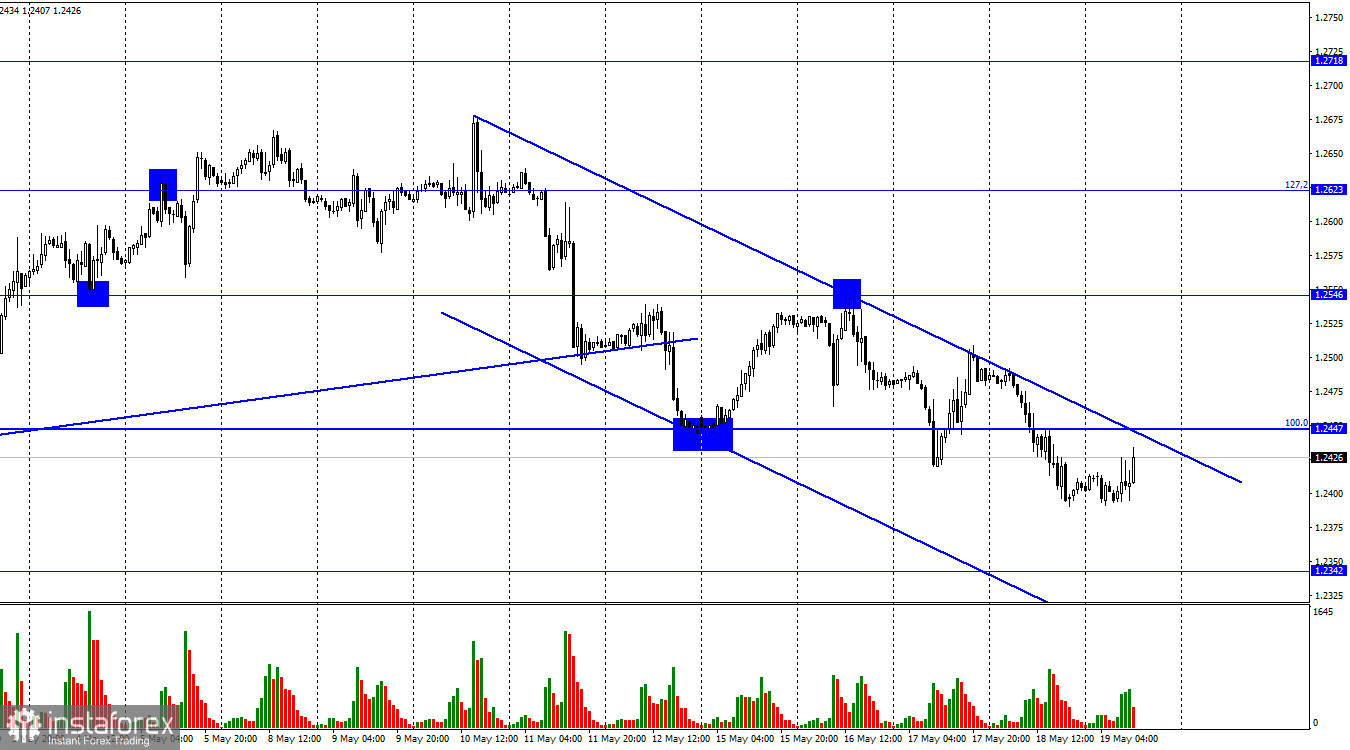

On Thursday, GBP/USD extended its decline on the 1-hour chart and settled below the 100.0% Fibonacci retracement at 1.2447. Therefore, selling the pair remains relevant until the price closes above this range, indicating the exit from the descending channel. In case of a rebound from 1.2447, the pound may continue to fall towards the next downward target at 1.2342. A close above the channel will favor the pound and increase its chances for a rise towards 1.2546 in the coming days.

There are two significant events in today's economic calendar. These are the speeches by Christine Lagarde and Jerome Powell. While Lagarde's speech has little relation to the pound, it is still worth considering since it will take place late in the evening. As for the ECB president, it is difficult to anticipate a change in rhetoric at the moment as the regulator has not yet signaled the end of its policy tightening. Thus, Lagarde may once again draw public attention to high inflation and the need to continue combating it. In this scenario, traders will have nothing to react to.

