Trading recommendations

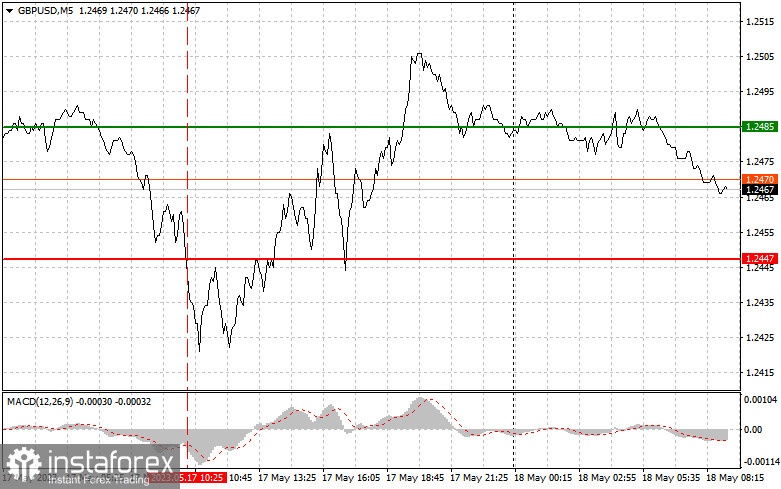

The price tested 1.2447 when the MACD indicator was considerably below the zero level. This limited the downward potential of the pair. For this reason, I did not sell the pound sterling. I did not get any market entry signals in the second half of the day.

Today, the speech of the Governor of the Bank of England Andrew Bailey is the only significant event. However, traders could pay attention to the hearings of the special committee of the UK Treasury, which could boost volatility and the British pound against the US dollar. As I am expecting a correction of the pair by the end of the week, I will bet on the implementation of Scenario No. 1 for buying.

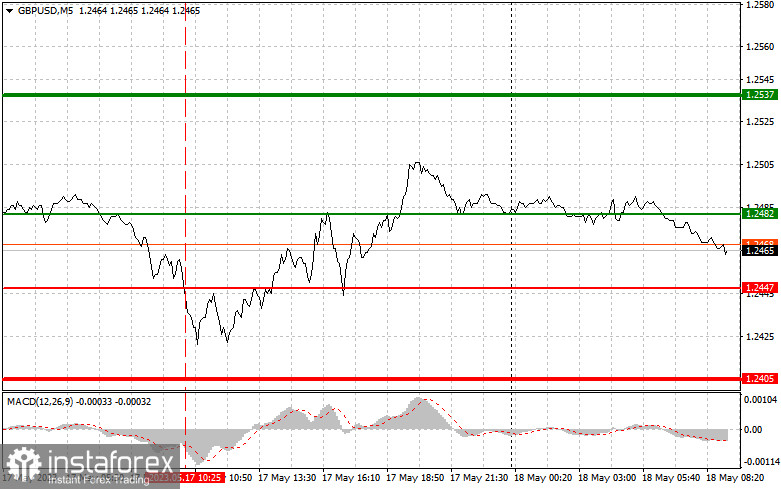

Signals to buy BGP/USD:

Scenario №1: You can buy the pound today if the price reaches 1.2482 (green line on the chart) with the target at 1.2537 (thicker green line on the chart). If the price approaches 1.2537, it is better to close buy orders and open sell ones (expecting a move of 30-35 pips in the opposite direction from the level). You can count on the pound's growth today already in the first half of the day. Important! Before buying, make sure the MACD indicator is above the zero mark and is just starting its rise from it.

Scenario No. 2: You can also buy the British pound in case of two consecutive tests of 1.2447. The MACD indicator should be in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. You can expect a rise to 1.2482 and 1.2537.

Signals to sell GBP/USD

Scenario No. 1: You can sell the pound sterling today only after the price drops below 1.2447 (red line on the chart). This will lead to a rapid decline in the pair. The key target for sellers will be the level of 1.2405, where I recommend closing sell orders and immediately opening buy orders (expecting a move of 20-25 pips in the opposite direction from the level). The pressure on the pound will intensify in case of strong data from the US labor market. Important! Before selling, make sure that the MACD indicator is below the zero mark and is just beginning falling from it.

Scenario No. 2: You can also sell the pound today in the case of two consecutive price tests of 1.2482. The MACD indicator should be in the overbought area. This will limit the pair's upside potential and lead to a downward market reversal. You can expect a decrease to the levels of 1.2447 and 1.2405.

What we see on the trading chart:

A thin green line is a key level at which you can place long positions on EUR/USD.

A thick green line is the target price since the quote is unlikely to move above it.

A thin red line is a level at which you can place short positions on EUR/USD.

A thick red line is the target price since the quote is unlikely to move below it.

A MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions to enter the market. Before the release of important reports, it is

better to stay out of the market to avoid sharp fluctuations in the price. If you decide to trade during the news release, place stop orders to minimize losses. Without stop orders, you can lose the entire deposit, especially if you do not use money management and trade large volumes.

Notably, for successful trading, it is necessary to have a clear trading plan. Rash trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.