Gold continues to consolidate ahead of the announcement of the results of the June FOMC meeting. The pause in the monetary policy tightening gives optimism to XAU/USD bulls. However, the fact that the federal funds rate will remain at elevated levels for a long time plunges buyers into deep sadness. The information from the physical asset market does not help them.

If gold prices continue to rise in India, sales of processed bars will increase by 20% and reach the previous record high of 19.5 tons, recorded in 2019. At the same time, the reduction in gold imports by one of the world's largest gold consumers should, in theory, exert downward pressure on XAU/USD, specially since the Central Bank of Turkey sold an additional 63 tons of gold in May to support the rapidly depreciating lira. As a result, its gold reserves decreased by 159 tons to 428 tons in the spring.

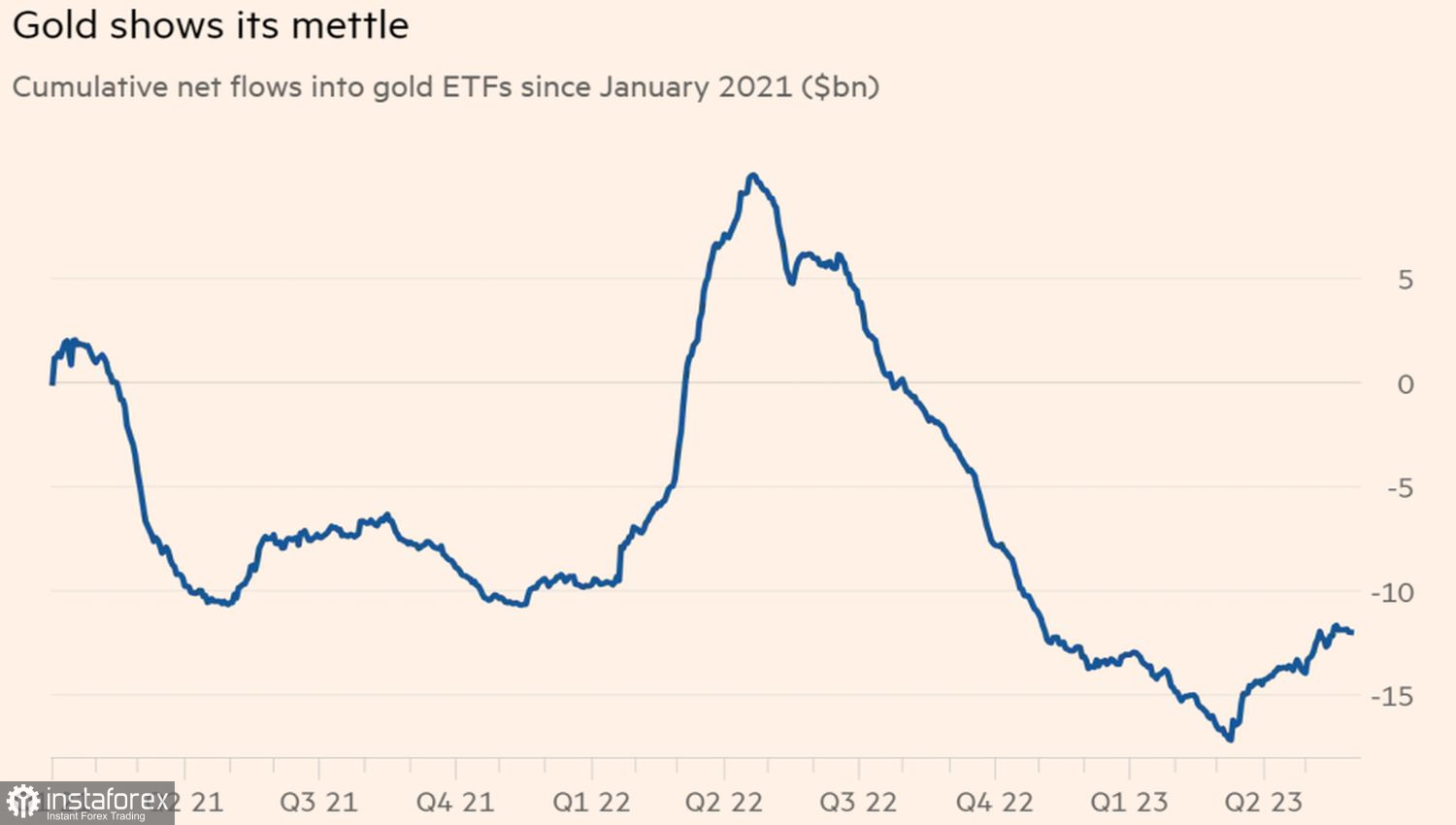

A bright spot in May was the ETF reserves, which increased by $1.9 billion. Since March, the indicator has grown by $4.3 billion. Prior to that, there were outflows of $27.2 billion in April 2022 until the turning point in March 2023. However, there are rumors circulating in the market that the May capital inflows into gold-oriented specialized exchange-traded funds were driven by concerns about the debt ceiling and potential default of the United States. After an agreement was reached between Republicans and Democrats, these fears disappeared from the market, which could have a negative impact on ETFs.

