According to the National Bank of Poland, the country's gold reserves increased to 7.828 million troy ounces (243.5 metric tons) last month. In April, the central bank acquired 14.8 tons of gold, marking the largest increase since June 2019, when Poland's reserves grew by 94.9 tons.

In April, the value of gold, including gold deposits and gold exchanges, rose from $14.55 billion to $15.52 billion.

As early as 2021, the bank's governor, Adam Glapinski, stated that Poland planned to add 100 tons to its gold reserves to safeguard against the most unpleasant circumstances. He explained that if someone were to disable the global financial system, gold would always retain its value.

"Of course, we do not assume that this will happen. But as the saying goes - forewarned is always insured," Glapisnki said. He added that the central bank must be prepared for the most unfavorable circumstances, which is why gold holds a special place in their currency operations.

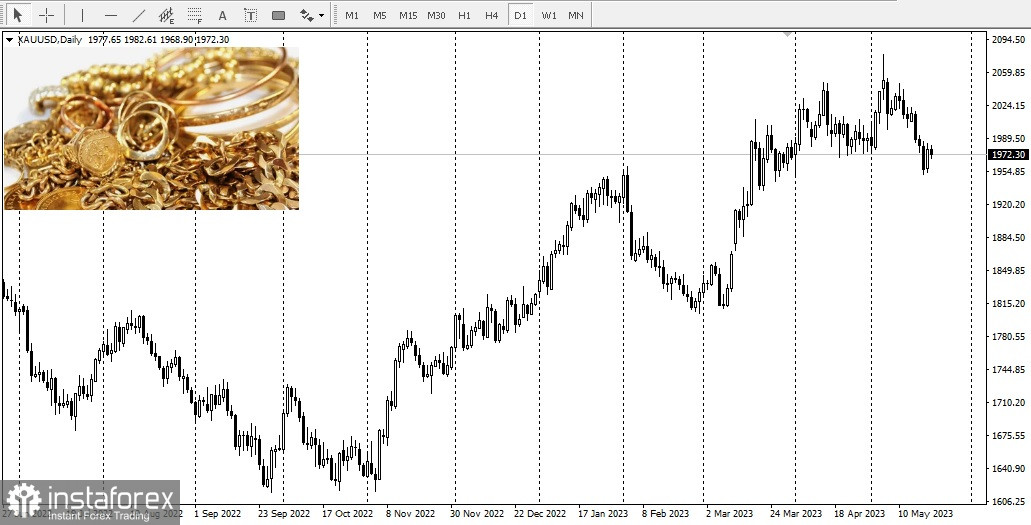

This year, central bank gold buying has been one of the driving forces behind the rise in gold prices.

According to the World Gold Council, alongside the Polish central bank, other central banks also bought gold in April: the People's Bank of China purchased 8.1 tons, the Czech National Bank acquired 1.8 tons, and the Central Bank of Mongolia bought 1 ton.

On the other hand, in April, the Central Bank of Turkey sold 80.8 tons of gold to meet the growing domestic demand. According to the WGC, after purchasing gold than any other central bank last year, Turkey has been selling gold in March and April. This was done in an attempt to limit the need for gold imports, which put pressure on the country's current account deficit.

Turkey experienced staggering demand for the yellow metal as citizens used it as a hedge against the devaluation of the local currency and inflation, which at one point last year exceeded 85%.

The aforementioned data may act as a tailwind for gold prices this year.