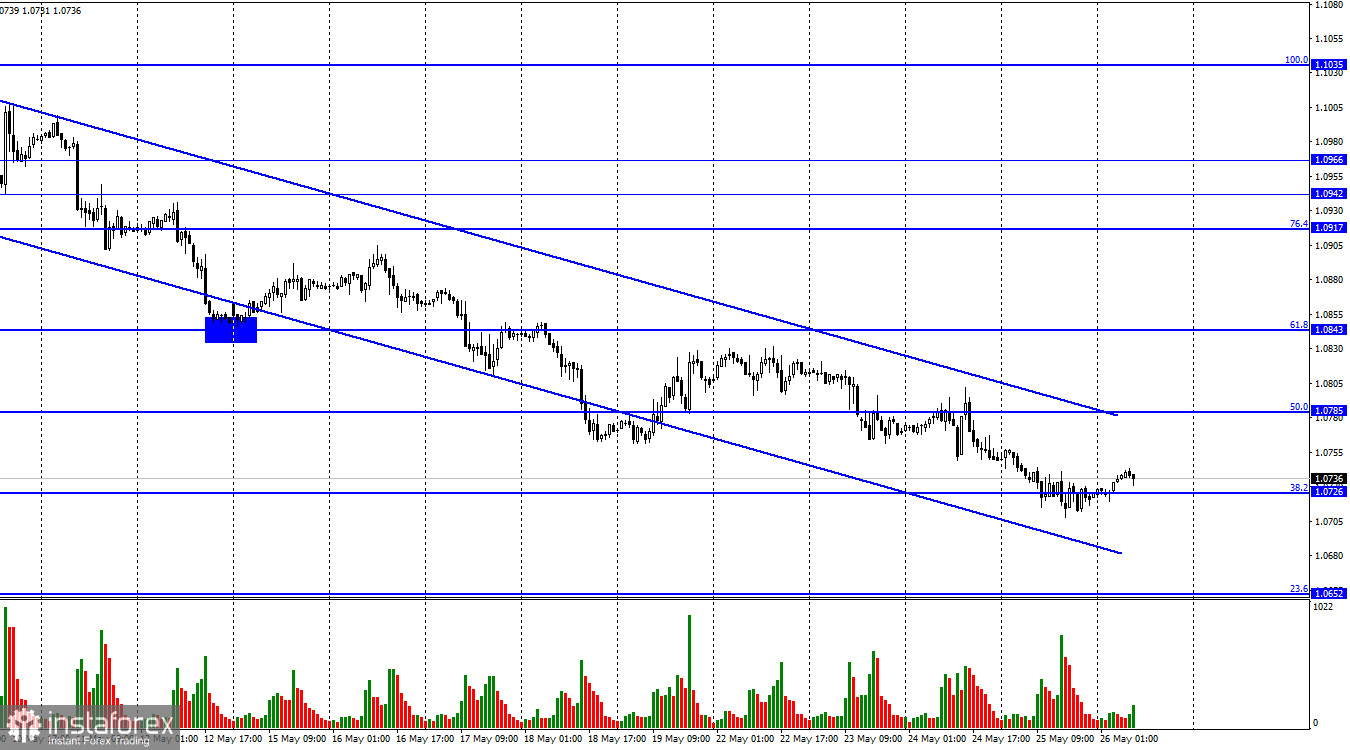

The EUR/USD pair continued downward on Thursday and tested the corrective level of 38.2% (1.0726). There was no significant rebound from this level, but trader activity is currently quite weak, with many levels being tested in non-standard ways. The descending trend corridor is the main focus at the moment. The pair remains within its bounds and does not attempt to break free. The bearish sentiment persists. If the pair manages to establish a foothold above the corridor, it will work in favor of the euro and allow for some growth. Until then, I expect a further decline toward the Fibonacci level of 23.6% (1.0652).

Trader activity is very low, with yesterday's range not exceeding 50 points. However, bulls are virtually absent from the market. Thus, the euro currency loses ground daily, but the movement is moderate. Yesterday, the news background once again supported the bears. Germany's GDP decreased by 0.3% in the first quarter, while traders expected it to remain at 0%. The number of initial jobless claims in the US was 229K, lower than the expected 245K. US GDP grew by 1.3% in the first quarter, surpassing the forecasted 1.1% growth. Thus, all three reports favored the bears, not the bulls.

In addition to this, there are several factors contributing to the strengthening of the American currency. Hawkish signals continue to come from the Federal Reserve. Some FOMC members maintain the view that the tightening of monetary policy should continue, which they have stated this week and last week, as evidenced by the latest Fed meeting minutes. Thus, under certain circumstances, ECB and Fed rates may continue to increase in equal measure. On the other hand, traders have recently been expecting a stronger rate hike by the ECB, which may have caused the growth of the European currency in the past few months.

