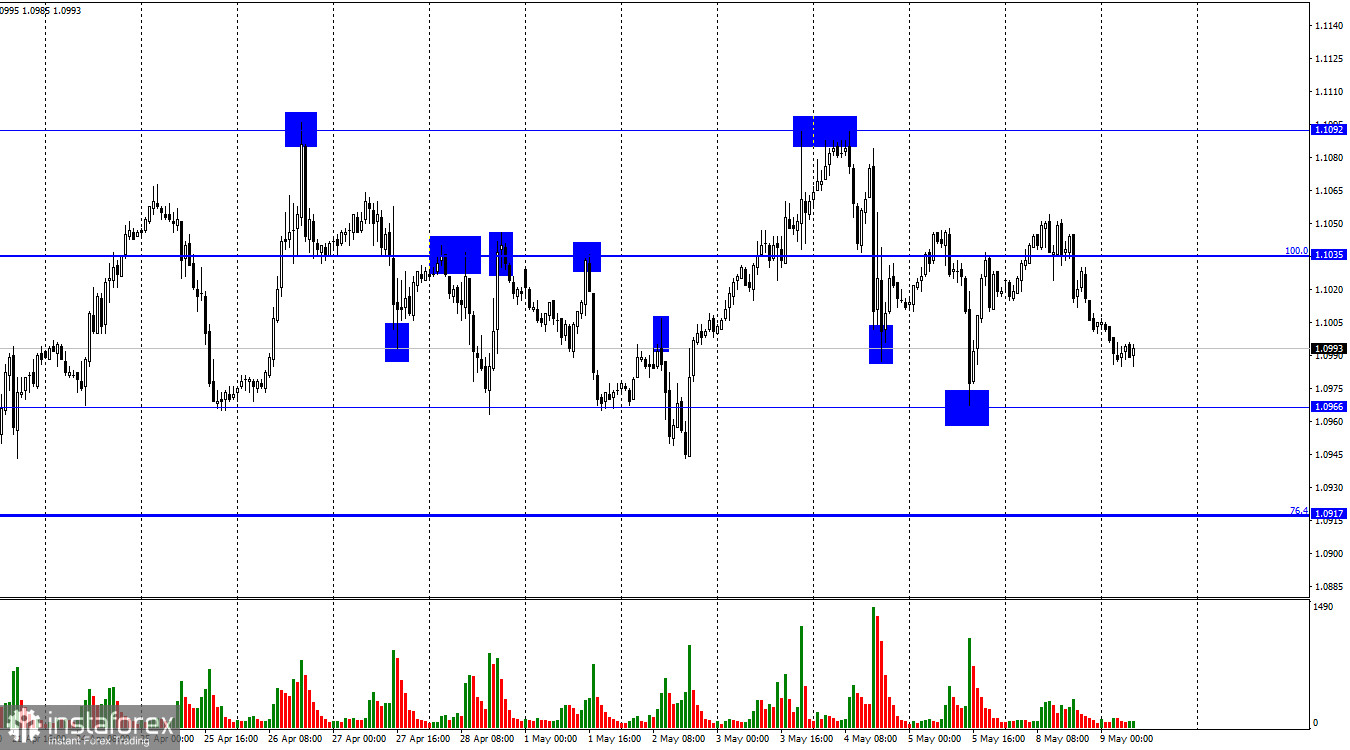

On Monday, the EUR/USD pair reversed in favor of the US currency and began declining toward the 1.0966 level. It's worth noting that the pair has been moving within a horizontal corridor for several weeks now. Neither bulls nor bears have an advantage, but that's only at first glance. The bulls hold winning positions for themselves and may be waiting for new, strong data to continue their upward journey.

The first two days of the new week are quite dull regarding the news background. Yesterday, Germany released a report on industrial production, significantly worse than traders' expectations. The European currency did not experience any discomfort over this. ECB Chief Economist Philip Lane and Governing Council Member Isabel Schnabel will deliver speeches today. Their talks may contain interesting information, but in my opinion, the ECB's position and plans are so obvious to the market that there will be no reaction to Lane's and Schnabel's speeches. The ECB will raise rates a few more times, as other ECB representatives have already stated, since inflation in the European Union remains relatively high.

