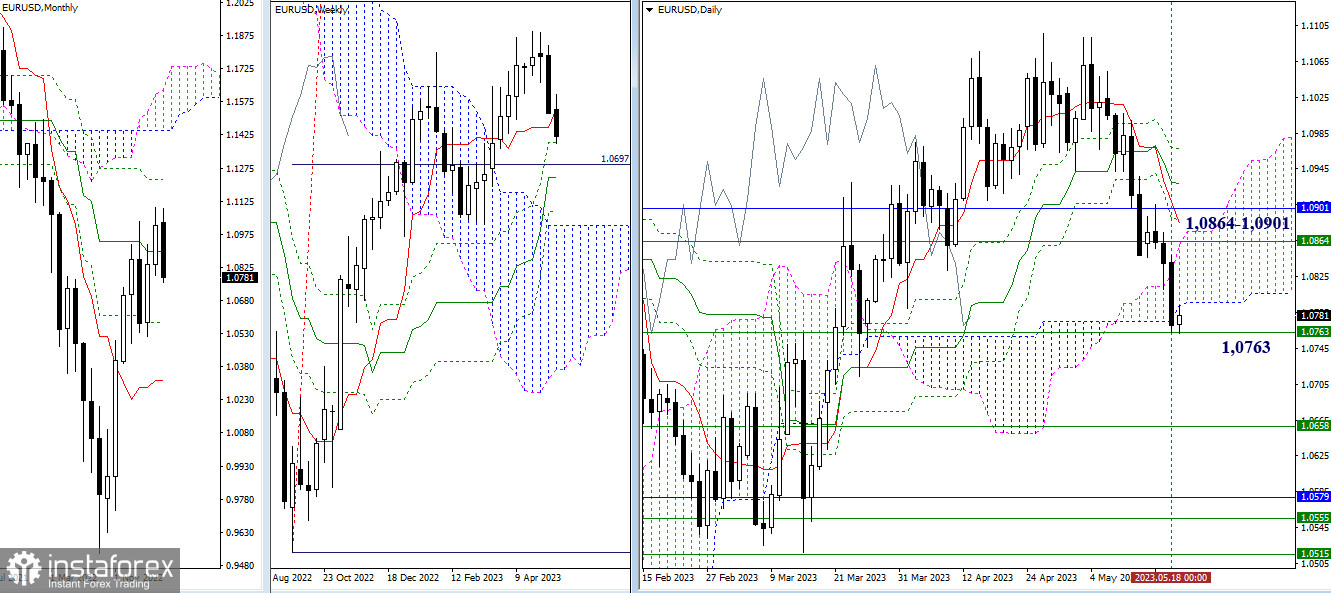

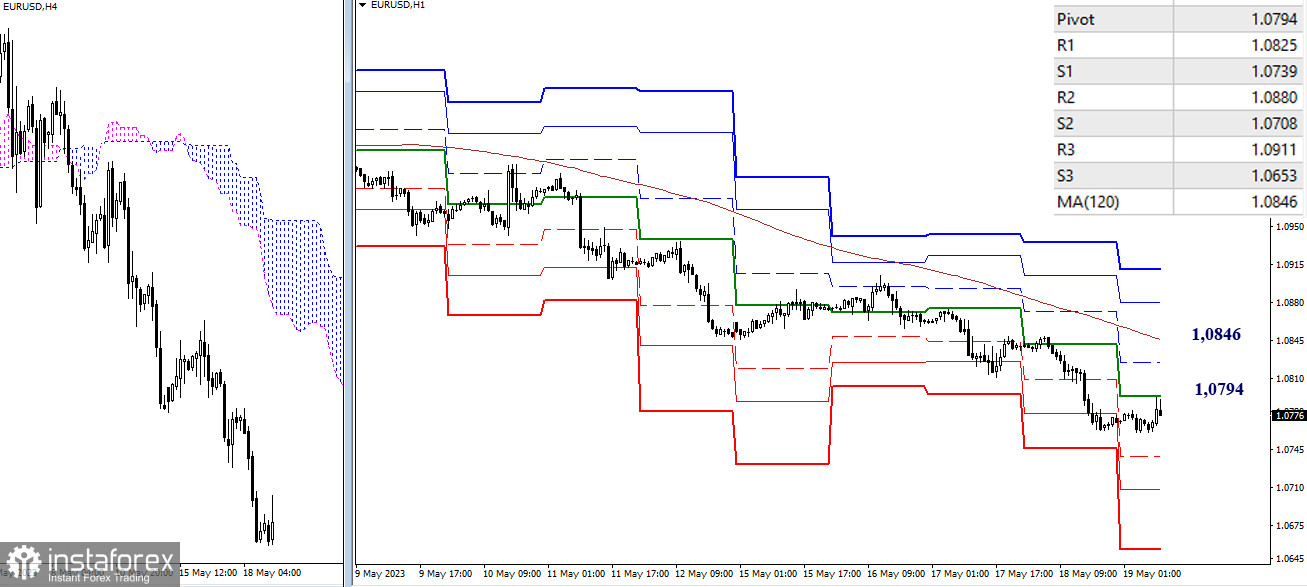

EUR/USD

Higher timeframes

Yesterday, the bears continued their downward movement and tested the weekly support at 1.0763. The result of the test will determine further possibilities for situation development. Overcoming the support and a reliable consolidation below will set a bearish target for breaking through the daily Ichimoku cloud, with the next nearest support becoming the weekly medium term trend (1.0658). A rebound and returning to the daily cloud could provide an opportunity for the bulls to further recover their positions, with the important resistance on this path being the area of 1.0864 – 1.0901 (weekly short-term trend + monthly mid-term trend + daily levels).

H4 – H1

On the lower timeframes, a downward trend is in effect, giving an advantage to the bears. In the case of a new phase of decline developing within the day, the supports of the classic pivot points (1.0739 – 1.0708 – 1.0653) will come into play. If a corrective rise develops after passing the central pivot point (1.0794), the main focus will be on the weekly long-term trend (1.0846), responsible for the current advantage; settling above it could change the balance of power that has formed.

