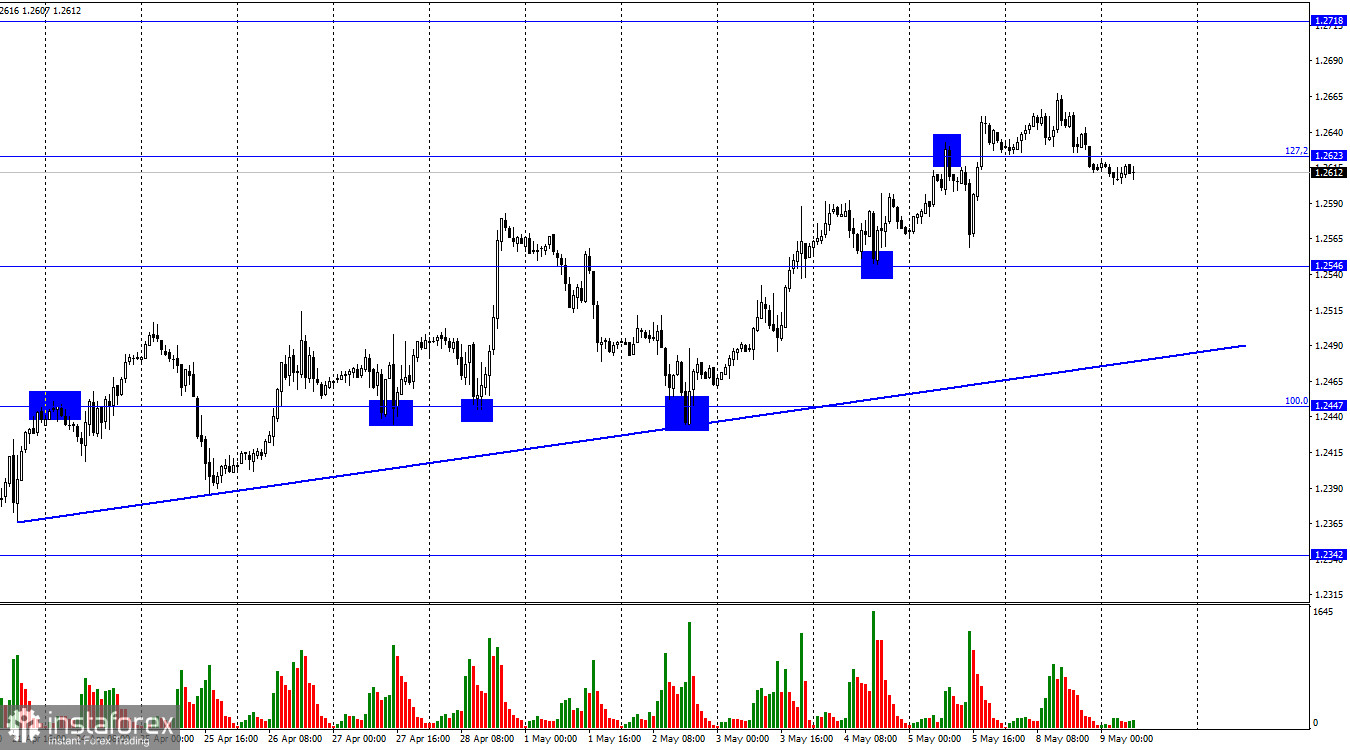

On the hourly chart, the GBP/USD pair on Monday performed a reversal in favor of the US currency and consolidation below the corrective level of 127.2% (1.2623). Thus, the decline may continue towards the level of 1.2546, and the ascending trend line continues to characterize the mood of traders as "bullish." Closing the pair's rate above the level of 1.2623 will again work in favor of the British currency and resume growth towards the level of 1.2718.

This week, all traders will focus on the US inflation report and the Bank of England meeting. The prospects for the dollar are not encouraging. The Bank of England is likely to raise the rate by another 0.25% and indicate its readiness to maintain the pace of tightening for several more meetings. At the same time, inflation in the US may fall below the current 5%, which will "cross out" new rate hikes by the FOMC. In this case, the British currency may show new growth, although it has grown quite strongly in recent weeks and months.

