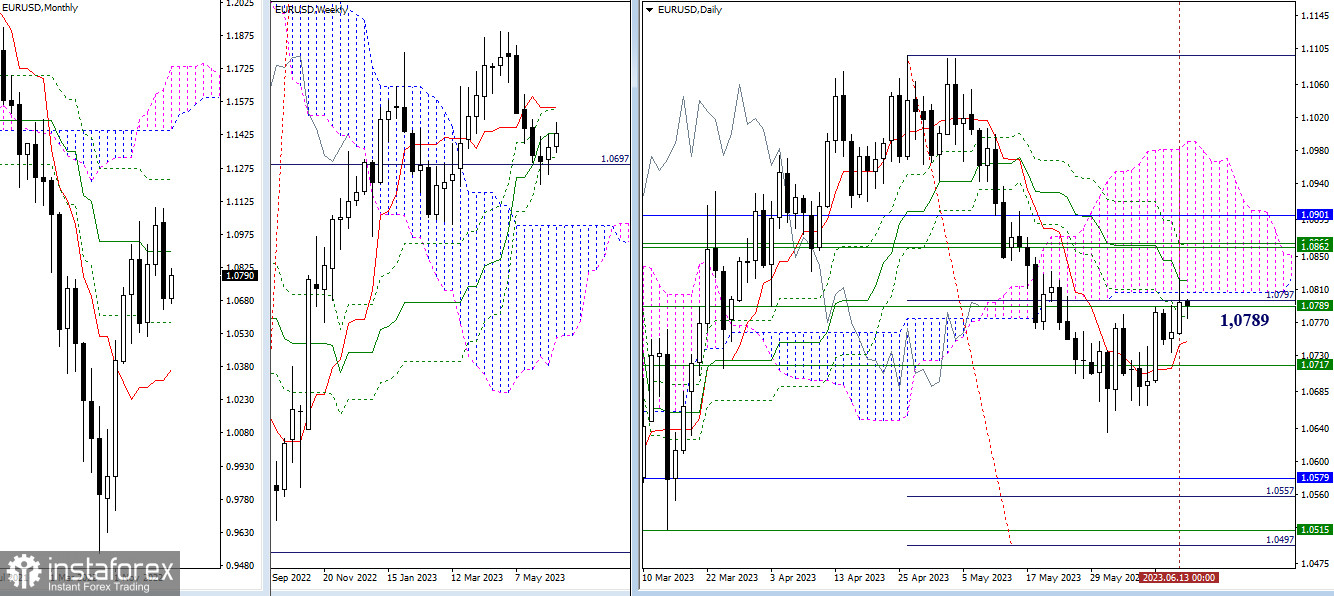

EUR/USD

Higher timeframes

Yesterday, the pair tested the resistance zone of 1.0789–1.0806 and reached the daily medium-term trend (1.0821), but by the end of the day, it went back and closed the day around 1.0789 (weekly medium-term trend). As a result, the conclusions and expectations did not undergo significant changes. A breakout of the encountered resistance zone will open the way to the next targets, which in this area are the weekly levels, the final barrier of the daily death cross (1.0866-62), and the monthly medium-term trend (1.0901). A rebound will bring the pair back to the support area of 1.0746 (daily short-term trend) - 1.0717 (final level of the weekly cross), with a subsequent update of the local low (1.0636).