Dynamics of gold ETF reserves

Unfortunately, due to the insignificant scale of the physical asset market compared to the paper market, it has never had as strong an impact on gold prices as the monetary policy of the Federal Reserve and the related U.S. dollar exchange rate and U.S. Treasury bond yields.

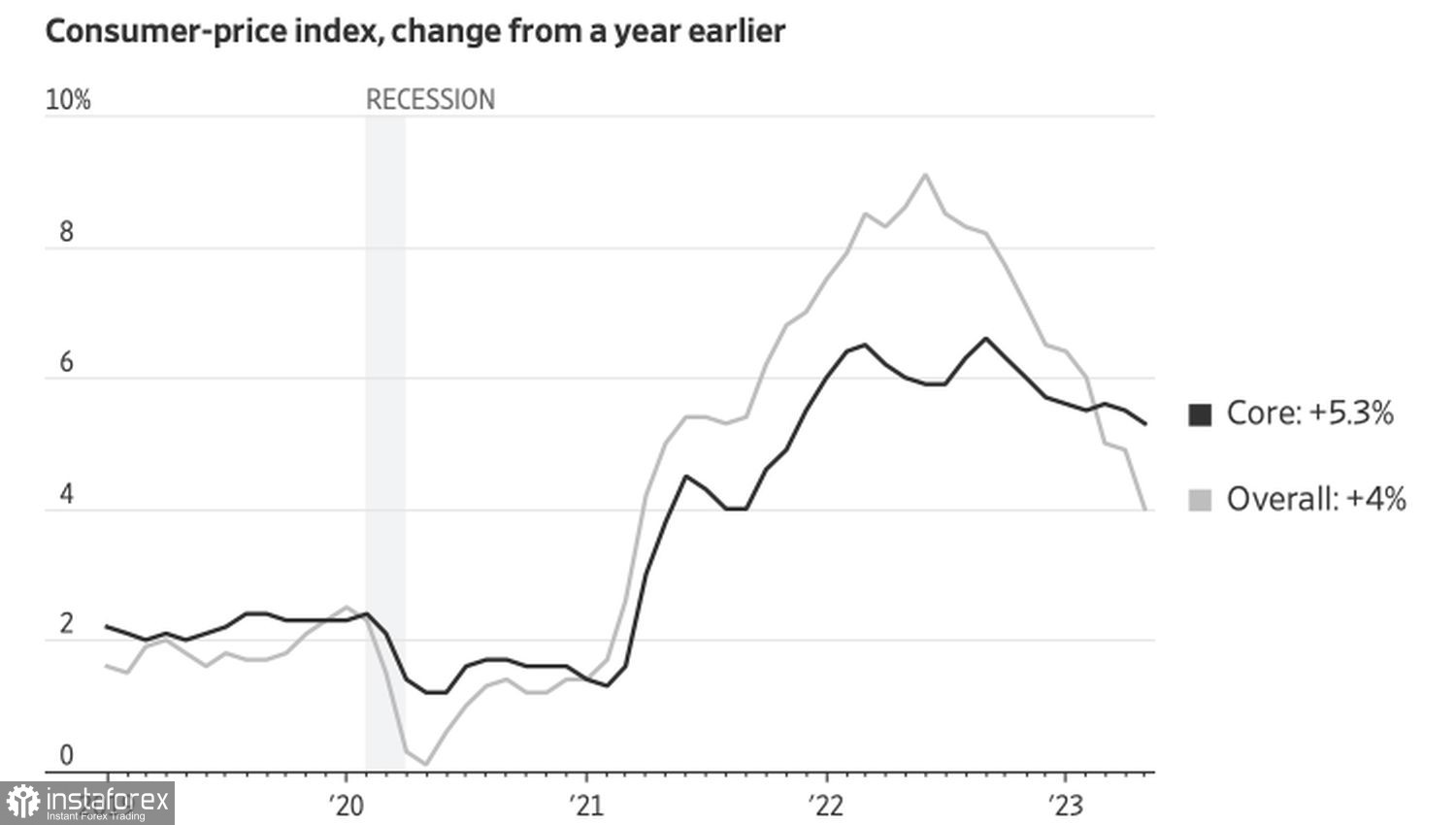

The release of U.S. inflation data failed to clarify the prospects for XAU/USD. Despite a significant slowdown in consumer prices to 4%, which is more than halved from the peak of 9.1% in this cycle, core inflation decreased only slightly. This circumstance supports the idea of maintaining the federal funds rate at a high level for an extended period, even if it doesn't increase in June. It's bad news for gold.