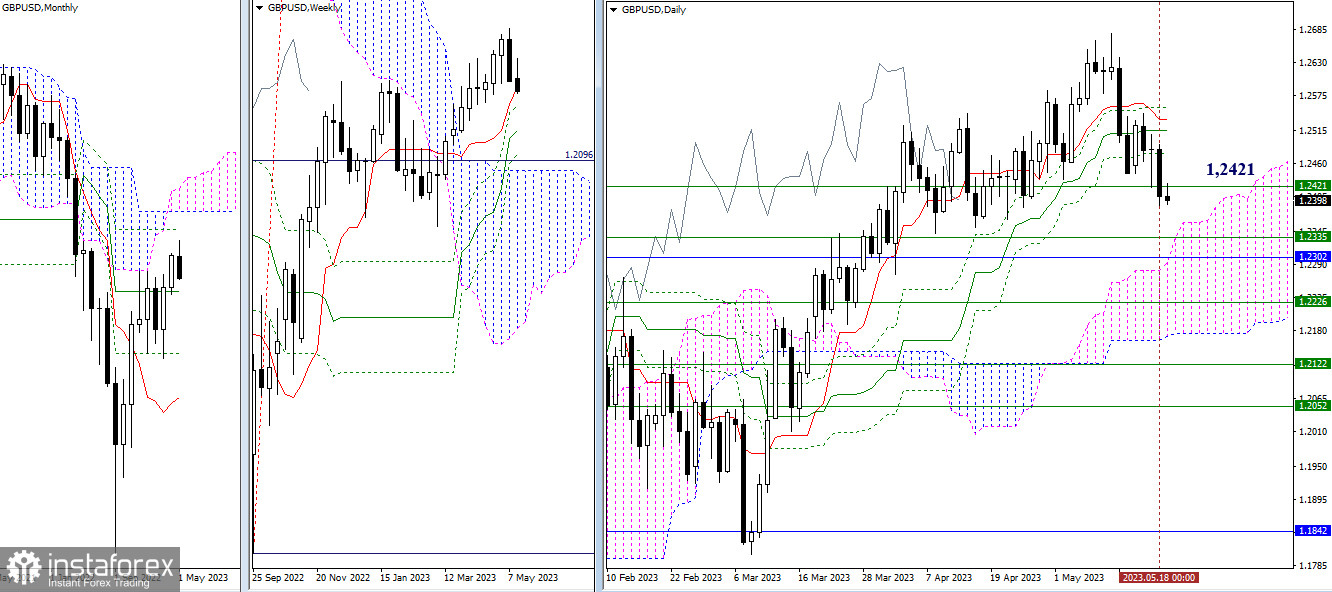

GBP/USD

Higher timeframes

Yesterday, the bears updated the previous day's low and managed to close below the weekly support (1.2421). Losing the weekly short-term trend (1.2421) will serve to strengthen bearish sentiments, with the next bearish target being the support zone of 1.2302–35 (weekly Fibo Kijun + monthly medium term trend + upper boundary of daily cloud).

H4 – H1

On the lower timeframes, the pair has dropped to the support of the first target level for breaking through the H4 cloud (1.2392) and is testing this level. The full execution of the target for breaking through the Ichimoku cloud lies at the level of 1.2360. Additional bearish targets today can be noted at 1.2365 – 1.2327 – 1.2263 (supports of classical pivot points). The key levels of lower timeframes at the moment are forming resistances, located at 1.2429 (central pivot point) – 1.2471 (weekly long-term trend).

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)