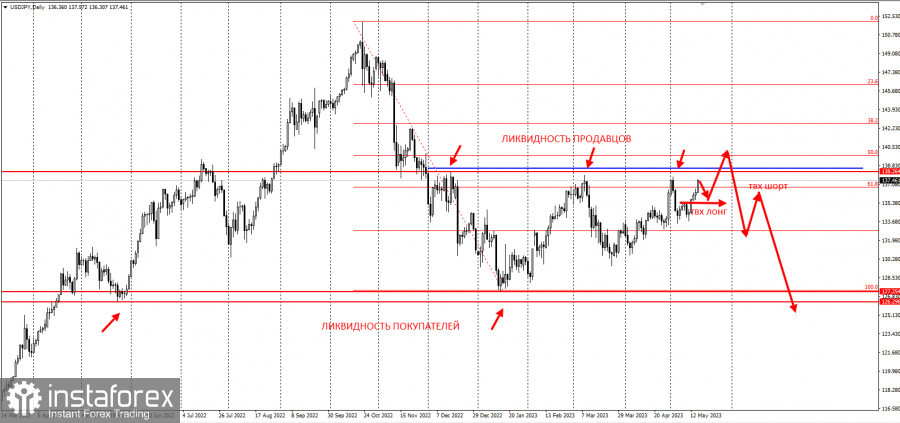

Good day, traders! Last May 17, there was a trading plan aimed at increasing and then decreasing the price of USD/JPY.

