EUR/USD is attempting to launch an attack. The bulls have armed themselves with factors like a potential slowdown in US consumer prices to 4.1% in May and the Federal Reserve holding rates steady. Against the backdrop of the European Central Bank's 25 bps rate hike, this creates a favorable tailwind for the euro. Unfortunately, if everything on Forex were that simple, everyone would be making money.

According to Economy Minister Robert Habeck, Germany will be forced to scale back or suspend industrial capacity if Russian gas stops flowing to Europe after 2024. Currently, deliveries are made to countries like Austria, Italy, Slovakia, and Hungary. If Moscow and Kiev do not sign a new transit agreement, which currently seems highly unlikely, Germany will lose part of its gas supply without any means of compensation. The specter of an energy crisis has once again appeared in Europe, which has dampened the enthusiasm of the EUR/USD bulls.

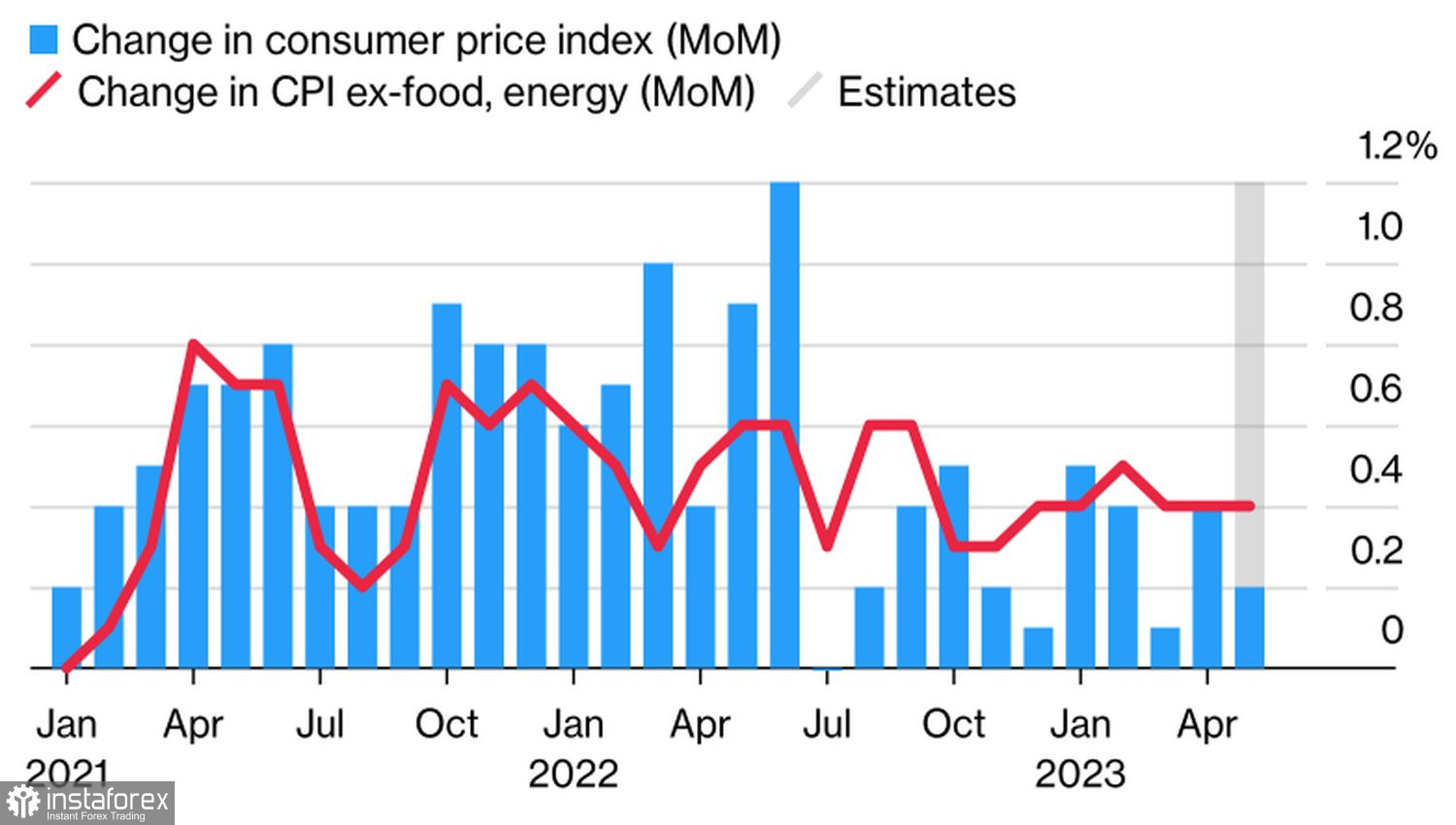

However, much will change by the end of 2024. A lot of water will flow under the bridge. At present, investors are concerned about topics like the US inflation report, as well as meetings of the Fed and the ECB. If the figures are close to the projected Consumer Price Index of 4.1% and core inflation of 5.2%, it will mean that the Fed is far from accomplishing its task. A strong labor market and high prices speak for themselves. A 500 bps increase in the federal funds rate since the start of the monetary tightening cycle has proven insufficient to break the backbone of inflation.