The market also closely monitors the situation with the US government debt, the limit of which should be increased by June 1. Very few people currently believe in a default, supporting the American currency.

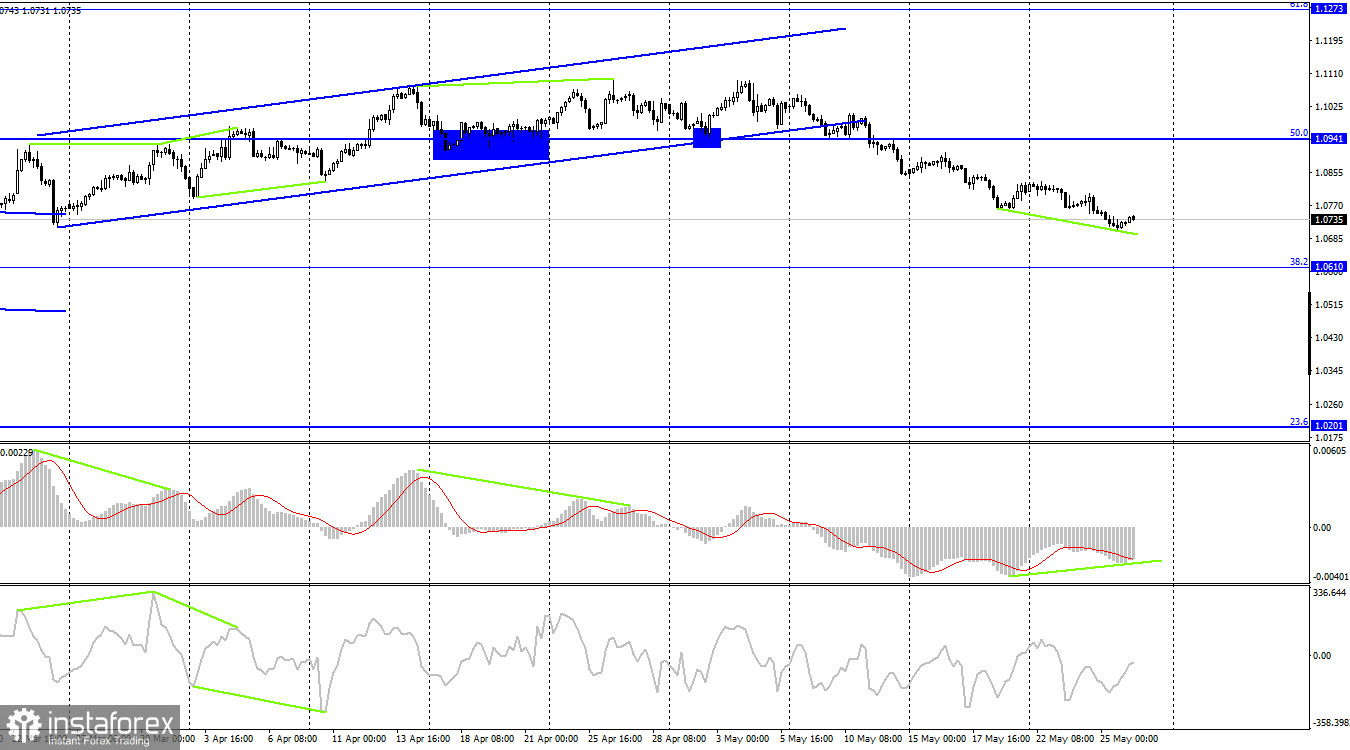

On the 4-hour chart, the pair has solidified below the ascending trend corridor and the 50.0% correction level at 1.0941, which suggests a continuation of the downward movement toward the next corrective level of 38.2% (1.0610). A rebound from the 1.0610 level will favor the euro and may lead to some growth toward the 1.0941 level. The MACD indicator shows signs of bullish divergence again, but I do not expect a strong rally for the pair after that.

News calendar for the US and the Eurozone:

Eurozone - Speech by ECB representative Lane (07:40 UTC).

USA - Core Durable Goods Orders (12:30 UTC).

USA - Personal Consumption Expenditures Price Index (12:30 UTC).

USA - Personal Income and Outlays (12:30 UTC).

USA - University of Michigan Consumer Sentiment Index (14:00 UTC).

On May 26, the economic events calendar includes several entries. The most important one is the Durable Goods Orders. The impact of the news on traders' sentiment for the remainder of the day may have moderate strength.

Forecast for EUR/USD and trader recommendations:

Short positions could be opened when the pair closed below the level of 1.0785 on the hourly chart, with a target at 1.0726. This target has been reached. New sales or holding existing ones are advised when the pair closes below 1.0726, with a target at 1.0652. I recommend buying after the pair closes above the descending trend corridor on the hourly chart, with a target of 1.0843.