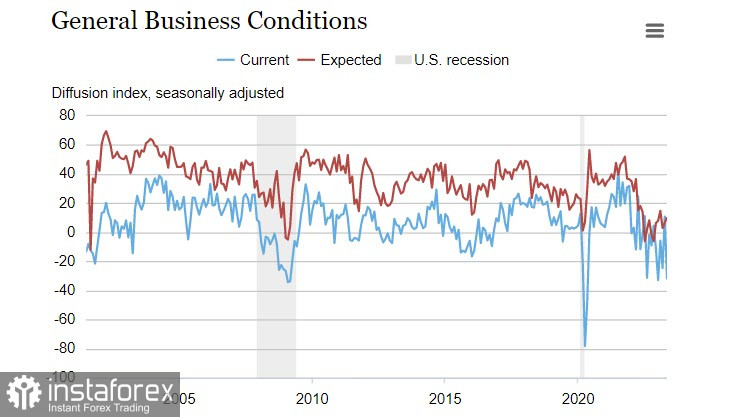

The New York Fed's manufacturing index plummeted to -31.8p versus a forecast of -3.9p. The review notes a sharp drop in new orders (-28.0 from 25.1) and shipments (-16.4 from 23.9), reversing the growth observed last month.

The graph of the manufacturing activity does not look at all like an economic recovery, but more like the start of a new recession.

Negotiations on the debt limit are still in the stage of aligning positions. Biden remains optimistic, Treasury Secretary Yellen once again reminded of the deadline of June 1, and Republican Speaker of the House McCarthy sees a more gloomy picture - in his opinion, a decision is not even close to being ready.

The joint session of Congress is scheduled just 4 days before June 1, and it is highly likely that a decision simply will not appear in time, leading to increased volatility and a surge in demand for safe-haven assets.

Comments from Federal Reserve officials were neutral and did not significantly impact market sentiment.

There is a lull on the currency market after the strong dollar recovery at the end of last week, which was caused by technical factors rather than fundamental reasons. No significant pullback occurred, there is some recovery in purchases of primary assets and sale of protective assets, but it will hardly develop.

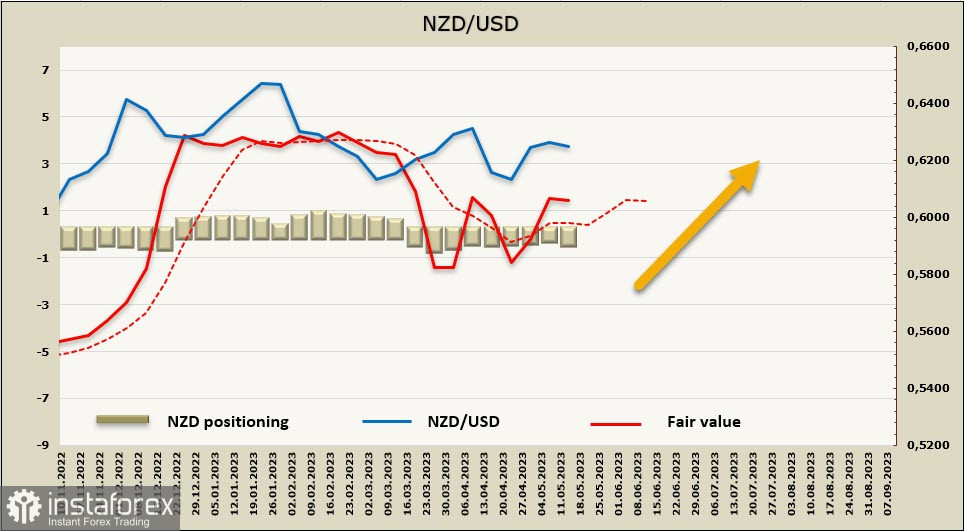

NZD/USD

The BNZ Bank expects another 25bp rate hike before a final halt, with the final rate seen at 5.5%. This is somewhat higher than the Fed rate, especially considering expectations of an imminent Fed rate cut, which makes the yield differential in favor of the kiwi.