The dynamics of US inflation

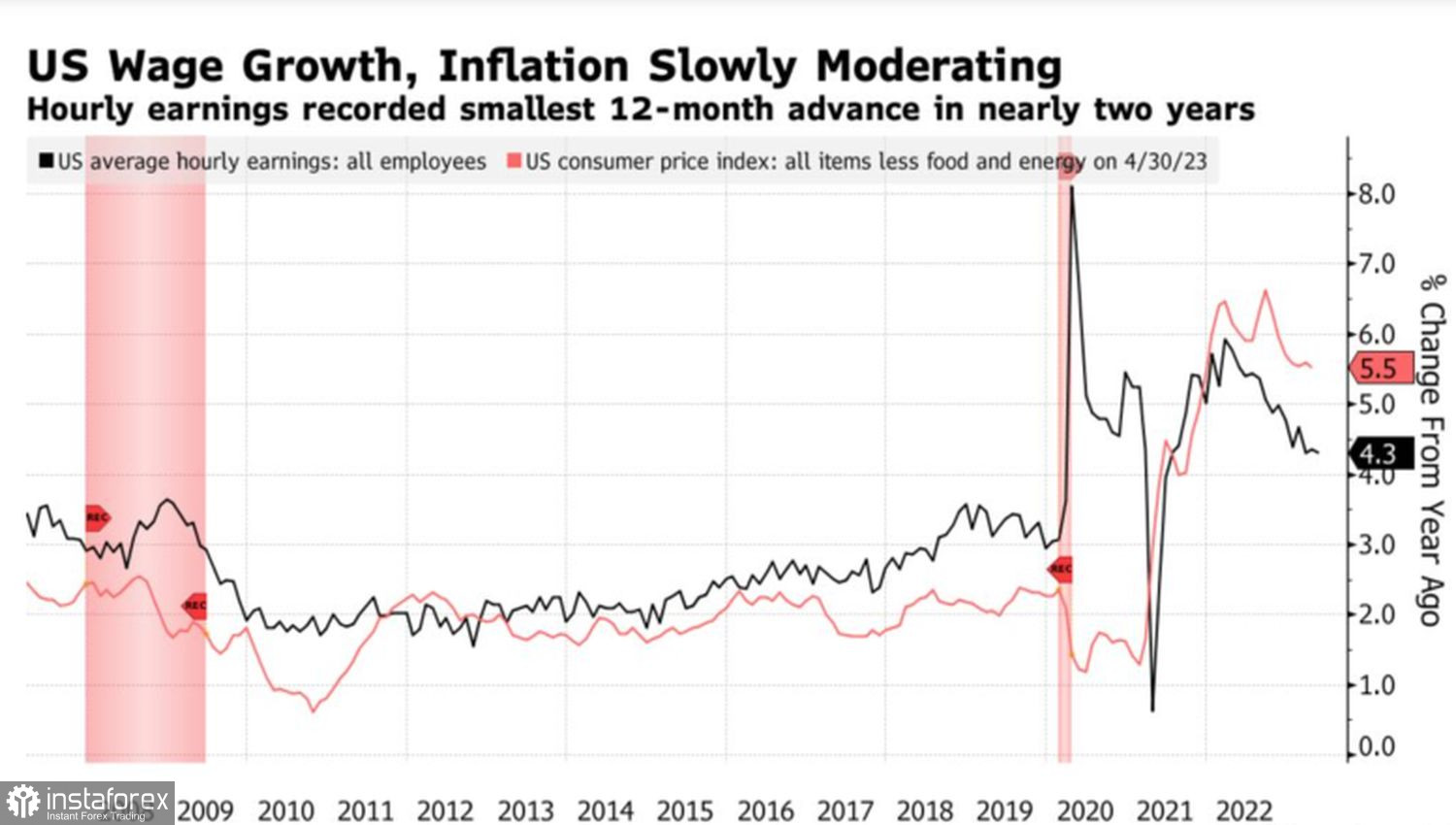

Interestingly, the rise in unemployment and the slowdown in average wages in May became the main arguments in favor of a pause in the process of monetary tightening in June. In fact, a study by the Federal Reserve Bank of San Francisco proves that wages have little influence on prices. Rather, rising inflation leads to more wage demands by wage earners. This is crucial for the Fed. The sooner the central bank breaks entrenched inflation expectations, the sooner the Personal Consumption Expenditure index will return to the 2% target.

