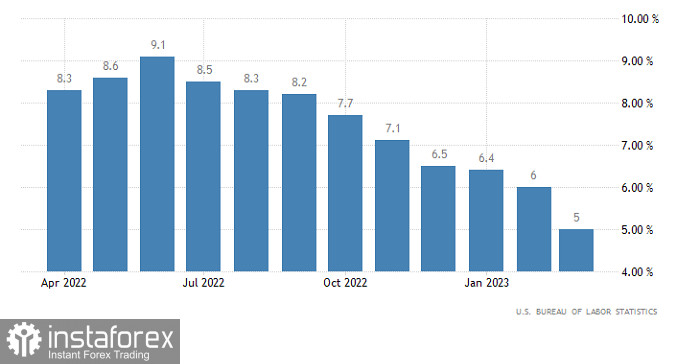

Despite the meetings of the European Central Bank's Governing Council and the Federal Open Market Committee, the single currency continues to trade within a relatively narrow range of 1.0950-1.1050. In essence, the market has been stuck within these limits for almost a month. Having reached the upper limit at the end of last week, the euro slid to the lower limit early this week. It seems that today, it will move back towards the upper one. The rise could be explained by today's inflation data in the United States. After all, consumer price growth is expected to slow down to 4.9% from 5.0%. This will be a kind of confirmation that the Federal Reserve will no longer raise interest rates, which is exactly what investors are counting on. Moreover, a decline in inflation usually has a negative impact on the currency of the country where it occurs.

US Inflation Growth Rate

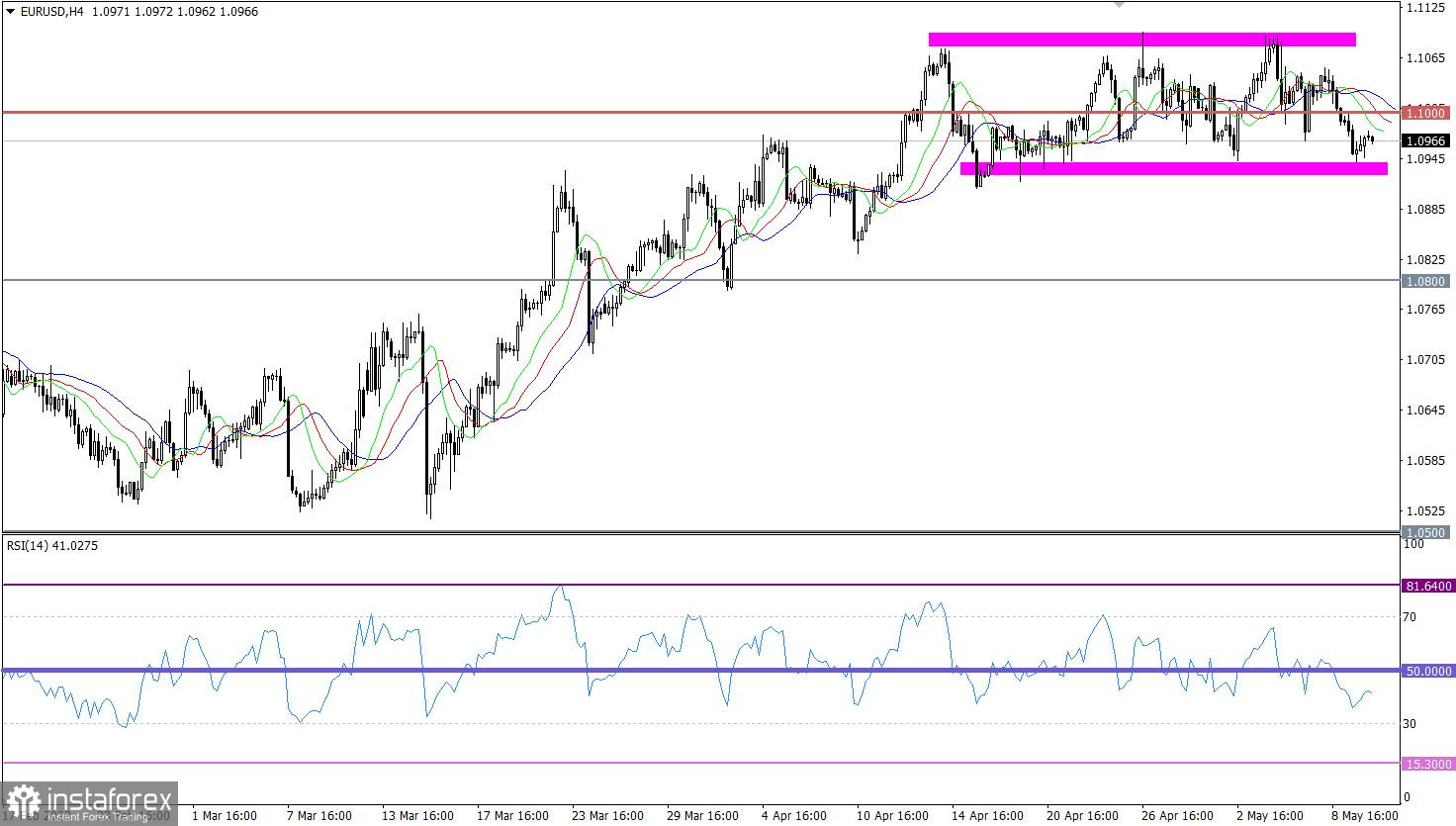

The euro lost about 1.3% against the US dollar after it reached the peak of the medium-term trend. However, there are no radical changes on the trading chart. The quote has been moving within the range of 1.0950-1.1100 for the third week in a row, touching one limit after another.

On the four-hour chart, the RSI indicator is moving in the lower area of 30/50, which corresponds to the touch of the 1.0950 limit.

On the same time frame, the Alligator's MAs are headed downwards. However, the signal is changing since the pair is trading sideways.

Outlook

The pair is likely to go on trading sideways. That is why it is possible to apply two strategies: breakout or rebound.

In case of a rebound, it is necessary to wait for the price to go beyond either limit in the daily period. In this case, a technical signal may point to a further direction of the price.

The comprehensive indicator analysis in the short-term and intraday periods points to selling opportunities since the price is approaching the lower limit of the range. In the daily period, the upward sentiment is still in force despite the local slowdown.