In my morning forecast, I drew attention to the 1.0881 level and recommended entering the market from there. Let's look at the 5-minute chart and figure out what happened there. Growth and the formation of a false breakout at this level in the first half of the day led to an excellent signal to sell the euro, which resulted in a downward movement of more than 20 points at the time of writing the article. The technical picture still needs to be revised for the second half of the day.

Requirements for opening long positions on EURUSD:

Although the European Commission has raised its inflation forecast in the eurozone and warned of persistent problems, policymakers have acknowledged the resilience of the region's economy. However, this only partially helped euro buyers, who decided to retreat again after showing initiative and failing to break through 1.0881. Several speeches by representatives of the Federal Reserve System are planned for the second half of the day, so volatility promises to remain at a good level. Comments from FOMC member Raphael Bostic and his colleague Neel Kashkari are expected. The Empire Manufacturing production index data will likely be of little market interest. Given that we have yet to go beyond the morning levels, I will stick to the strategy detailed in the first half of the day.

I think the optimal scenario remains long positions only on corrections from the weekly minimum of 1.0848, formed due to the Asian session. Only this will confirm the presence of real buyers willing to push the euro up at the beginning of the week. The formation of a false breakout there will allow long positions to rise to the resistance of 1.0881, which has yet to be broken through. Only a breakthrough and test from top to bottom of this range after the speeches of the Fed representatives will strengthen demand for the euro and form an additional entry point for increasing long positions with the renewal of the maximum around 1.0907. The furthest target remains the 1.0935 area, where I will fix profits.

In the event of a decrease in EUR/USD and the absence of buyers at 1.0848 in the second half of the day, which is quite possible in such a bearish market, further trend development can be expected. Therefore, only the formation of a false breakout around the next support of 1.0800 will signal a buy for the euro. I will open long positions immediately on the rebound from the minimum of 1.0748 with the goal of an ascending correction of 30-35 points within the day.

Requirements for opening short positions on EURUSD:

The bears continue to control the market and have no plans to retreat. Active actions around 1.0881 have convinced us of this. However, as you can see on the chart, the desire to sell the euro is diminishing as the pair approaches weekly lows. Protecting the nearest resistance at 1.0881, where moving averages pass, remains an excellent scenario for building new short positions. A false breakout at this level, analogous to what I analyzed above, will give a sell signal capable of pushing the pair to 1.0848. Consolidation below this range and a reverse test from the bottom up are a direct path to 1.0800. The farthest target will be a minimum of 1.0748, where profit will be fixed.

In the event of an upward movement of EUR/USD during the American session and the absence of bears at 1.0881, which could happen against the backdrop of profit-taking by large players, buyers will try to return to the market. In this case, I will defer short positions to 1.0907. You can also sell there, but only after unsuccessful consolidation. I will open short positions immediately on the rebound from the maximum of 1.0935, aiming for a downward correction of 30–35 points.

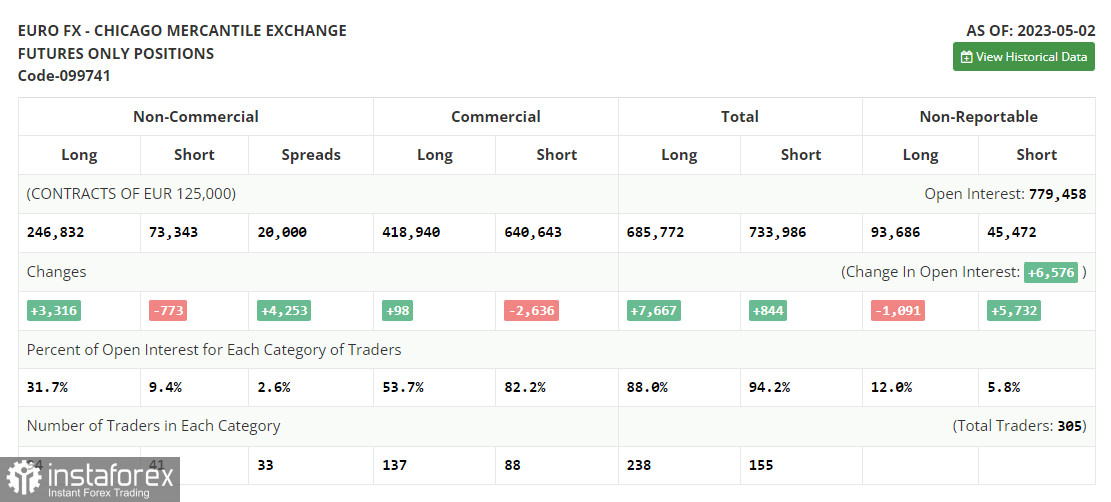

In the COT report (Commitment of Traders) for May 2, the growth of long positions and the reduction of shorts continued. It is worth noting that this report still needs to consider significant changes that occurred in the market after the meetings of the Federal Reserve and the European Central Bank last week, so it should not be given special attention. Rates were raised by 0.25% by both central banks, which maintained market equilibrium and allowed buyers of risky assets to expect further growth. There are no important statistics this week, so traders can exhale and relax. The COT report indicated that long non-commercial positions increased by 3,316 to 246,832, while short non-commercial positions decreased by 773 to 73,343. As a result of the week, the total non-commercial net position increased and amounted to 173,489 against 144,956 a week earlier. The weekly closing price decreased and amounted to 1.1031 against 1.1039.

Indicator signals:

Moving Averages

Trading is conducted below the 30- and 50-day moving averages, which indicates a further fall in the pair.

Note: The author considers the period and prices of moving averages on the H1 hourly chart and differs from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands

In the case of growth, the upper boundary of the indicator around 1.0881 will act as resistance.

Indicator Description

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, who use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.