The week has just begun, and the first economic reports are already being released. However, immediately after the Federal Reserve meeting, which took place more than a week ago, the blackout period among FOMC members ended, and each of them began to comment on monetary policy. In particular, James Bullard, one of the most aggressive hawks, spoke over the weekend. Bullard noted that inflation expectations correspond to the 2% mark, and the prospects for its further slowdown are optimistic. The interest rate hike helped to prevent inflation from getting out of control. Bullard also called the current rate level the "lower bound of the restrictive range," hinting that the rate could rise stronger if needed.

On Monday, Raphael Bostic, who holds the position of President of the Atlanta Fed, spoke. He stated that the Fed faces a long battle with inflation, and noted that the interest rate could rise again this year. He also noted that his personal baseline scenario does not foresee a rate cut in 2023. "We are now at the point that is the top in my forecast, but if necessary, we will go even higher," Bostic said, also hinting at another rate hike. According to him, there is progress in disinflation, but the Fed has only done the easiest part of reducing it. He also noted that the economy is functioning very well in high-interest-rate conditions, and inflation will continue to decrease in the next few months. It's not worth rushing with a new rate hike, as we should wait for the reaction to the steps already taken.

The President of the Chicago Fed, Austan Goolsbee, noted on Monday that the impact of rates on inflation has not fully manifested yet. He stated that the May rate hike was the right decision, but refrained from forecasts regarding further actions by the central bank. Based on all of the above, we can conclude that if necessary, the Fed will raise the interest rate once or twice more. Everything will depend on economic indicators of GDP and inflation, as well as the labor market and unemployment. However, if the market expected an increase each time last year, then any rate change for the remainder of the year could be a surprise for the market. Regardless of current expectations for rates, the European Central Bank, the Bank of England, and the Fed are close to the moment of reaching their peak values. After a two-month decline in demand for the US currency, I think now is a good time to increase it, according to the current wave marking for both instruments.