However, the British economy shows good resilience; the recession has not started yet, and the UK banking system has not lost a single bank during the recent crisis. The situation in America is also not the worst. The economy is growing, the labor market consistently creates jobs, and unemployment has remained at a minimum level for decades. But the US banking system has lost at least three major banks, which also matters. The main factor remains the rates. They may continue to rise in the UK, while in the US, they may not.

Even the pound's fall after the Bank of England meeting will not lead to the formation of a downward trend. A significant decline in the pair can be expected after closing below the trend line. Currently, the dollar is unfavorable, and bullish traders do not give up the initiative to bear.

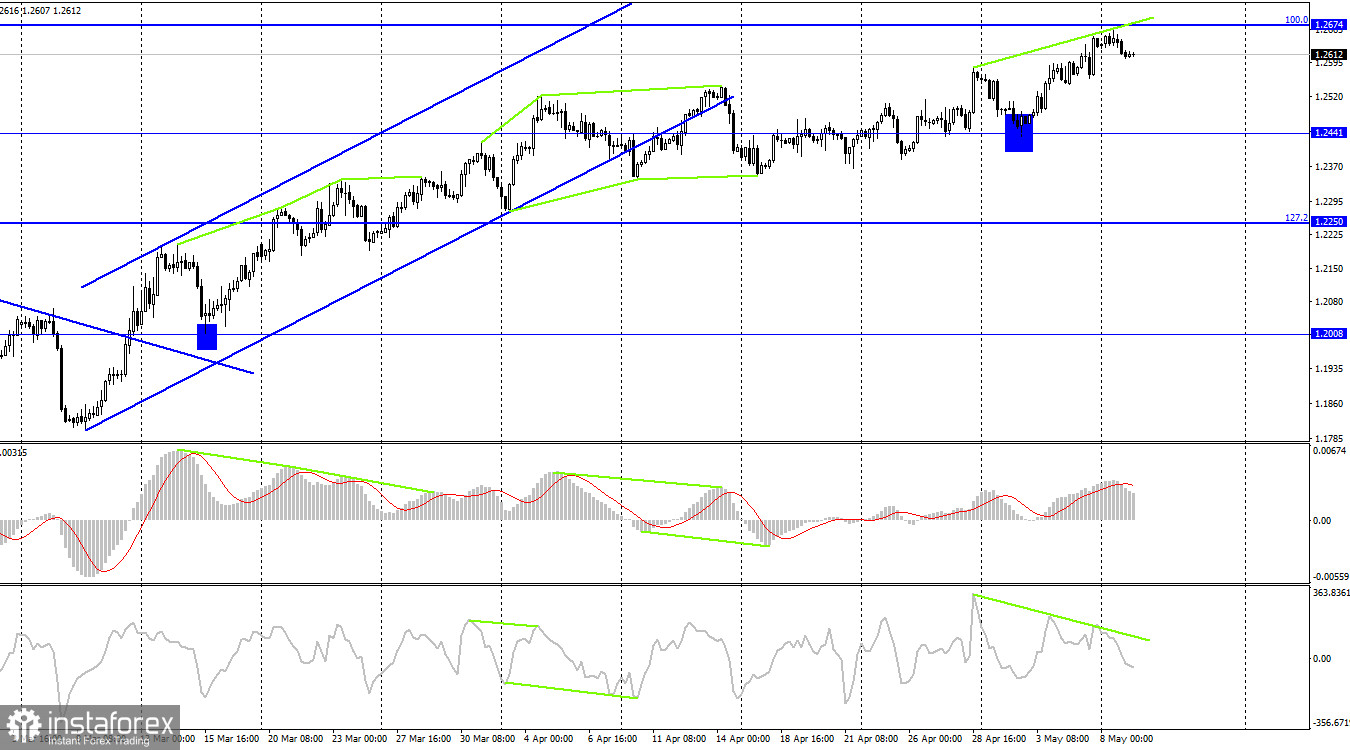

On the 4-hour chart, the pair has consolidated below the ascending trend corridor, and nothing happened. The decline did not start. However, the rebound from the level of 1.2441 worked in favor of the British currency and resumed growth towards the Fibo level of 100.0% (1.2674). A "bearish" divergence in the CCI indicator is brewing again and, combined with the level of 1.2674, may create a serious barrier to further growth. The decline of the pair would be logical in the current circumstances.