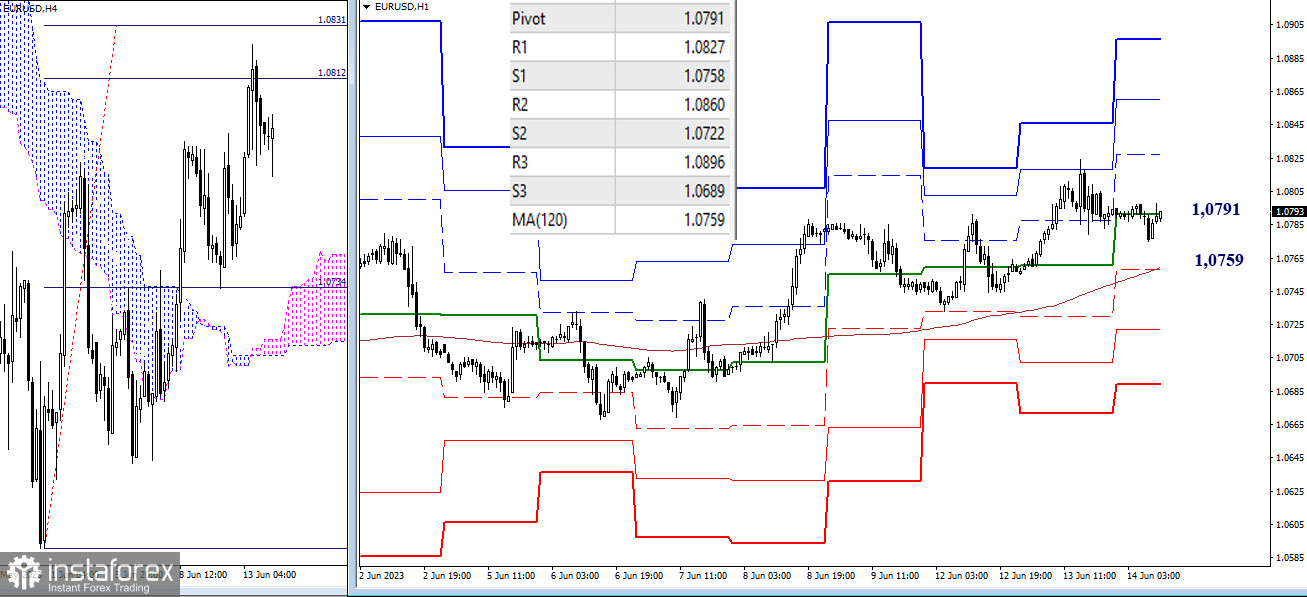

H4 - H1

On the lower timeframes, the pair achieved the target for breaking the H4 cloud at the first target level (1.0812), after which it entered a correction phase. As of writing, the support of the central pivot point of the day (1.0791) is being tested. The most significant reference point for the correction is always the weekly long-term trend (1.0759). A breakdown and consolidation below can change the current balance of power. Additional reference points for the downward movement are the supports of the classic pivot points, which can be noted today at 1.0758 - 1.0722 - 1.0689. In the case of the completion of the correction and a continuation of the upward movement, attention within the day will be directed on breaking the resistances of the classic pivot points (1.0827 - 1.0860 - 1.0896).