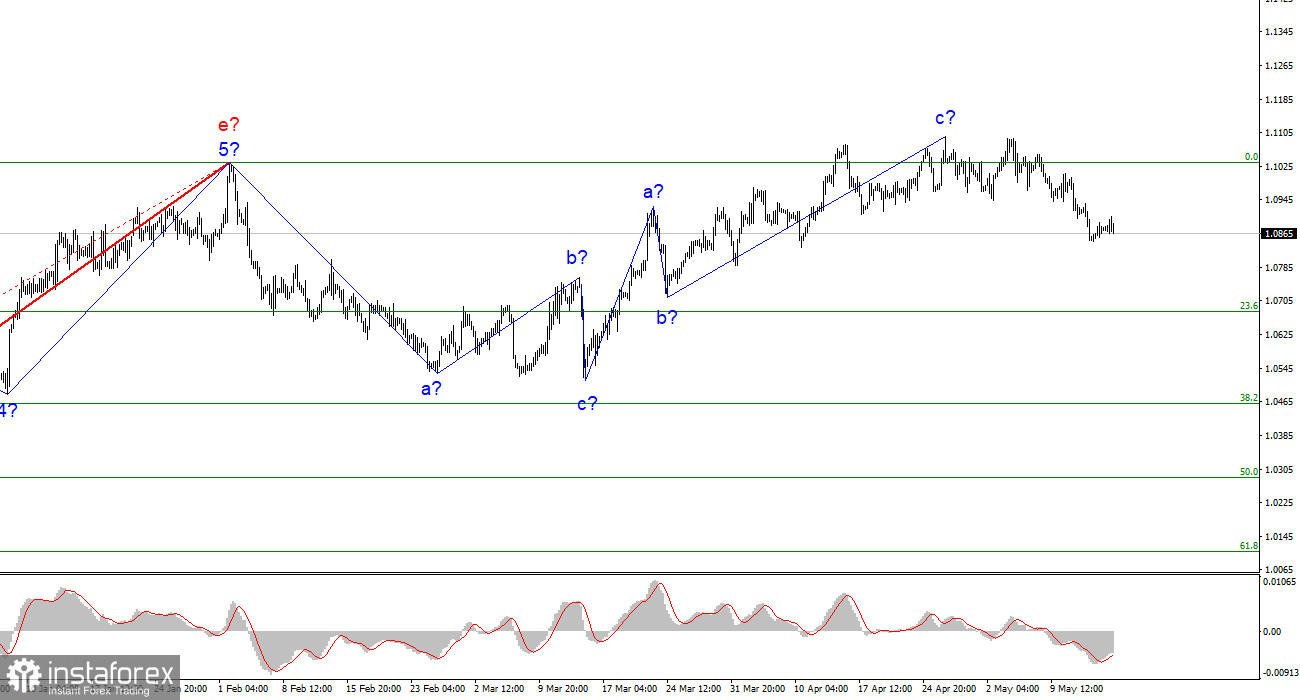

Based on the analysis, I conclude that the construction of the uptrend segment is completed. Therefore, you can now consider short positions, and the instrument has quite a large space for decline. I think that targets in the area of 1.0500-1.0600 can be considered quite realistic. With these goals, I advise selling the instrument on downward reversals of the MACD indicator as long as the instrument is below the 1.1030 mark, which corresponds to 0.0% Fibonacci.

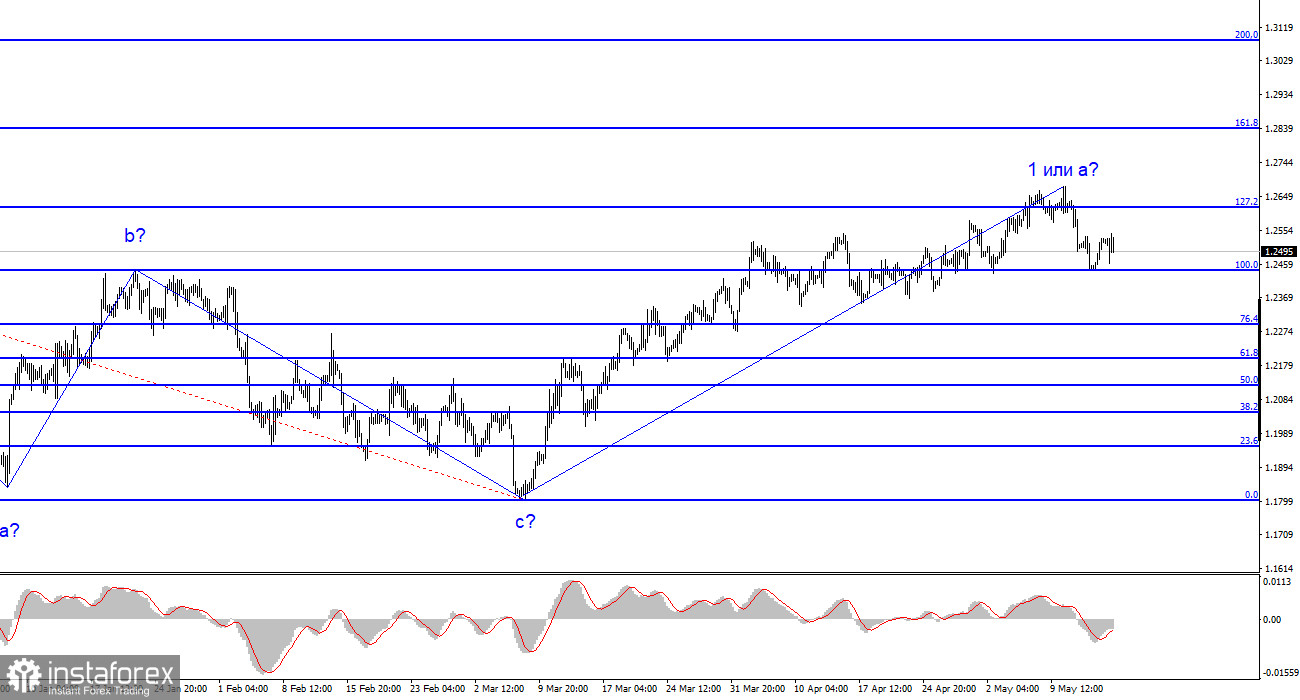

The wave pattern of the GBP/USD pair has long suggested the construction of a new downward wave. The wave marking is not entirely clear, as is the news background. I don't see factors that would support the British pound in the long term, and wave b can turn out to be very deep, but so far we can't confirm that it has started. I believe that the pair will likely fall, but the first wave of the ascending segment can get even more complicated. An unsuccessful attempt to break through the 1.2615 mark, which corresponds to 127.2% Fibonacci, indicates that the market is ready to sell, but there was also an unsuccessful attempt to break through the 1.2445 mark, which is equal to 100.0% Fibonacci.