The situation with the Federal Reserve is also clear. Inflation this week may fall even lower; the rate is already 5.25%, so in 2023, one can expect a maximum of one more tightening, definitely not in June. Additional tightening will be of an emergency nature in case inflation stops declining or starts to rise. Both central banks are close to completing the tightening cycle, but the Federal Reserve is much closer. This factor may support the euro and bulls for some time, but I don't think it will be significant. The ECB may also take a break soon.

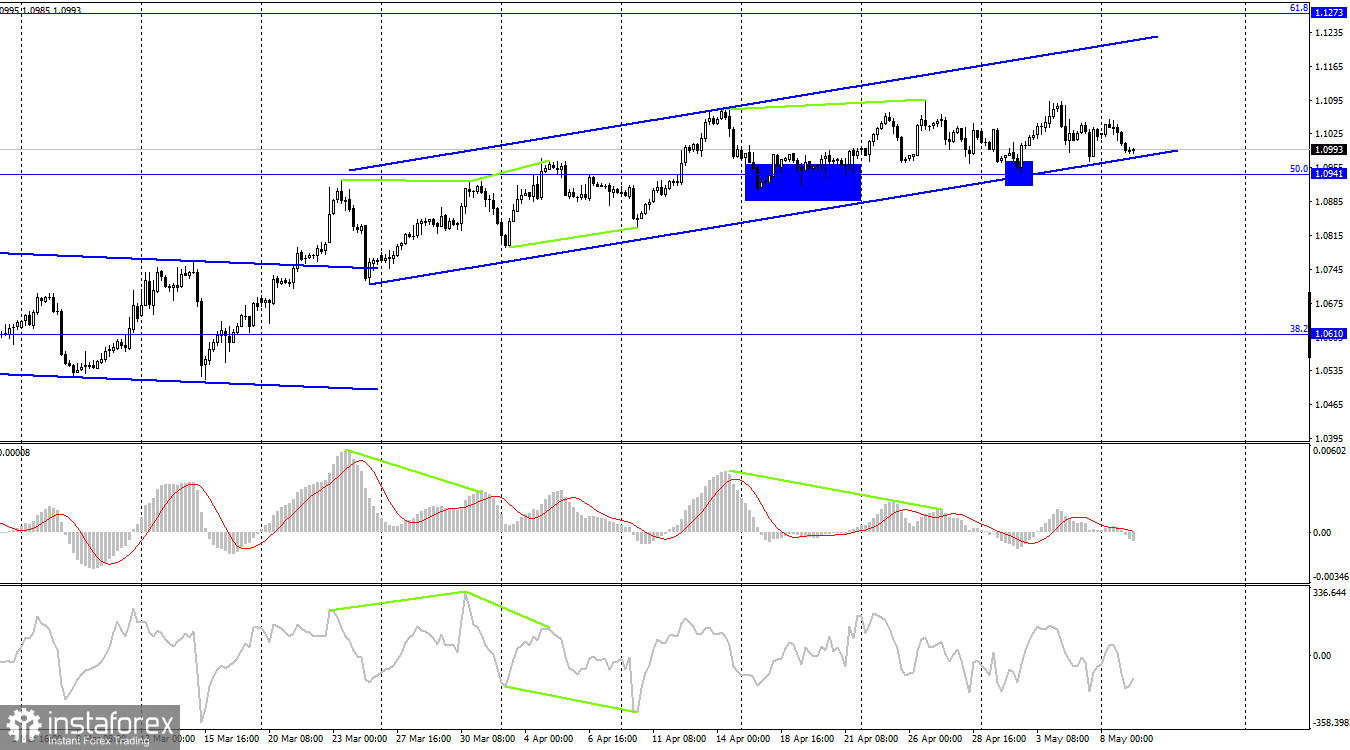

On the 4-hour chart, the pair has consolidated above the sideways corridor, which allows for the continuation of growth toward the corrective level of 61.8% (1.1273). However, consolidation below the new ascending corridor and the Fibonacci 50.0% level (1.0941) will favor the US currency and the long-awaited decline towards 38.2% (1.0610). No emerging divergences are observed today in any indicator.

