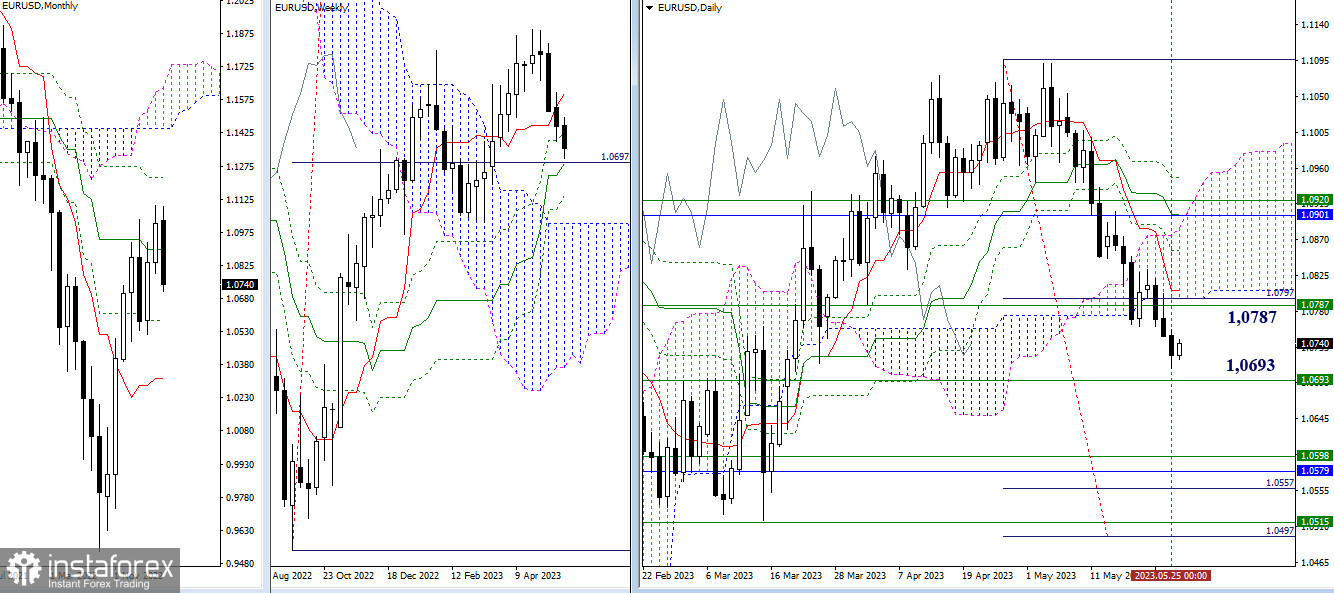

EUR/USD

Higher timeframes

Yesterday, the pair continued to decline but failed to reach the support level at 1.0693. As a result, the conclusions and expectations voiced earlier remain relevant. For bears, the nearest level of importance is 1.0693 (weekly medium-term trend). For bulls, a breakout of the daily and weekly resistances around 1.0787 - 1.0796 - 1.0809 will be significant.