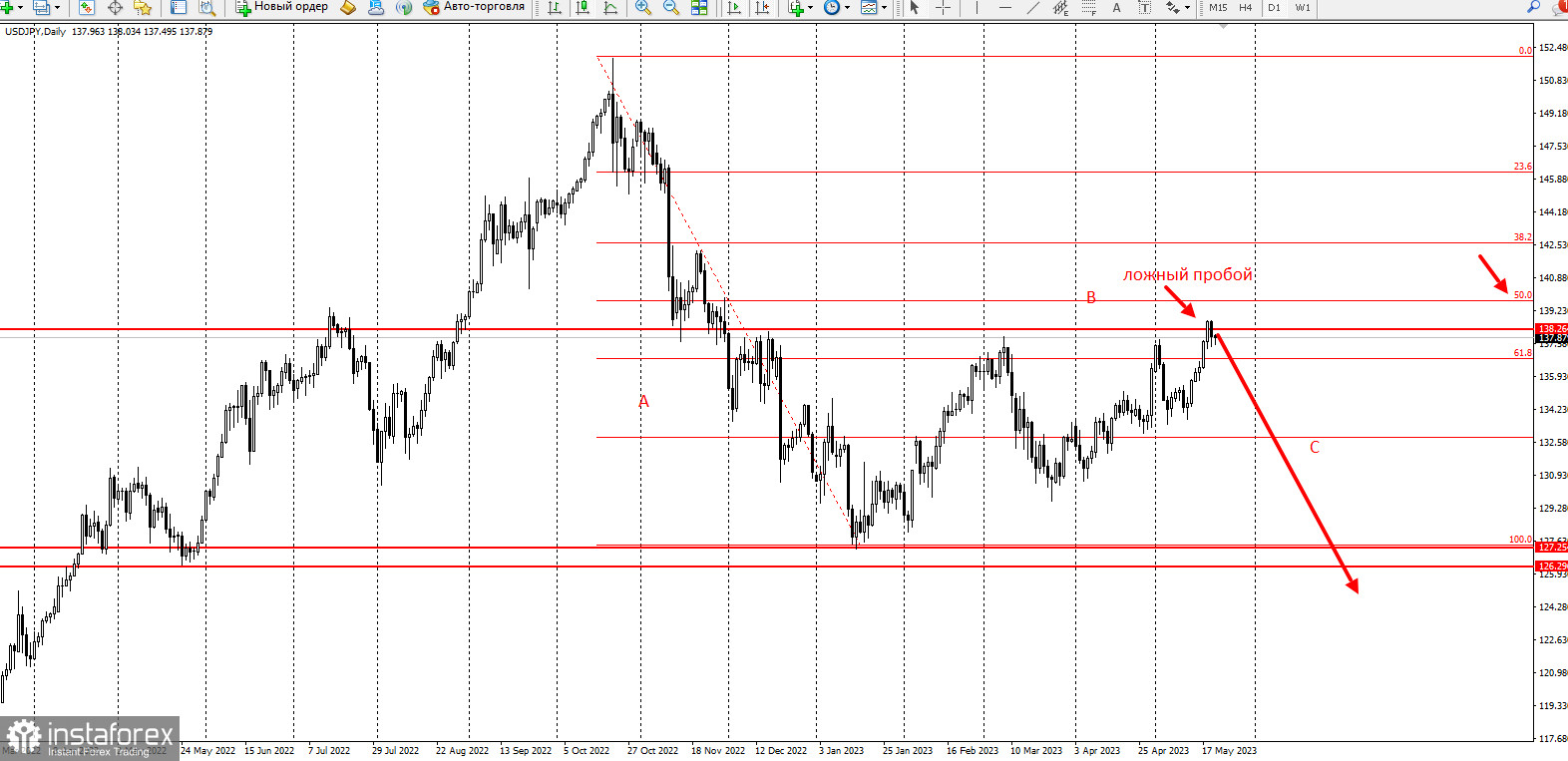

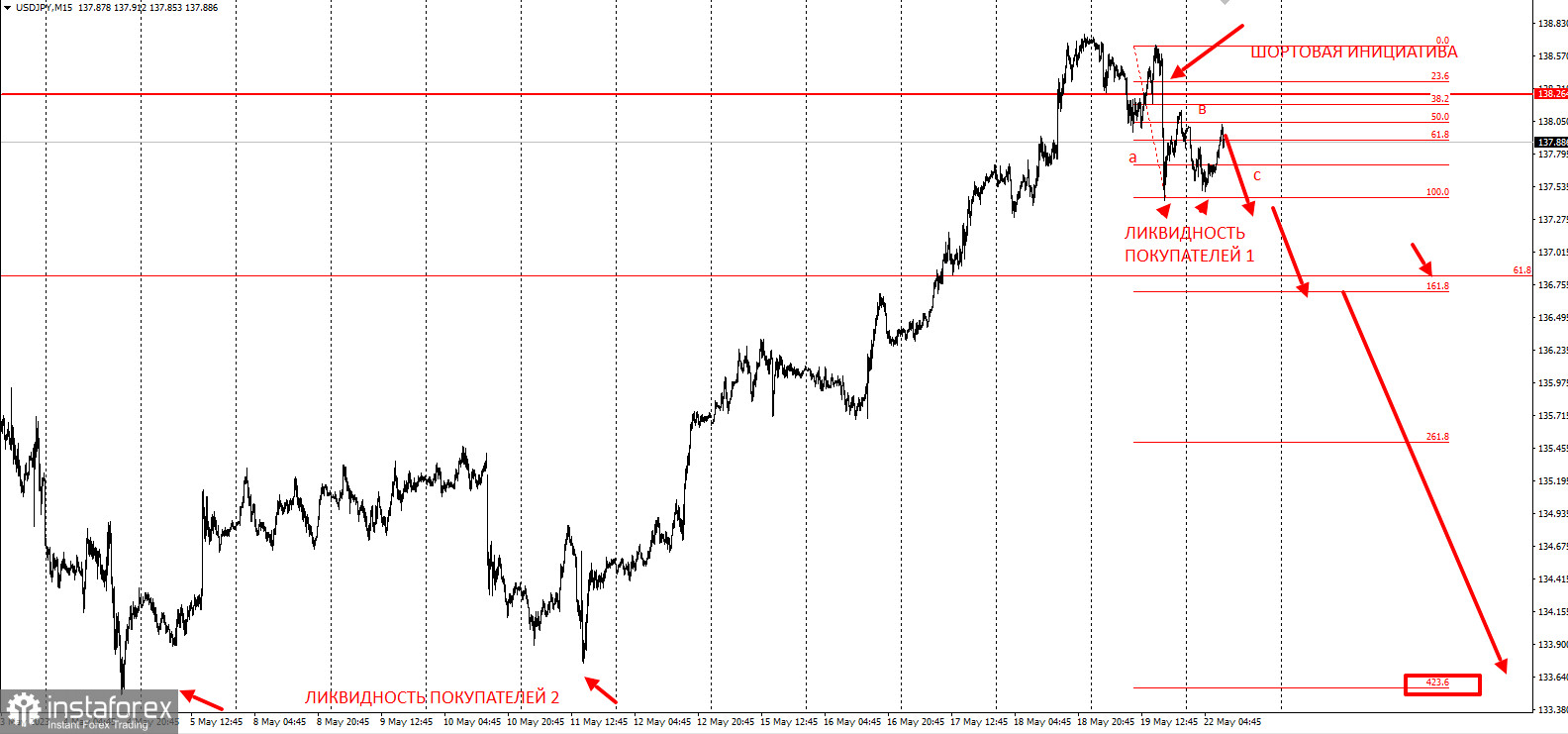

It was today that the pair completed the desired upward movement, and after breaking through 138.3, pressure returned, allowing traders to consider short positions.

Looking at the false breakout at 138.3 in the 15-minute timeframe, it is clear that a small "abc" pattern was formed, and this can be used to prompt a decline in the pair.

In the pattern, wave "a" is a representation of the selling pressure last Friday, which means that traders could open short positions, with stop-loss set at 138.6. Take profit upon the breakout of 137.4, 133.5, and 128.0.

This trading idea is based on the "Price Action" and "Stop hunting" methods.

Good luck and have a nice day! Don't forget to control the risks.