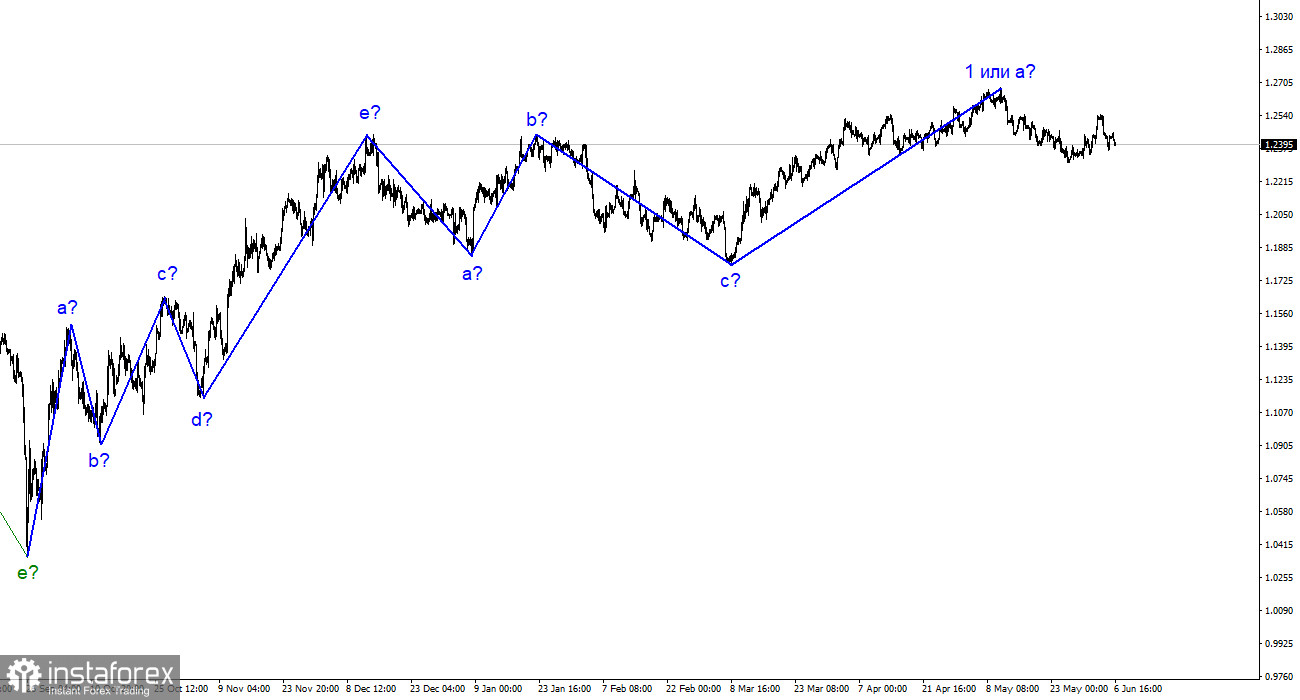

The wave analysis for the pound/dollar pair must still be more complex and clear. After a horizontal corrective phase, I expected a similar downward movement. Still, the increase in quotes over the past two weeks suggests that the market is ready for a full-fledged, upward impulse trend. The presumed wave 2 or b could have completed its formation last week (although I'm still skeptical about it). If that is the case, forming an ascending wave 3 or c has already begun. This provides an excellent opportunity for the British pound to rise to 26-30 figures. Whether the current news background justifies this is for you to decide.

The wave analysis for the EUR/USD pair will differ significantly from that of GBP/USD. For the euro currency, a downward set of waves is expected, and the hypothetical complexity of the upward trend section needs to be added to the agenda. At the same time, everything looks like a new upward trend section for the British pound. The news background for the pound has remained largely unchanged recently, so I need help determining what is driving the market's demand.

The construction sector in Britain supports the pound.

