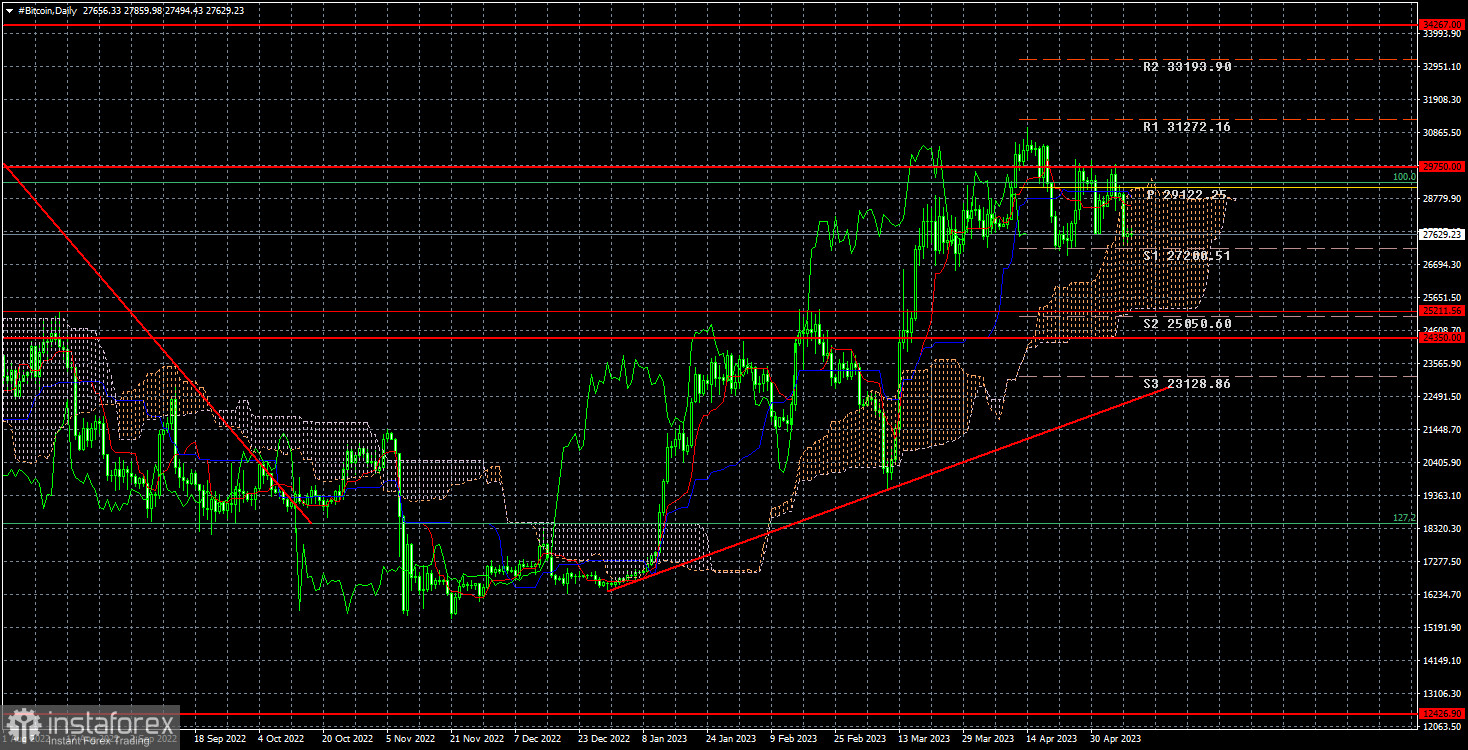

Bitcoin's trajectory remains consistent with our previously outlined strategy - it has risen to $29,750, bounced off that level, and dropped by $2,000-$3,000. The cryptocurrency has been moving within a new sideways channel for several months, and there are no current indications of a breakout. As such, the technical situation has remained unchanged in the past 24 hours. In the short term, Bitcoin may retest $29,750 as BTC has reached the lower boundary of the channel.

The founder of BitMex and Bitcoin advocate Arthur Hayes has suggested that the Federal Reserve and US authorities have resumed their quantitative easing policies in response to bank failures. Hayes has argued that policymakers cannot afford to let the banking system collapse, and as a result, will take any necessary action to save it. This includes printing enough money to maintain stability. According to Hayes, the only alternative to massive money printing is letting the banking system fail. He contends that the banking sector must self-regulate in order to maintain an appropriate number of institutions for the economy. Regardless of inflation or interest rate moves, the Fed will continue printing money, pushing inflation even higher, Hayes stated.

If Hayes' outlook turns out to be accurate, some of the newly printed money will inevitably enter the cryptocurrency market, which occurred during the pandemic and previous rounds of quantitative easing. Bitcoin experienced its most recent bull run during these periods and reached its all-time high. The Fed currently plans to print $300 billion to offset losses from the collapse of three major US banks. While it is not a substantial sum, reports about it were published two months ago, suggesting that the money has probably already entered the economy and contributed to Bitcoin's rise from $15,000 to $30,000. Consequently, Bitcoin's future performance depends on the potential failure of additional US banks. Current data suggests more bank collapses are unlikely, especially as the Fed is expected to reach peak rates with a 90% probability and begin reducing them early next year. Therefore, Hayes' outlook may not come true.

Over the past 24 hours, Bitcoin has made several unsuccessful attempts to break above $29,750. A breakout of this level would allow traders to go long on BTC, targeting $34,267. However, each rebound from $29,750 triggers a downward correction wave and pushes Bitcoin down by $2,000-$3,000, a pattern observed over the past month. In addition to monitoring $29,750, we advise keeping an eye on the $26,800-$30,600 sideways channel, where the cryptocurrency may continue to fluctuate in for some time.