Thus, memories of the energy crisis have clipped the wings of EUR/USD bulls. At the same time, the market expects hints from the US inflation data and the Fed meeting. Investors believe that the US central bank will pause the monetary tightening process and they anticipate a hawkish-sounding Powell during the press conference following the June meeting.

The dynamics of inflation and average wages in the US

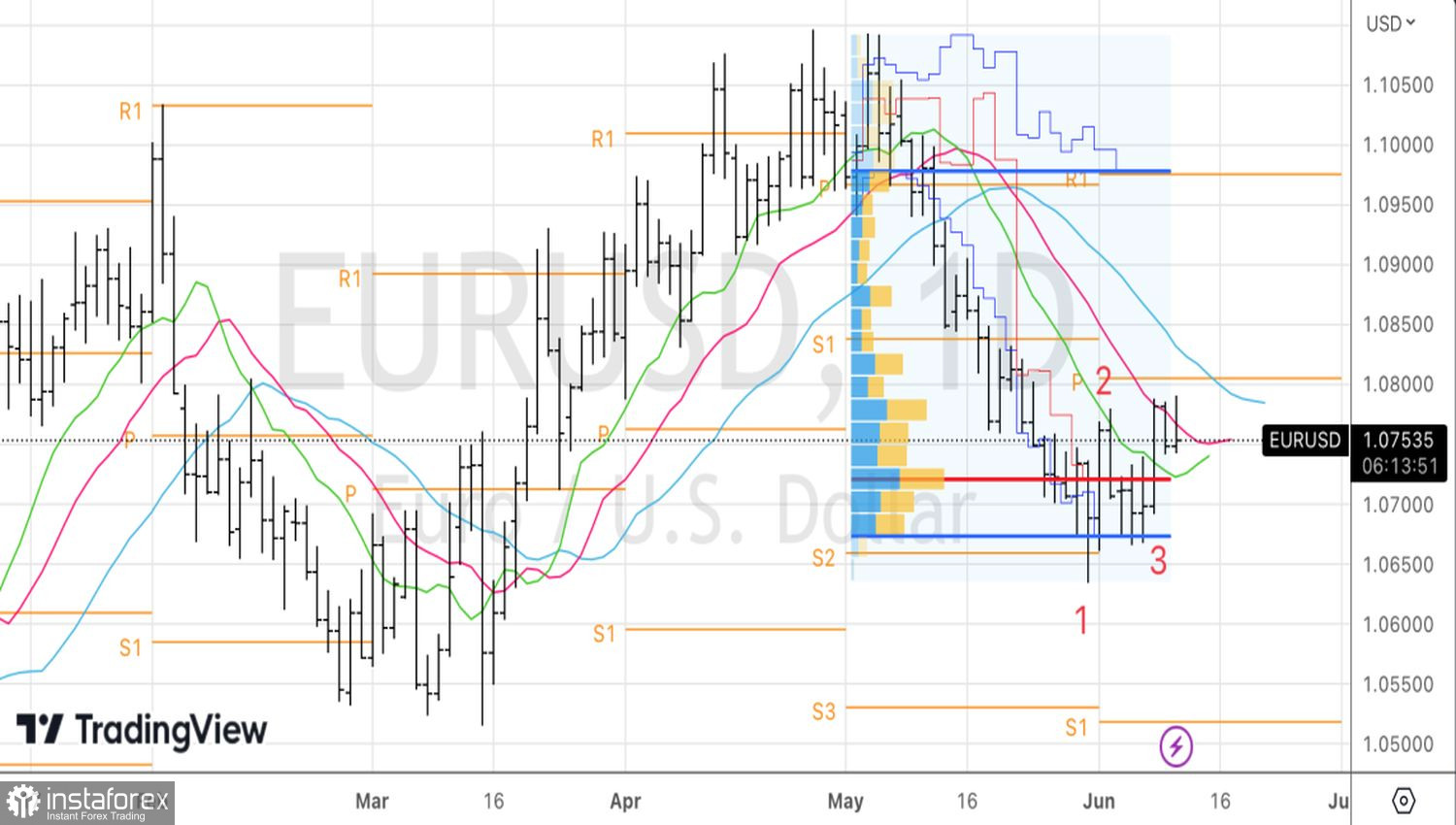

Naturally, ahead of important events, few people want to rush forward. Traders are not in a hurry to open new positions and are closing old ones, resulting in consolidation of the main currency pair.

Technically, on the daily chart, the bulls' attempts to win back the internal bar ended in failure. If the market doesn't go in the direction where it is expected to, it is more likely to go in the opposite direction. Therefore, it is advisable to set a sell limit order for the euro near $1.074.