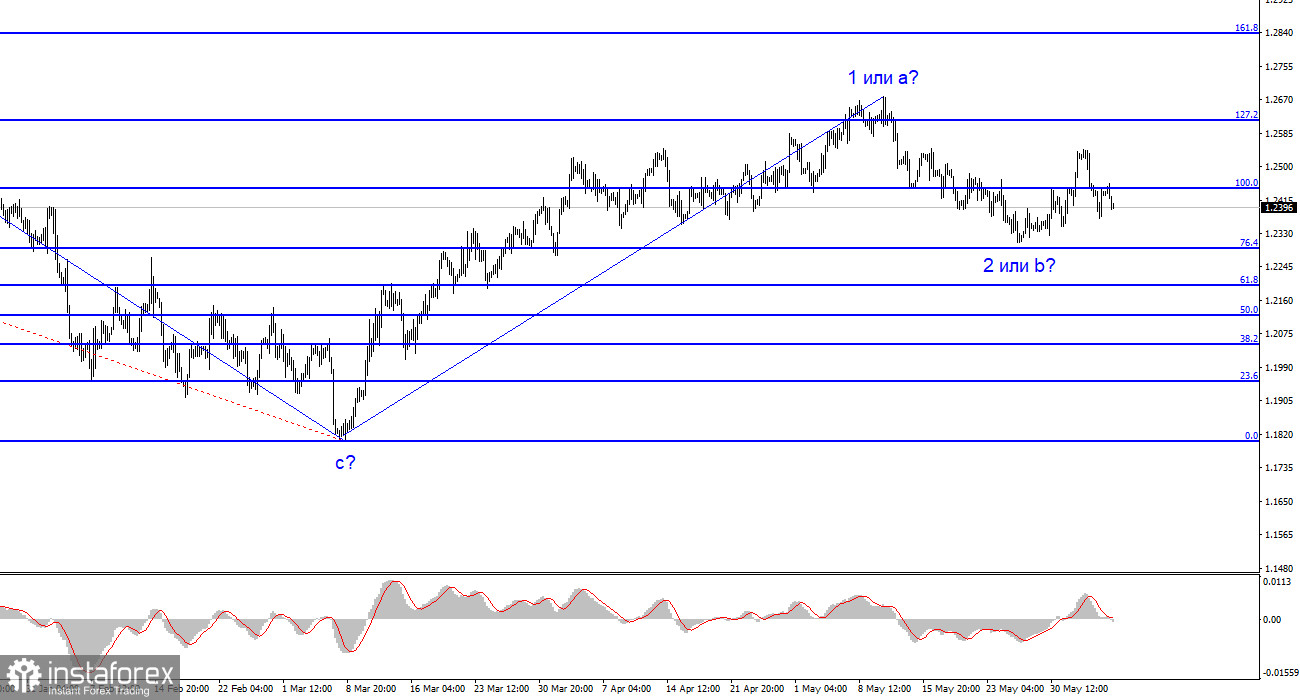

The exchange rate of the pound/dollar pair decreased by 20 basis points on Tuesday, and the range of movement was 30. Considering the almost complete absence of news, such weak movements do not surprise me. It is still unclear whether corrective wave 2 or b formation has been completed or if the market has paused. The downward movement of the pair will continue.

Today's only report is the Construction PMI in Britain, which slightly increased. However, it remained near the key level of 50.0, and a drop below this level could indicate problems in the sector. But that did not happen, so the British pound may have a slight increase today. However, that did not occur either.

It is time to prepare for future meetings of the Bank of England and the Federal Reserve and await new inflation reports. This week's news background is very weak, so significant price changes are not expected. There needs to be more to analyze in the market, and the uncertainty regarding wave 2 or b further complicates the current situation. Therefore, we must wait for news and movements to clarify the current wave pattern.

General conclusions.

The wave pattern of the pound/dollar pair has long suggested the formation of a downward wave. Wave b could be very deep, as all recent waves have been roughly equal. However, the recent upward movement suggests a possible completion of this wave. In this case, the trend section may transform into an upward one. This would present a completely different wave pattern and different conclusions with recommendations. Therefore, I recommend selling the pound with targets around 23 and 22 figures, but we need to wait for signals of a resumption of the downward wave formation.

On a larger wave scale, the pattern is similar to the Euro/Dollar pair, but some differences remain. The downward corrective section of the trend is completed, but the formation of a downward wave is still in progress. This wave may be deep and extensive, and the entire trend section may be horizontal, similar to the previous one.