If we compare the movements of the EUR/USD and GBP/USD instruments, it is evident that in recent weeks they have been moving slightly differently. Since the beginning of May, when both started forming a downward wave, the British pound has fallen by 350 basis points, while the euro has declined by 450. The difference might not seem significant, but it is worth noting that the pound is more volatile and, therefore, under equal circumstances, it should have gone down more than the euro. Now it gets more interesting. In the last two weeks, the euro has recovered by 150 points, while the pound has recovered by 300 points. In other words, the pound has almost completely recovered from its losses, while the euro has only slightly pulled back to the upside. What causes such a mismatch between the movements of these instruments, considering that the news background has been almost the same?

We can assume that the discrepancy in the movements of the EUR/USD and GBP/USD instruments is due to interest rates and inflation. In the UK, inflation remains higher than in the US or the eurozone, implying a higher peak interest rate for the Bank of England. However, this is only an assumption and not an indisputable fact. Many analysts have substantial grounds to believe that the BoE will not raise rates in 2023 to a value of 5% or 5.5%, let alone higher. There were already rumors in May that the British central bank might pause, but then the rate increased again (for the 12th consecutive time) by 25 basis points. The BoE has provided very little information. While the European Central Bank and Federal Reserve officials have been actively providing comments over the past three weeks, giving us an understanding of what to expect from the central banks themselves, the BoE remains uncertain. Expectations from it can be anything.

However, relying on "expecting anything" is unlikely to be a guiding principle for buying the pound, which the market continues to engage in actively (despite Monday's decline). If we compare the European economy to the British economy, we will find gloomy figures in both cases. In the eurozone, the latest quarterly data shows -0.1% and -0.1%. In the UK, it's 0.1%, -0.1%, 0.1%, and 0.1%. Economic growth is almost non-existent in both cases. Business activity indices are leaning towards a decline. In the manufacturing sector, they have been in negative territory for almost a year. Unemployment levels are rising in the UK, while they traditionally remain high in the eurozone. As we can see, the situations are nearly identical, but for some reason, the pound enjoys much higher demand than the euro.

