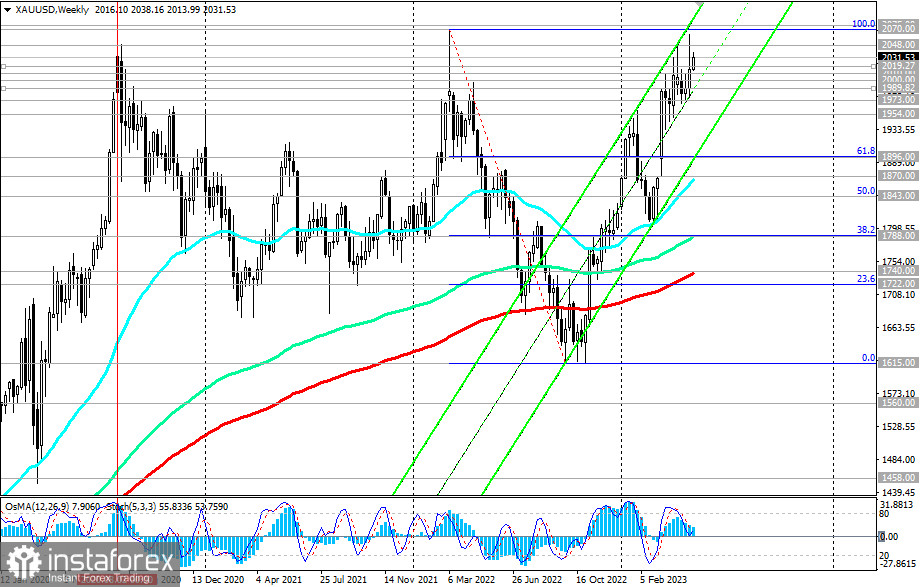

Our main forecast involves betting on further growth of XAU/USD. In the current situation of uncertainty, cautious investors prefer to stay "in gold." Its quotes last week and the day after the Fed meeting jumped to a new record high of 2077.00, updating the March high of last year at 2070.00.

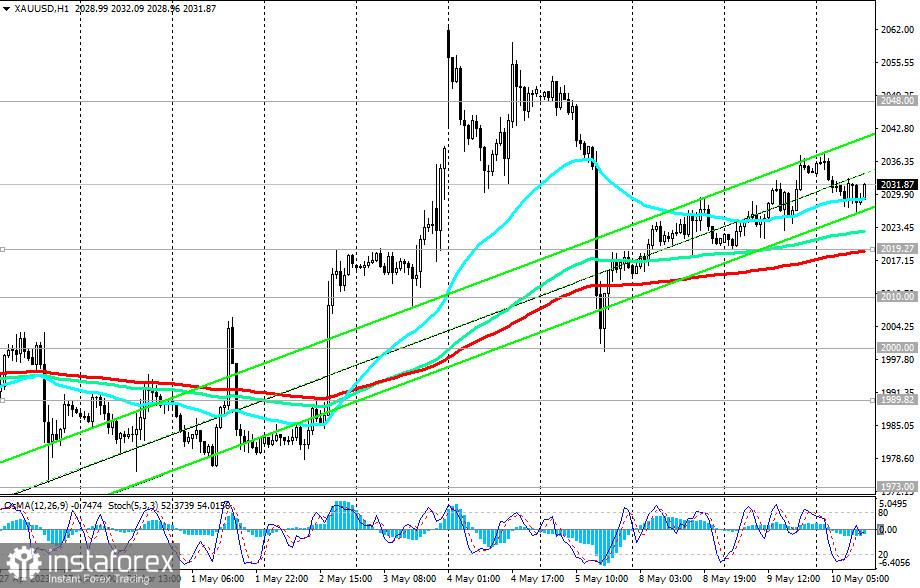

Subsequently the XAU/USD pair declined, but its upward dynamic persists. A signal for increasing long positions could be the breakout of the local resistance level at 2037.00. The nearest growth target is located at the local resistance level of 2048.00, and the distant one is in the area of record highs at 2070.00 and 2077.00.

In an alternative scenario, after breaking the support levels of 1990.00 (200 EMA on the 4-hour chart), and 1973.00 (50 EMA on the daily chart), the price will move towards key support levels at 1896.00 (144 EMA on the daily chart and 61.8% Fibonacci level in the downward correction wave from its peak at 2070.00 to its low at 1615.00), and 1870.00 (200 EMA on the daily chart).

The first signal for implementing this scenario could be the breadown of the support level at 2019.00 (200 EMA on the 1-hour chart).

Support levels: 2029.00, 2019.00, 2010.00, 2000.00, 1990.00, 1973.00, 1954.00, 1896.00, 1870.00, 1843.00, 1800.00

Resistance levels: 2037.00, 2048.00, 2070.00, 2077.00