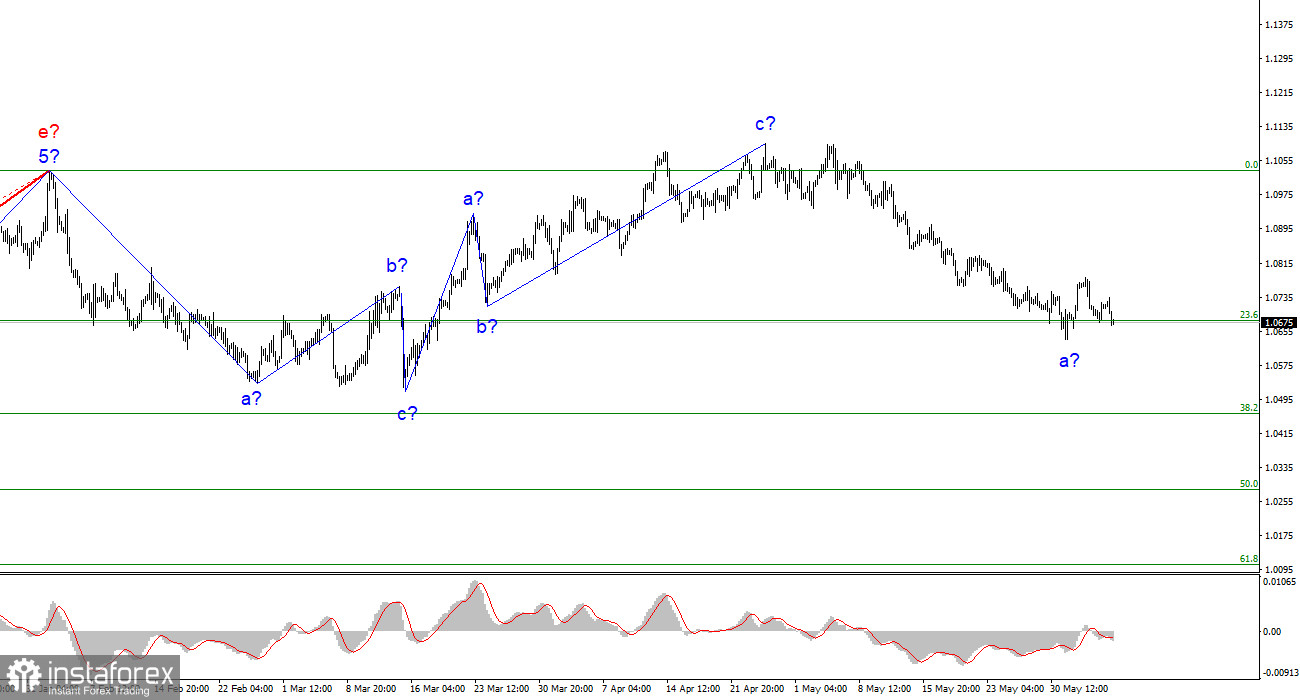

The wave analysis on the 4-hour chart for the euro/dollar pair continues to be non-standard but understandable. The quotes continue to move away from the previously reached highs, so the three-wave upward structure can be considered complete. The entire ascending trend section, which began on March 15th, may adopt a more complex structure, but at the moment, I expect the formation of a downward trend section, which is likely also to be three-wave. Recently, I have consistently mentioned that I expect the pair to be around the 5th figure, from where the upward three-wave structure started to form.

The upper point of the last trend section was only a few dozen points higher than the highest point of the previous upward section. Since December of last year, the pair's movement can be considered horizontal, and such a character of movement will continue. The presumed wave b, which could have started its formation on May 31st, currently has a very inconclusive appearance. If the decline in quotes continues, it will be canceled, and its formation will start later.

The market calms down.

The exchange rate of the euro/dollar pair moved by 30 basis points on Tuesday, and the pair's amplitude was again low. The news background today was very weak. Besides the retail trade report in the European Union, there is absolutely nothing worth noting. The volume of retail trade in April remained unchanged, although the market expected a slight increase of 0.2-0.3% month-on-month. Many indicators currently tend to worsen or slow down. If the ECB, the Bank of England, and the Federal Reserve raise interest rates at every meeting and have not made a single pause since the beginning of the tightening program, how should the economy react? Obviously, with a decline, decrease, and contraction. Therefore, I am not concerned about another weak EU or US report. It is normal in the current conditions.