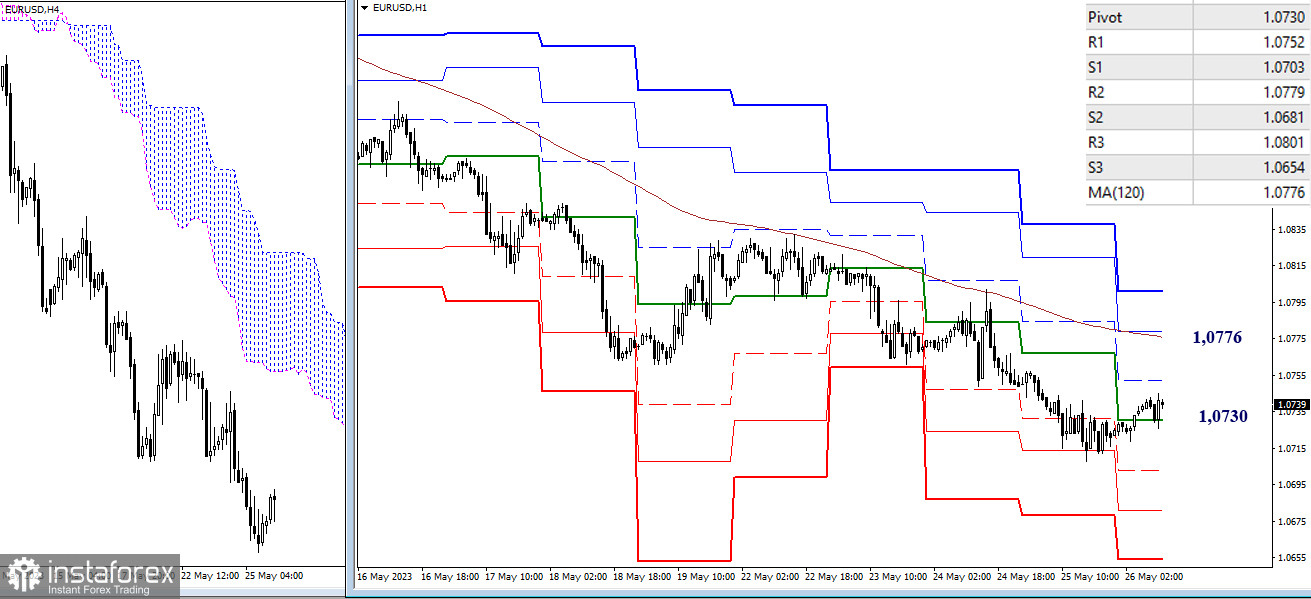

H4 - H1

The decline is again halted. On lower timeframes, a corrective upward movement is currently developing. The pair has consolidated above the central pivot point (1.0730). Further deceleration is possible around the first resistance of the classic pivot points (1.0752), but the key value in this direction is the weekly long-term trend (1.0776). Consolidation above and a reversal of the momentum could break the existing bearish trend and change the balance of power. In case the correction is completed and the decline continues, the intraday supports today are located at 1.0703 - 1.0681 - 1.0654 (classic pivot points).

