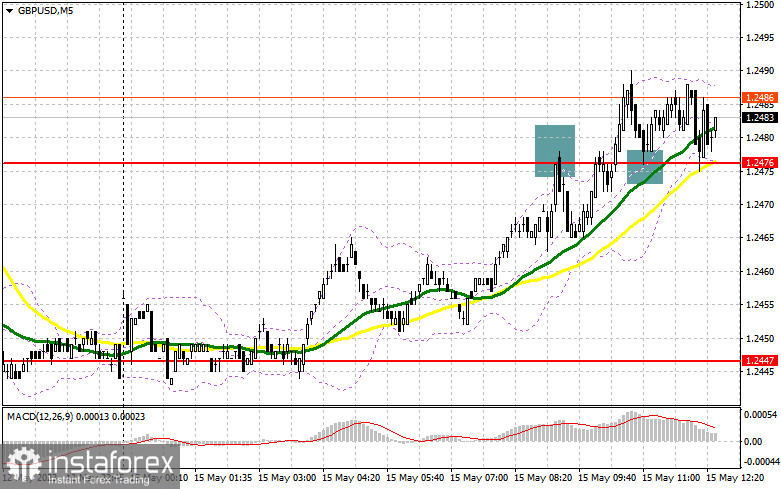

In my morning forecast, I paid attention to the level of 1.2476 and recommended making decisions on entering the market with his level in focus. Let's look at the 5-minute chart and see what happened there. Growth and a false breakdown at this level generated an excellent entry point into short positions, but GBP/USD did not develop a major fall. In the morning, I turned your attention to a false break at 1.2476 and told you that there should be an immediate fall of the pound. If this does not happen, it is best to terminate short positions. A break and reverse test from top to bottom of 1.2476 provided a buy signal, but at the time of writing, the move-up was about 11 pips. However, there is a chance for a further correction.

What is needed to open long positions on GBP/USD

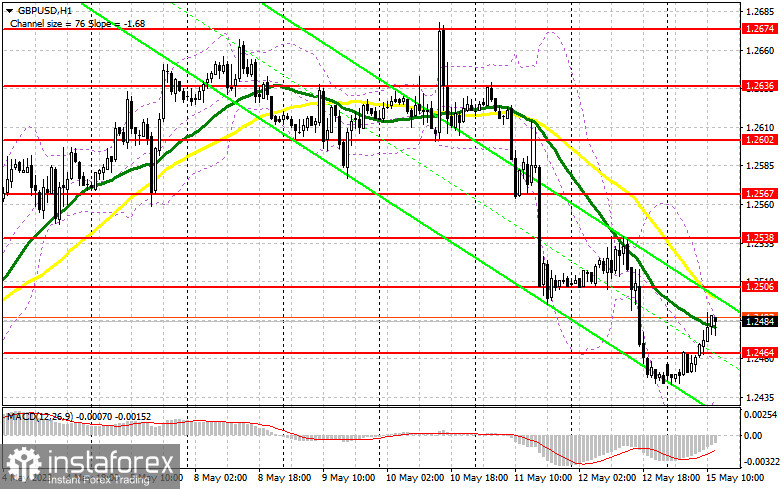

Obviously, taking advantage of the empty economic calendar, the bulls decided that the pair had slipped enough to start buying back the drawdown that occurred after the rate hike by the Bank of England last Wednesday. The Empire Manufacturing data released this afternoon will be of secondary importance, so I advise you to switch your attention to the speeches of FOMC members Rafael Bostic and Neil Kashkari. Following their statements, GBP/USD could decline. This price action will convince the bulls to re-enter the market actively in the area of 1.2464. A false breakdown there will produce a signal to buy betting on a recovery to the area of 1.2506, a new resistance formed last Friday. If the price settles above this level and makes a reverse test from top to bottom, this will provide an additional buy signal with a jump to 1.2538. The highest target will be around 1.2567, where I will take profits.