The speech by Jerome Powell, scheduled earlier today, may influence trader sentiment throughout the day. The Federal Reserve has likely completed its tightening cycle, but some of the members of the Board of Governors signal readiness to hike the rate once more. Hence, Powell will have to answer the question of whether another tightening is coming or not. If he confirms another rate hike, the dollar may continue to gain momentum. On the contrary, if Powell's response negates another tightening, the dollar's growth may slow down, and it may even reverse against the pound. Meanwhile, the European currency is depreciating at a faster pace, demonstrating its weakness against the pound.

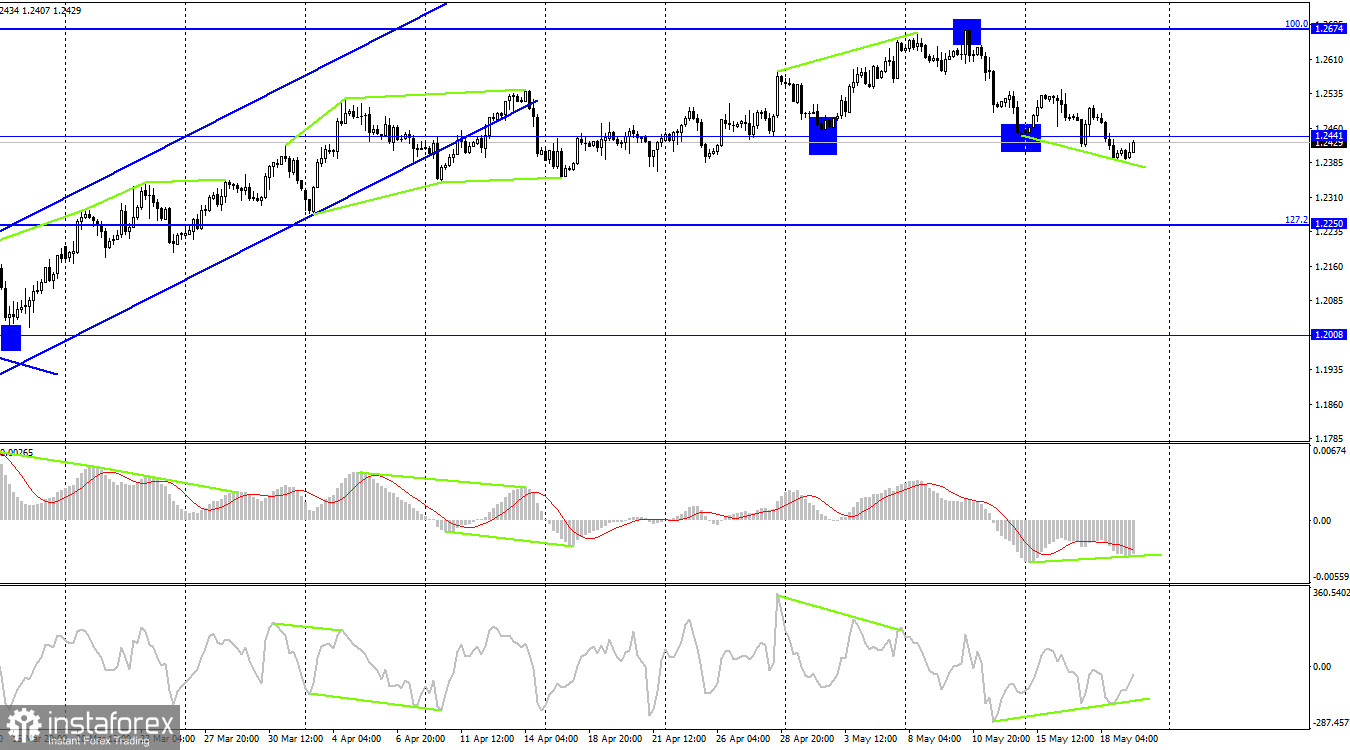

On the 4-hour chart, the pair settled below the 1.2441 level. So, the price may continue to decline toward the next Fibonacci retracement level of 127.2% located at 1.2250. However, the MACD and CCI indicators are showing a bullish divergence which may help the pair resume the uptrend. Consolidation above 1.2441 will confirm the bullish trend which may continue up to the 100.0% Fibonacci level at 1.2674.