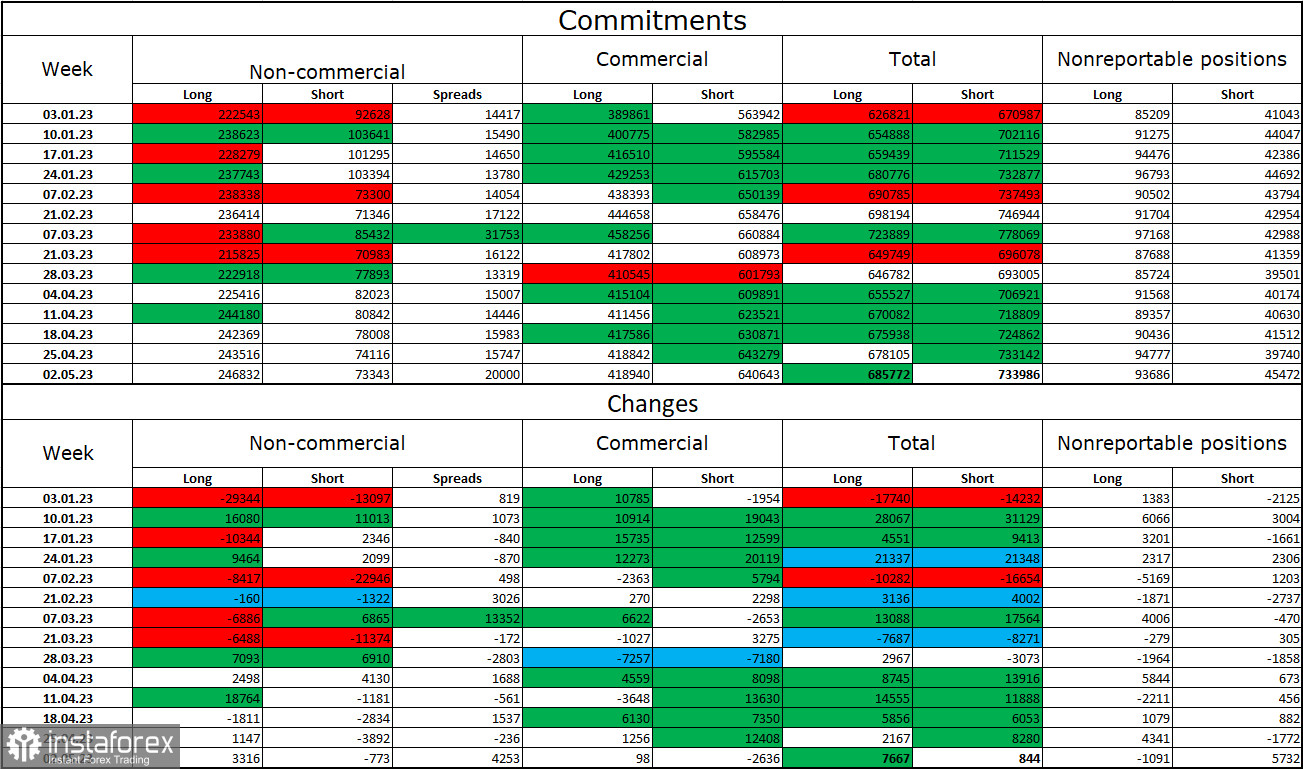

Commitments of Traders (COT) report:

During the last reporting week, speculators opened 3,316 long contracts and closed 773 short contracts. The sentiment of major traders remains "bullish" and continues to strengthen overall. The total number of long contracts concentrated in the hands of speculators now amounts to 247 thousand, while short contracts total 73 thousand. The European currency has been growing for more than half a year, but the news background does not always support the further strong growth of the pair. Last week, the ECB lowered the rate hike pace to 0.25%, but bulls have not yet retreated from the market. The difference between the number of long and short contracts is threefold, indicating the proximity of the moment when bears will take the offensive. For now, a strong "bullish" sentiment is maintained, but I think the situation will start to change soon. The euro has maintained high levels in recent weeks but has not grown further.

News calendar for the US and the European Union:

On May 9th, the economic events calendar contained no important entries. The influence of the news background on traders' sentiment for the rest of the day will be absent.

EUR/USD forecast and advice for traders:

The pair can be sold upon a rebound from the 1.1092 level on the hourly chart, with targets at 1.1035 and 1.0966. Or upon closing below 1.0966 with a target of 1.0917. Purchases are possible upon a rebound from the 1.0966 level on the hourly chart, with a target of 1.1092.