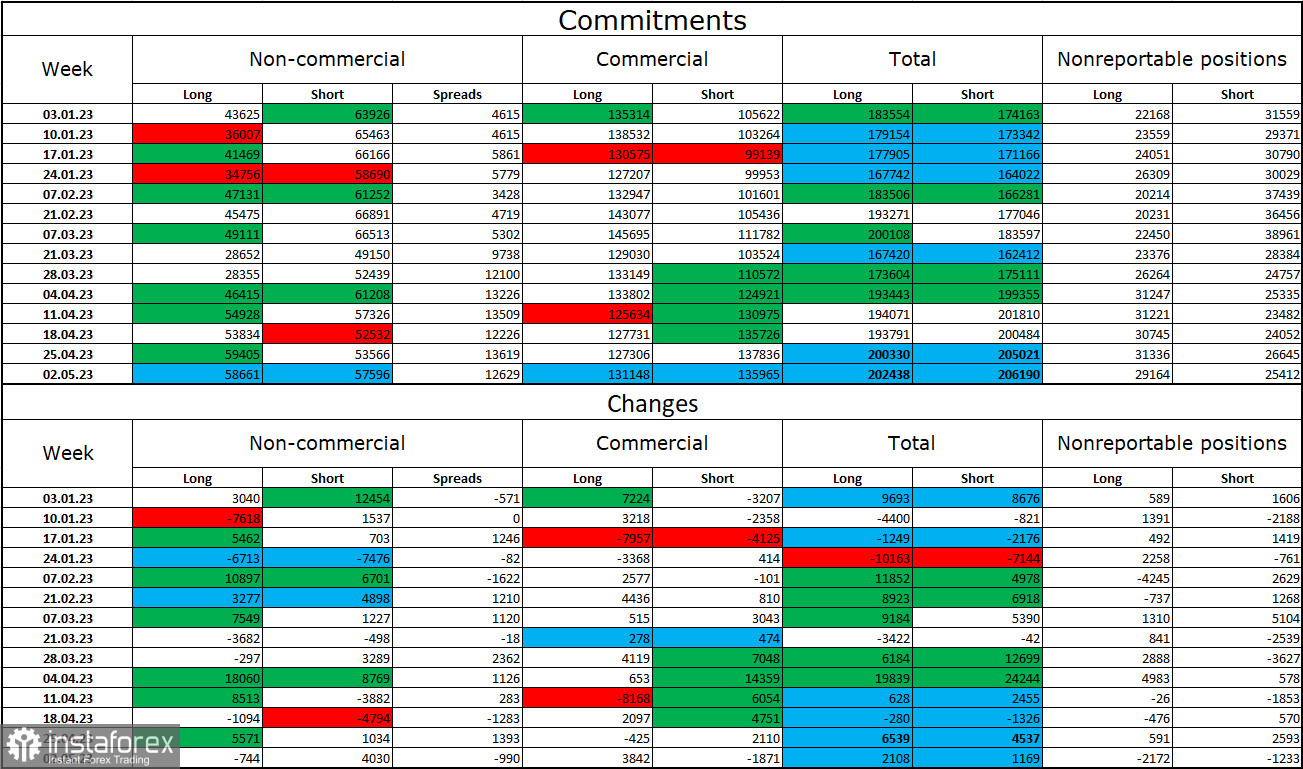

Commitments of Traders (COT) report:

The sentiment of the "non-commercial" category of traders over the last reporting week has become less "bullish." The number of long contracts held by speculators decreased by 744 units, while the number of short contracts increased by 4030. The overall sentiment of major players remains fully "bullish" (for a long time, it was "bearish"), but the number of long and short contracts is now almost the same – 57.5 thousand and 58.5 thousand, respectively. The British currency continues to grow predominantly, although very few factors support its buyers. The prospects for the pound remain decent, but a decline can be expected in the near future. The Bank of England's decision to raise the rate will not surprise traders after eleven monetary policy tightenings.

News calendar for the US and UK:

On Tuesday, the economic events calendar contained no interesting entries. The influence of the information background on traders' sentiment for the remainder of the day will be absent.

GBP/USD forecast and advice for traders:

I advised selling the British currency with a target of 1.2546 in case of closing below the level of 1.2623 on the hourly chart. Now these trades can be kept open. Purchases of the British currency are possible with a close above 1.2623 on the hourly chart and a target of 1.2718.