***

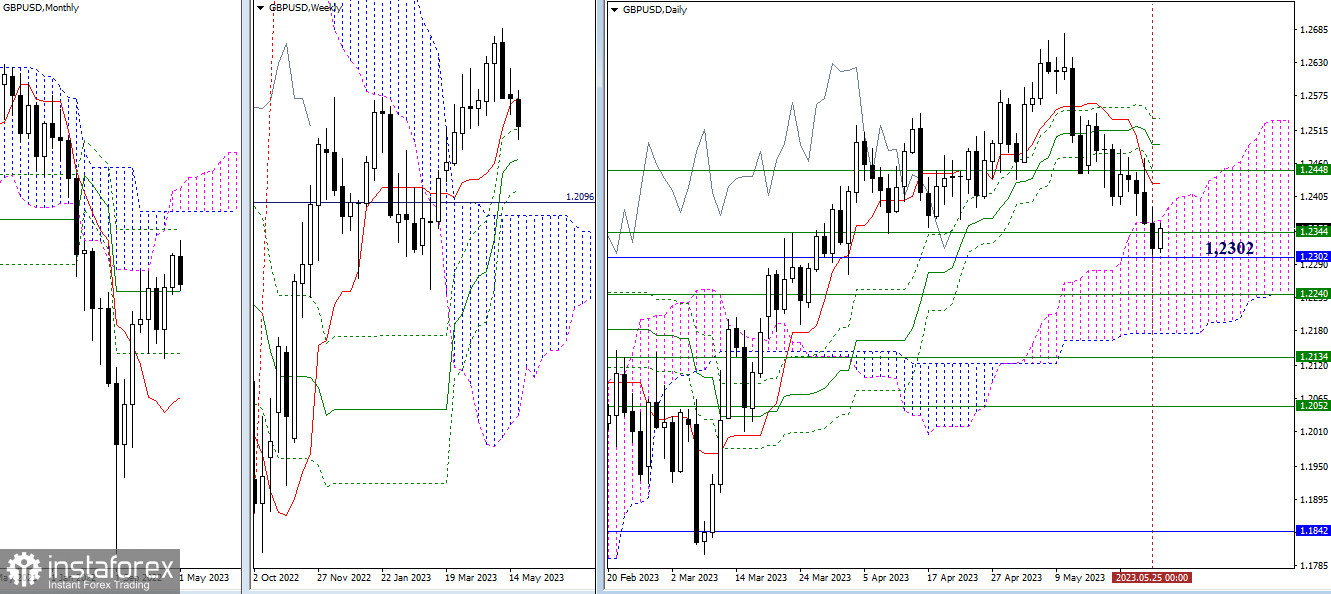

GBP/USD

Higher timeframes

Yesterday, the pair fell to the area of the monthly medium-term trend (1.2302). It should be noted that on this part of the market, several levels are gathered in close proximity to each other, such as 1.2365 - 1.2344 - 1.2302 - 1.2240, etc. Therefore, at any moment, one can expect the formation of deceleration, consolidation, or a rebound.

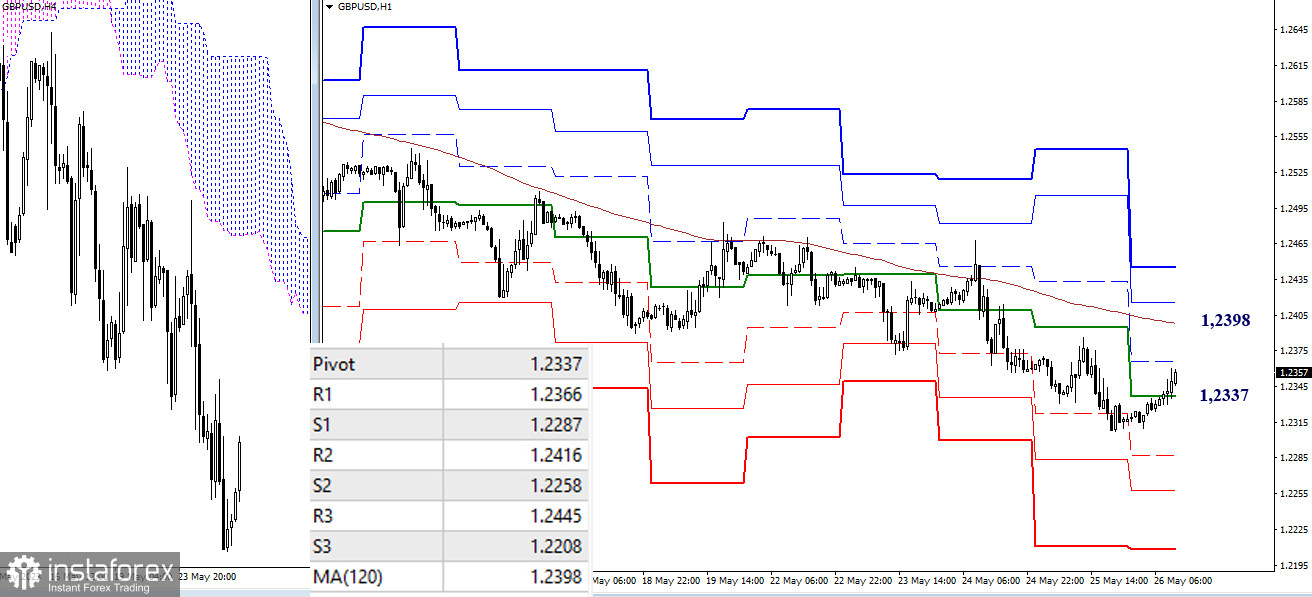

H4 - H1

On lower timeframes, the main advantage in the current situation belongs to the bears. Nevertheless, there is a developing corrective upward movement, and bulls have surpassed the central pivot point (1.2337) and continue the ascent. Their main reference point is the weekly long-term trend (1.2398). Consolidation above this level will change the current balance of power. Additional reference points within the day can be the classic pivot points at 1.2366 - 1.2416 - 1.2445 (resistances) and 1.2287 - 1.2258 - 1.2208 (supports).

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)