***

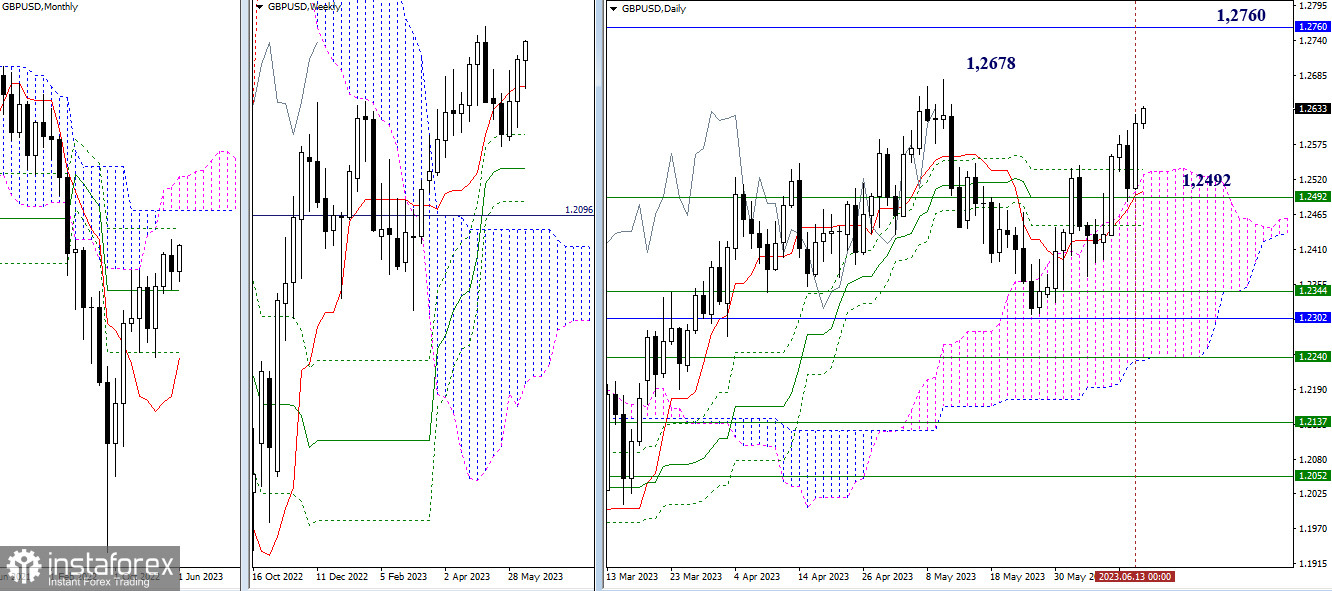

GBP/USD

Higher timeframes

Bullish players have updated the previous week's high and continue their upward movement. The next bullish targets in the current situation are the May all-time high (1.2678) and the monthly resistance (1.2760). The support zone, which combines several daily levels and the weekly short-term trend (1.2492), retains its value and position today.

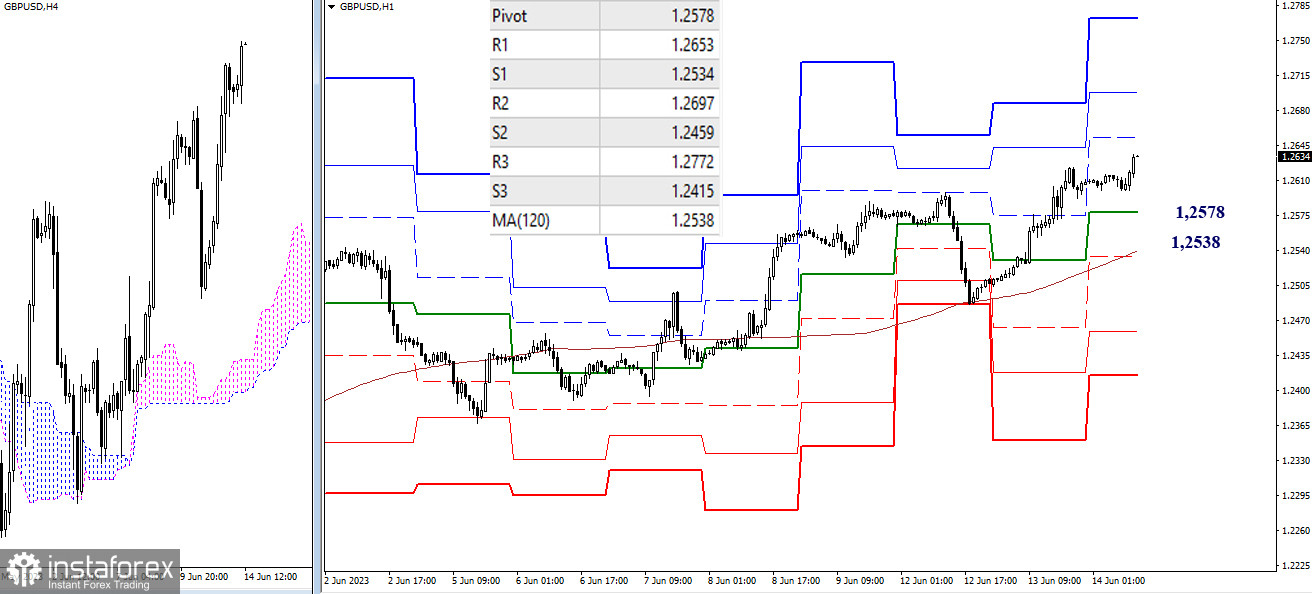

H4 - H1

On the lower timeframes, the main advantage currently belongs to the bulls. They have updated the high and are developing an upward trend. The resistance levels of the classic pivot points (1.2653 - 1.2697 - 1.2772) serve as targets for continued upward movement within the day. The key levels today act as supports, ranging from 1.2578 (central pivot point of the day) to 1.2538 (weekly long-term trend). A consolidation below these key support levels may shift the current balance of power in favor of strengthening bearish sentiment. The reference points for downward movement within the day will then be the supports of the classic pivot points, which today are located at 1.2534 - 1.2459 - 1.2415.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)