With a scenario of decline to the area of 1.2464, and the lack of activity from the buyers in the afternoon, I will postpone long positions until a new weekly low and a larger level of 1.2422 are updated. I will open long positions there only on a false breakdown. I plan to buy GBP/USD immediately at a dip only from the low of 1.2387, bearing in mind a 30-35-point correction within the day.

What is needed to open short positions on GBP/USD

The sellers showed up in the first half of the day, but, as I said above, the market is heavily oversold. Fresh evidence of a further increase in interest rates by the Bank of England is enough for us to see the return of large buyers to the market. Selling at 1.2506 remains an attractive scenario for the second half of the day as moving averages are passing there, playing on the side of the sellers. As a result, GBP/USD might come under pressure again suggesting the scenario of a decline to the level of 1.2464, a new support formed on the basis of today's results. A break and reverse test from the bottom-up of this range will increase pressure on the pound, forming a sell signal with a fall to 1.2422.

Under the scenario of GBP/USD's growth and the lack of activity at 1.2506, which is more likely, all this will lead to the demolition of the sellers' stop orders. In this case, I will postpone selling until the test of resistance 1.2538. Only a false break there will give an entry point for short positions. If there is no downward movement, I will sell GBP/USD at a rebound immediately from 1.2567, but only on the condition of a correction of the pair down by 30-35 points within the day.

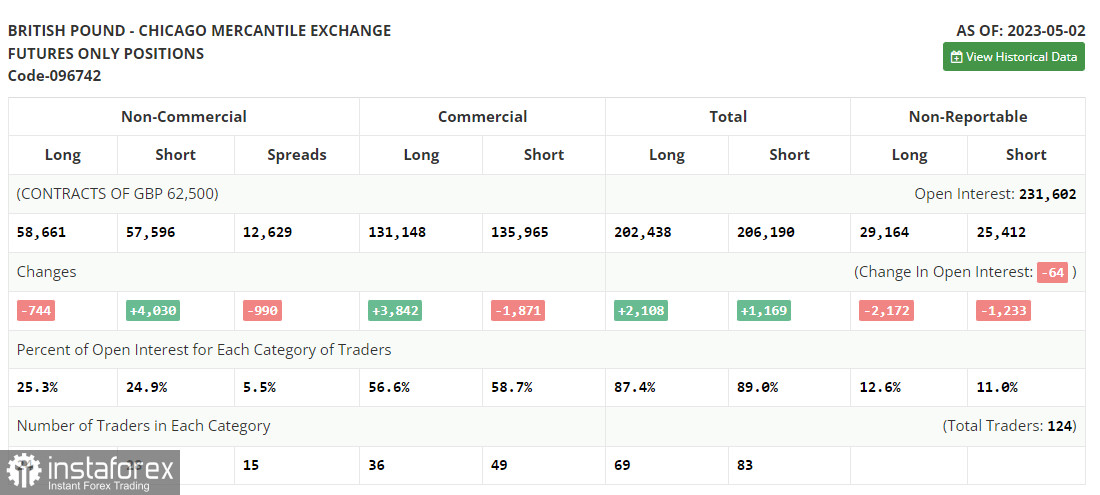

In the COT report (Commitment of Traders) for May 2, there was an increase in short positions and a decrease in long positions. Everyone understood that last week, the Bank of England had nowhere to go and had to follow other central banks to raise interest rates. The fight against inflation in the UK will continue for quite a long time, especially considering that the regulator has not achieved any positive results during the year of raising rates. It is unlikely that the pound will respond higher to a 0.25% rate hike, as this is already priced in, so don't be surprised if the pair shows a deeper correction this week. The latest COT report says short non-commercial positions rose 4,030 to 57,596, while long non-commercial positions fell by 744 to 58,661. This led to a decrease in the non-commercial net position to 1,065 from 5,839 from a week earlier. This is the first decline in six weeks, so it can be considered as a normal correction. GBP/USD closed last week higher at 1.2481 against 1.2421 on the previous week.

Indicators' signals

Moving Averages

The instrument is trading below the 30 and 50-day moving averages. It indicates further weakness of the pound sterling.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case GBP/USD gains ground, the indicator's upper border around 1.2495 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.