However, if the economic situation in New Zealand worsens, and faster than forecasts, this will increase the probability of a pivot from the Reserve Bank of New Zealand towards stimulus, and in this case, the dollar may gain an advantage. The situation remains too uncertain to formulate a long-term forecast.

The net short position on NZD increased by 0.2 billion for the reporting week, to -0.29 billion, maintaining a weak bearish bias. The calculated price is above the long-term average, indicating a bullish trend, but the momentum is lost.

A week ago, we speculated that NZD/USD would try to break out of the horizontal channel up to the resistance of 0.6533. It failed and the kiwi retreated to the middle of the channel, and the chances of further growth became lower. Another upward move is not excluded, but currently, there are no drivers capable of creating directed movement. We assume that the kiwi will remain in a wide range of 0.6100/6375 with a weak tendency to grow.

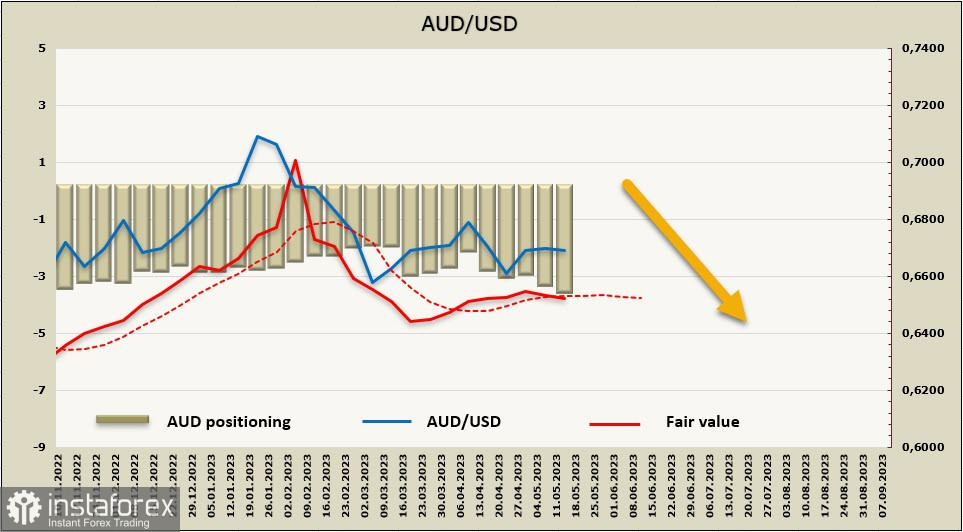

AUD/USD

The Westpac Consumer Confidence Index fell in May from 9.4% to -7.9%, significantly worse than the -1.7% forecast, which NAB bank analysts see as a reaction to the Reserve Bank of Australia's decision to resume rate hikes against an unchanged economic backdrop, in which there are no visible improvements.

On Thursday morning, a report on the pace of wage growth for the 1st quarter, which is key for the RBA, will be published, as it will provide an answer about inflation stability.

If the result is the same as in Q4 (+0.8%), then the RBA will get an argument about reducing inflationary pressure provided that productivity growth accelerates. In this case, the RBA will have grounds not to raise the rate, and the AUD rate, as a consequence, may decrease.

If growth at the level of 1% or even higher is recorded, then in this case the forecast for the RBA rate will shift upwards, and the aussie may grow on expectations of yield growth.

The net short position on AUD increased by 0.3 billion, to -3.3 billion, a pronounced bearish bias persists. The calculated price has gone below the long-term average, the probability of developing a downward movement has become higher.

AUD/USD, as expected, found no reason to leave the range. Given the strengthening bearish positioning, the aussie is likely to roll back to the lower limit of the range at 0.6565/75, and if the bearish sentiment gets more support, the decline will lead to the end of the correction and the development of another wave to the downside. If the base of 0.6565/75 does not hold, the next target will be the technical level of 0.6466.