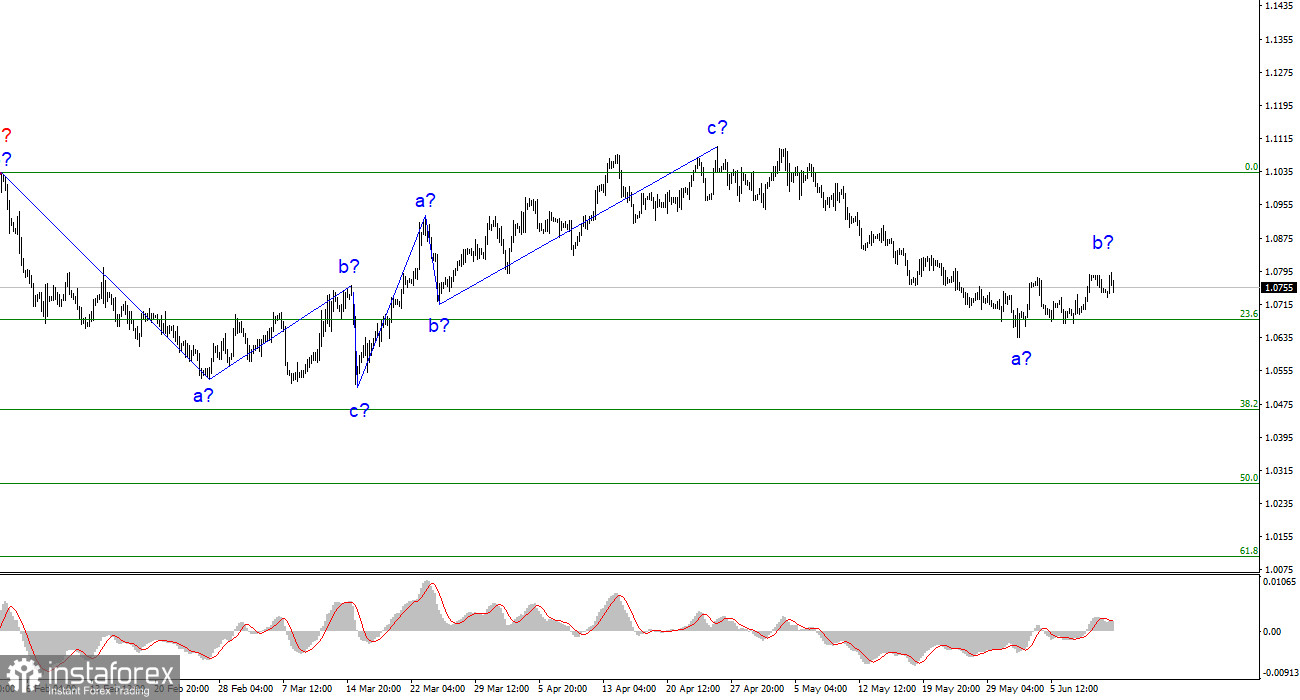

Based on the analysis conducted, I conclude that a new downtrend is currently being built. Therefore, I would recommend selling at this point, since the instrument has enough room to fall. I believe that targets around 1.0500-1.0600 are quite realistic. I advise selling the instrument using these targets. A corrective wave started from the 1.0678 level, so you can consider short positions if the pair surpasses this level or after wave b has obviously been completed. Within the correction, the instrument may reach the 0.9 figure, but wave b already has enough grounds for completion.

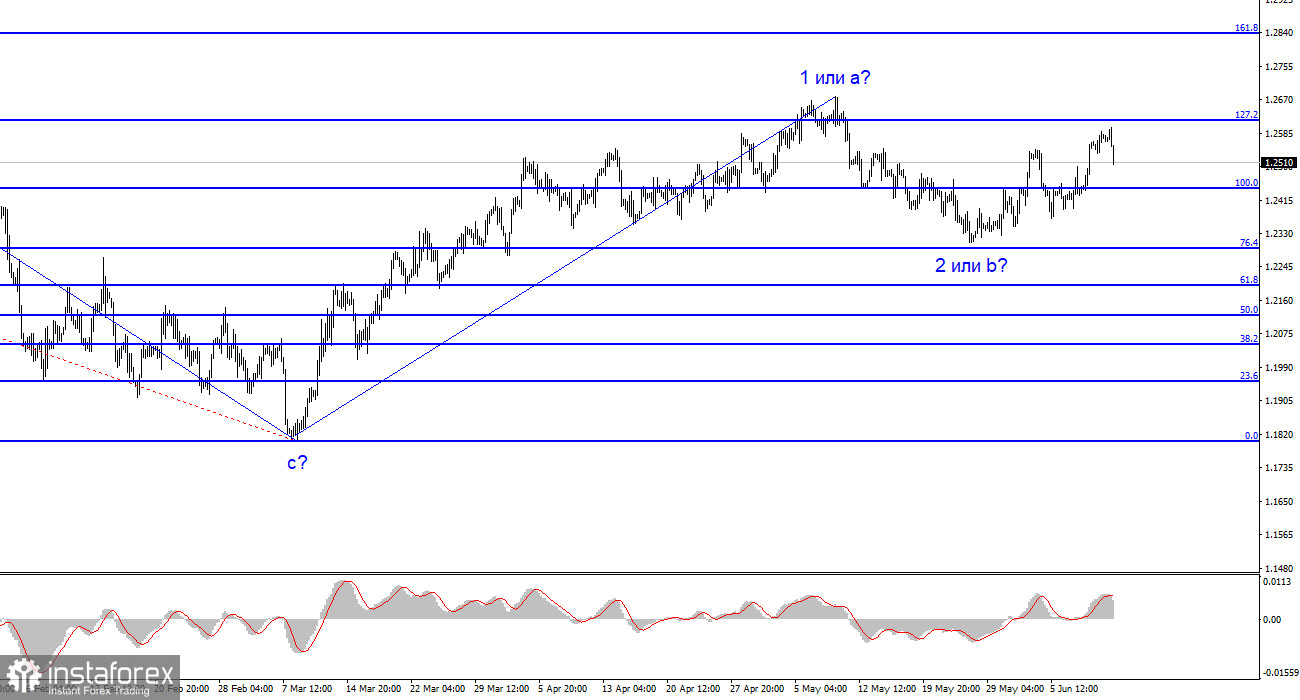

The wave pattern of the GBP/USD pair has long suggested a downward wave. Wave b could be very deep, since all the waves have recently been equal. However, the recent growth indicates a possible completion of this wave on May 25th. In this case, this could turn into a full uptrend, and this is already a completely different picture and other conclusions with recommendations. Therefore, for now, I recommend selling the pound with targets around the 23 and 22 figures, but now we need to wait for signals of the resumption of the downward wave. I suggest you be cautious.