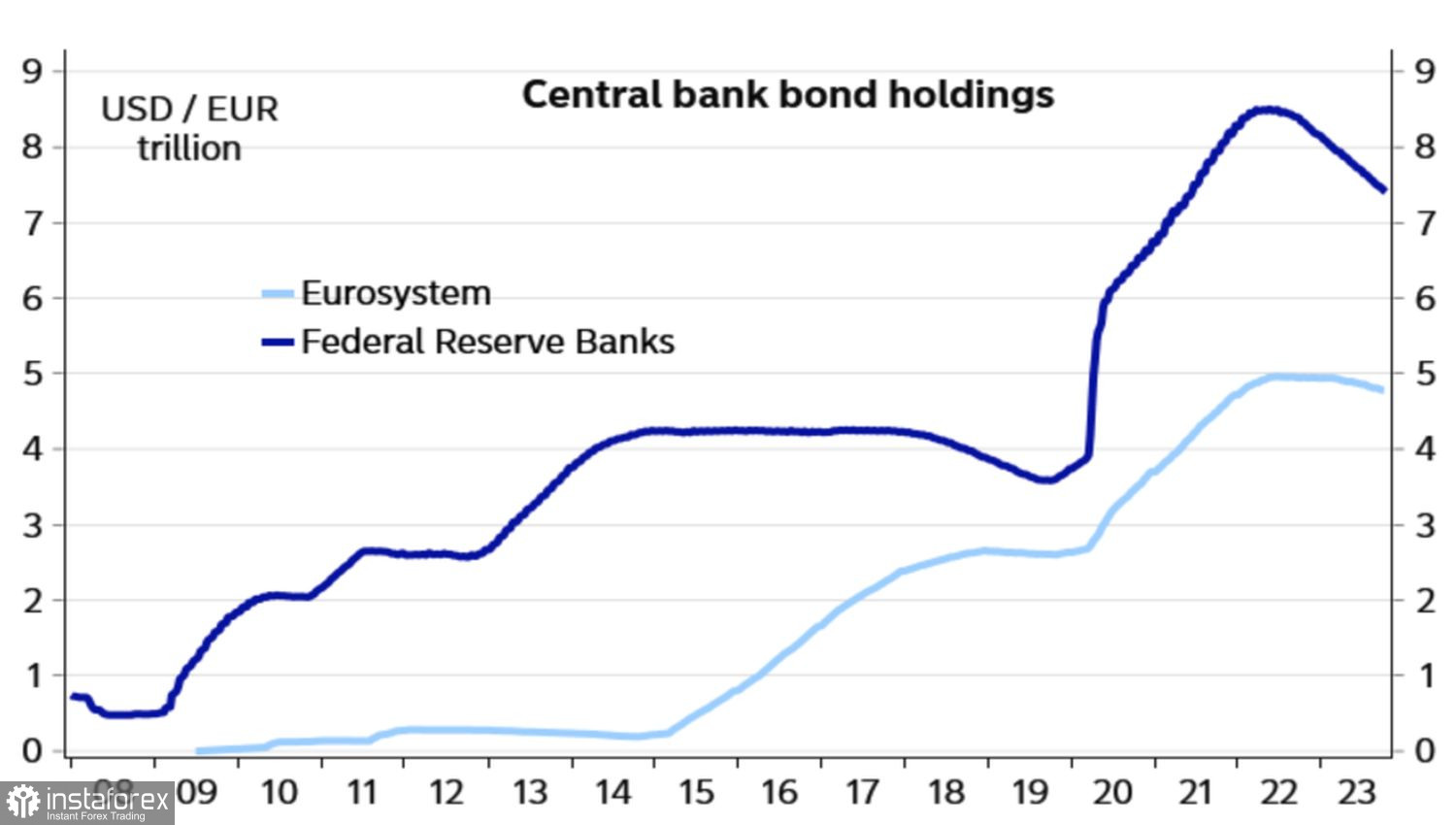

During its latest meeting, the ECB signaled the end of its monetary policy tightening cycle. The deposit rate will remain at 4% for a long time. In contrast, the federal funds rate, which may still rise from 5.5% to 5.75%, offers a divergence in monetary policy. However, this policy divergence is not the only manifestation. The Federal Reserve is shrinking its balance sheet much faster than its counterparts at the European Central Bank. This leads to a faster rise in U.S. bond yields compared to German bonds and a decline in EUR/USD quotes.

Dynamics of the Fed and ECB Balance Sheets

Weaker-than-expected economic growth coupled with tightening financial conditions has ignited problems in Italy. Rome has planned a higher budget deficit to GDP ratio in 2024 and 2025 than previously anticipated. It stated that the EU's requirements on this indicator would only be met in 2026. As a result, the spread between Italian and German bond yields has widened to more than 200 basis points, which indicates increased political risk and exerts additional pressure on EUR/USD.

