Over the past two weeks, the cryptocurrency market has significantly slowed down compared to the bullish March and mixed April. Trading volumes of major crypto assets and the number of daily users have decreased to local lows.

Simultaneously with this process, we have witnessed the beginning of a prolonged consolidation movement of BTC/USD within the range of $26.6k–$27.5k. Important economic events failed to change the balance of power between bulls and bears, and therefore the price of BTC remained within this range.

Strong stock market

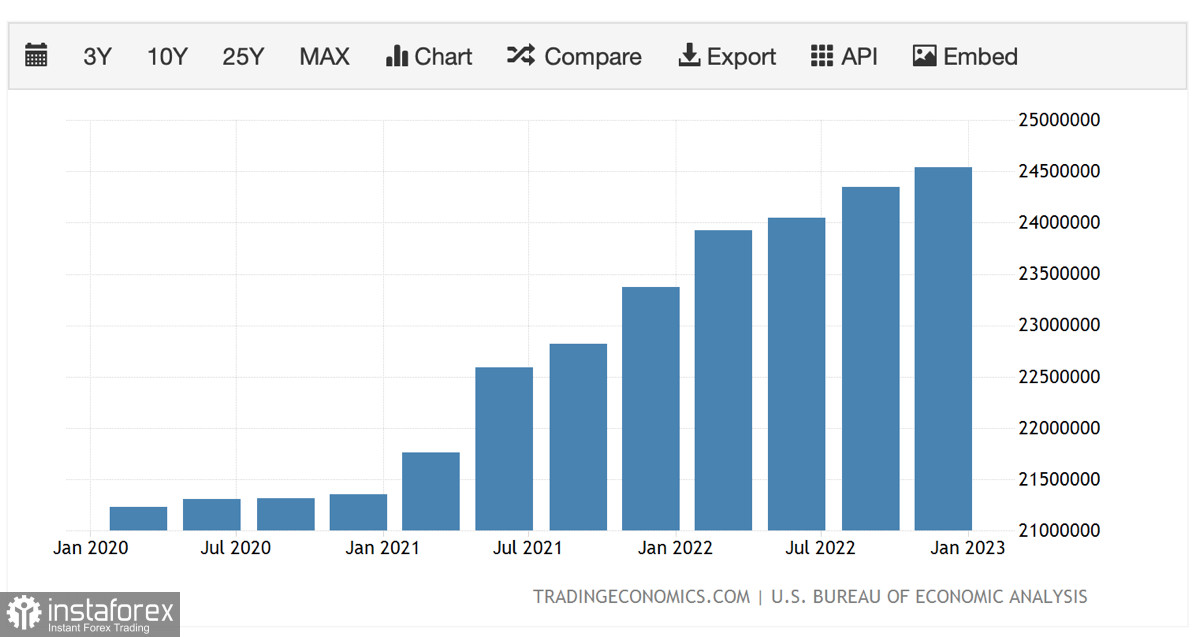

The stock market has become one of the key reasons why Bitcoin and other cryptocurrencies have become less attractive among investors. During March and April, when BTC reached its local high, activity in the stock market stagnated. There were several reasons for this, significantly reducing investor interest in SPX and other instruments.

The first reason was the mass forecasts of leading banks in the United States and the world regarding pessimistic data during the reporting period. Analysts predicted that weak financial reports would cause a decline in the SPX index to the $3,200–$3,400 levels, which deterred a significant portion of investors.

The second reason was the crisis in regional banks in the United States, which occurred as a result of the hawkish policy of the Federal Reserve System. Meanwhile, Bitcoin and gold began to oppose the stock market and started moving towards local highs. However, over time, as inflation levels fell and the reporting period ended, the situation changed.

Insiders are not selling their stocks, as expected, after the spin-up of pessimistic sentiments regarding the publication of financial reports by companies in the S&P 500. This suggests that further market growth can be expected in the near future.

Bank of America confirms this and reports that the forecast for the S&P 500 in 2023 has been raised from $4,000 to $4,300. Overall, the situation in the stock market has stabilized, and therefore the SPX index confidently holds the $4,000 mark. However, there is a fly in the ointment, which lies in the U.S. debt ceiling limit.

Bitcoin and U.S. default

According to the latest estimates, the U.S. government's funds will run out between June 8th and 16th. If this happens, the United States faces a technical default, and the significant increase in the default insurance premium size in 2023 confirms investors' concerns.

The fear of a U.S. default is another restraining factor for investors in relation to cryptocurrencies. Taking this into account, it can be concluded that financial markets have frozen in anticipation of a resolution of the U.S. debt situation. Therefore, significant price movements should not be expected due to the lack of short-term/medium-term strategies among investors.

BTC/USD Analysis

Bitcoin made a local upward surge but encountered resistance at the $27.5k level, after which it retraced to familiar positions. As of 08:00 UTC, the asset is trading near the $27k level and, with varying success, approaches the upper boundary of the volatility channel. At the same time, trading volumes and address activity remain at a low level.

Santiment reports that bearish sentiments continue to grow among crypto investors, which usually leads to price growth. Glassnode also notes that long-term holders are not selling their reserves, unlike miners who have significantly increased pressure on the asset's price.

Technical metrics for BTC on the 1D chart demonstrate the prerequisites for a bullish impulse. The Stochastic indicator is undergoing a broad bullish crossover, and the RSI is approaching the 50 level. Additionally, the MACD is one step away from completing the "bullish crossover" pattern, which is a strong signal for a potential upward movement.

Conclusion

Despite the asset's fundamental value and the commitment of long-term investors, Bitcoin lacks sufficient strength for a strong upward movement. However, technical metrics suggest that a bullish impulse is likely, so it is worth highlighting the order block of $27,250–$27,500 and the final level of $27.5k as the main targets for bulls in the upcoming upward surge.