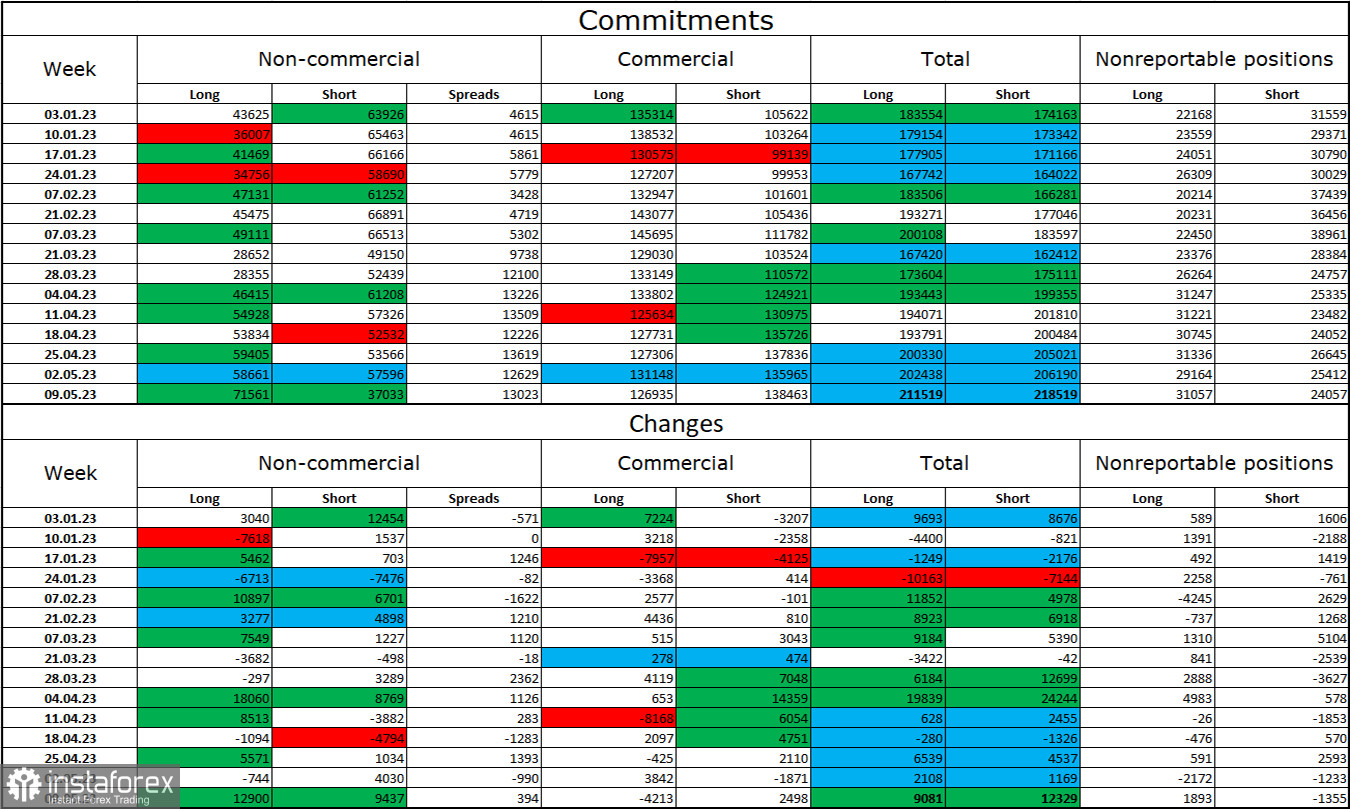

Commitments of Traders report

Commitments of Traders report

The sentiment of the non-commercial group of traders has become more bullish over the past week. The number of long contracts rose by 12,900, while the number of short contracts increased by 9,437. The overall sentiment of large market players is now completely bullish. Previously, the market had been bearish on the pair for quite a long time. Yet, the number of long and short contracts is almost equal, with 71,500 vs 67,000 respectively. The pound keeps rising but at a much slower pace than a few months ago. The outlook for the pound remains rather optimistic although it may decline in the near term after a prolonged uptrend.

Economic calendar for US and UK

US – Fed Chair Powell speaks (15-00 UTC)

On Friday, the US economic calendar has only one important event. The influence of the information background on the market can be quite strong today.

GBP/USD forecast and trading tips

I recommended selling the pound after a close below 1.2441 on the 4-hour time frame with the target at 1.2342. You can leave these trades open until the price closes above the channel on the H1 chart. Buying the pair will be possible after the price closes above the channel on H1 with the target at 1.2546.