Finally, rising oil prices exacerbate the Eurozone's problems. If in 2022, the energy crisis weakened the economy due to supply issues, at present, a different situation is unfolding. An armed conflict in the Middle East threatens to reduce Iran's black gold exports and continue the Brent rally. Consequently, the prices of other energy carriers, including natural gas, are likely to rise. The specter of an energy crisis continues to haunt Europe, making the EUR/USD bulls uneasy.

It is not surprising that the attempts of U.S. and German officials to diplomatically resolve the situation in Israel have gained support for the euro. However, Jerusalem remains determined, so the EUR/USD respite is likely temporary.

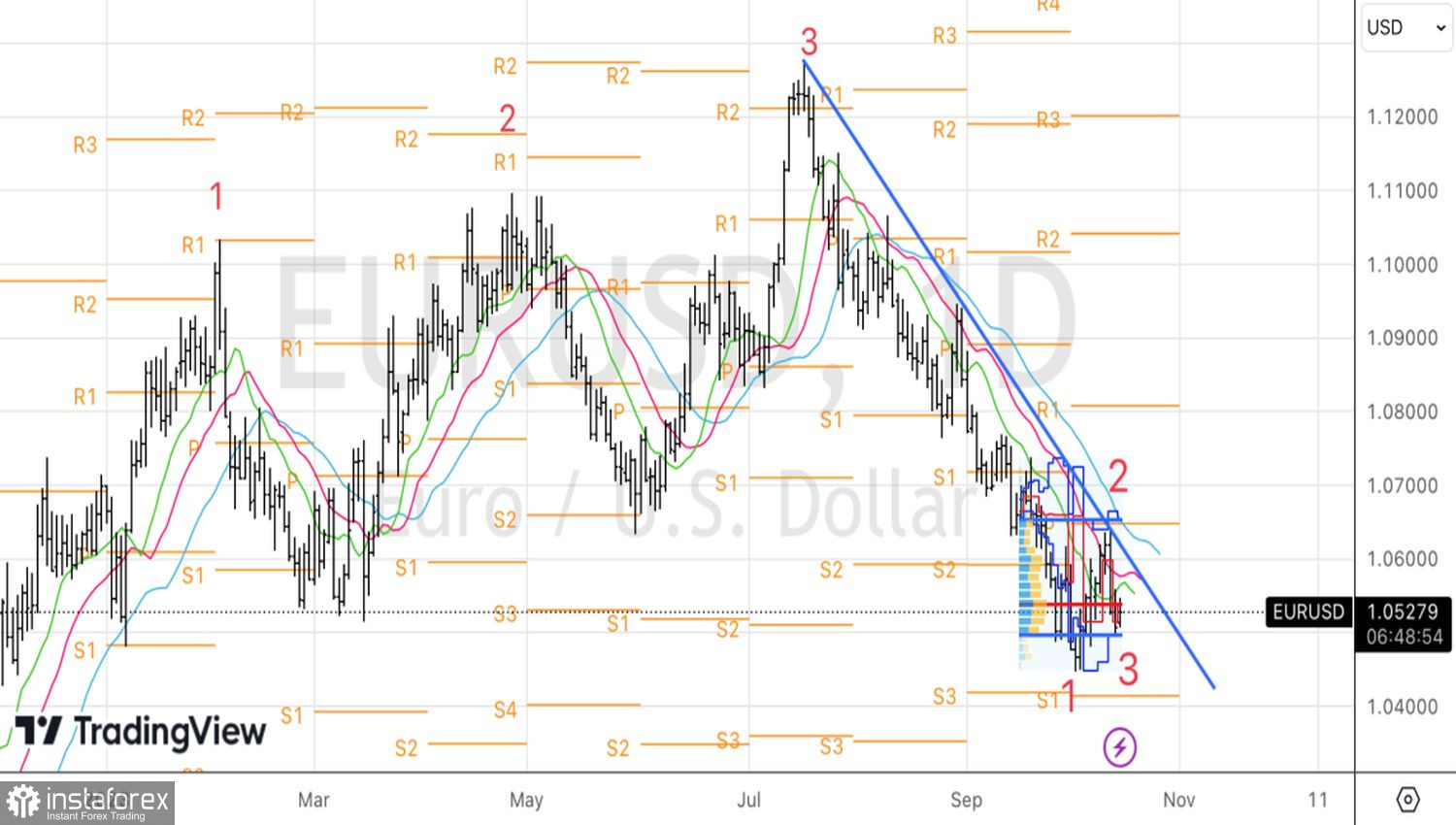

From a technical perspective, a substantial correction in the major currency pair can only occur upon activation of the reversal pattern 1-2-3. To achieve this, a break above resistance at 1.0595 is needed. A successful breach would enable long positions in EUR/USD. However, as long as the euro is trading below this level, preference should be given to selling.