Dynamics of U.S. inflation

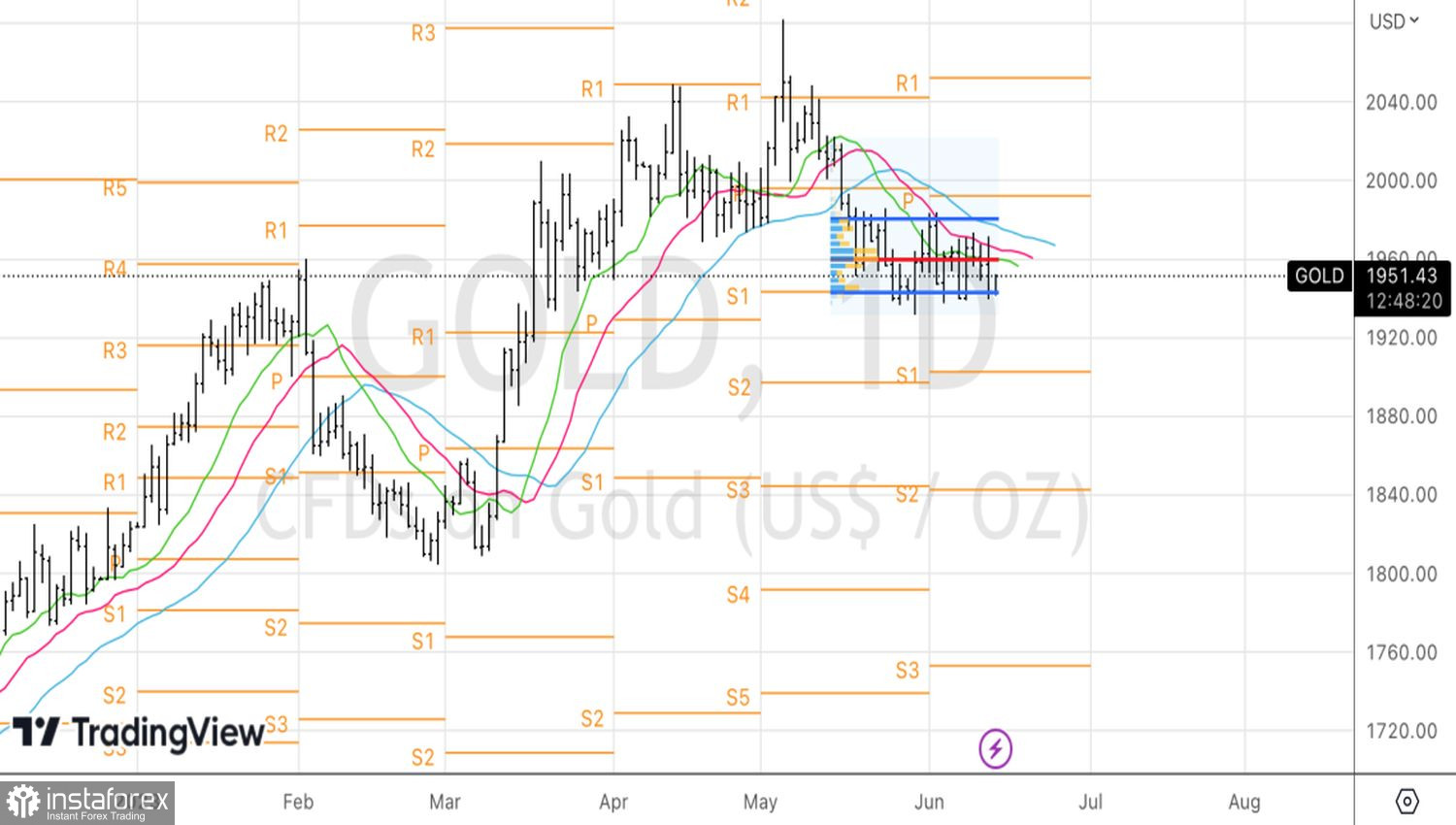

In the medium-term perspective, the resilience of the U.S. economy, expectations of tightening monetary policy by the Federal Reserve in July, and a decrease in recession risks in the United States create headwinds for XAU/USD. Therefore, I assess the chances of a correction towards an upward trend higher than the probability of a recovery in the bullish trend. In the short term, the fate of gold will be determined by the FOMC meeting. If Jerome Powell's rhetoric appears hawkish to investors, gold will have a tough time.

Technically, on the daily chart of the analyzed asset, there is a Spike and Ledge pattern. It makes sense to buy gold in the case of a successful break above the upper boundary of the consolidation range of $1938–$1983 or the ledge. A break below the support at $1938 per ounce would be suitable for selling.