The wave analysis, although non-standard, is quite unambiguous. There are currently only questions about the corrective wave b, which may either be shortened due to high demand for the US dollar or has not started its formation. In the latter case, the slight increase in quotes we observed in the past week is just an internal wave of wave a. A successful attempt to break through the 23.6% Fibonacci level will indicate the market's readiness for new sales.

We shouldn't expect anything interesting tomorrow. In the European Union, Vice President of the ECB Luis de Guindos and several of his colleagues will speak. The trade balance report will be released in the US, which rarely attracts market attention. Therefore, I expect a low amplitude of movements again tomorrow. If this assumption is correct, then on Wednesday, the pair's exchange rate will not change significantly.

General conclusions.

Based on the conducted analysis, the upward trend section is formed. Therefore, it is currently advisable to recommend selling, and the pair has significant room for decline. I still consider targets around 1.0500-1.0600 quite realistic, and I advise selling the pair with these targets in mind. A corrective wave may start (or may have already started) from the level of 1.0678, so I recommend new sales in case of a successful attempt to break this level or after an obvious completion of wave b.

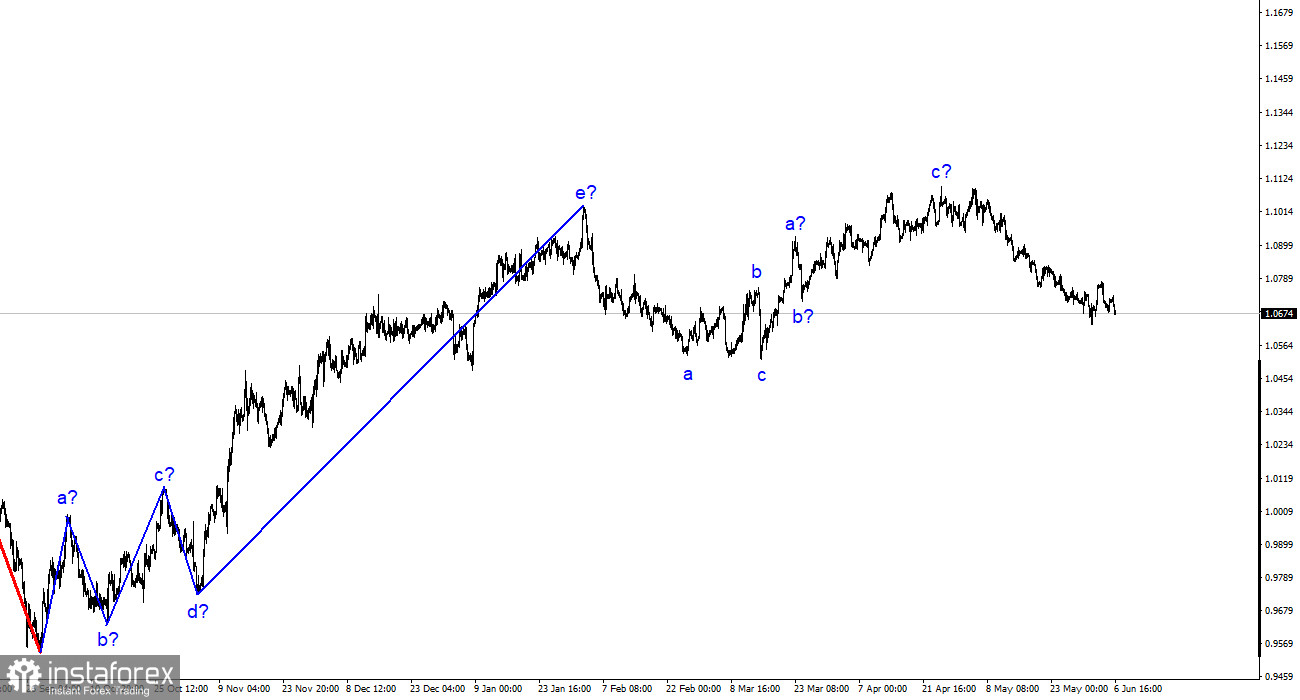

On a larger wave scale, the wave analysis of the ascending trend section has taken on an extensive form but is likely completed. We have seen five upward waves, likely a structure of a-b-c-d-e. The formation of the downward trend section may still need to be completed, and it can take any form and length.