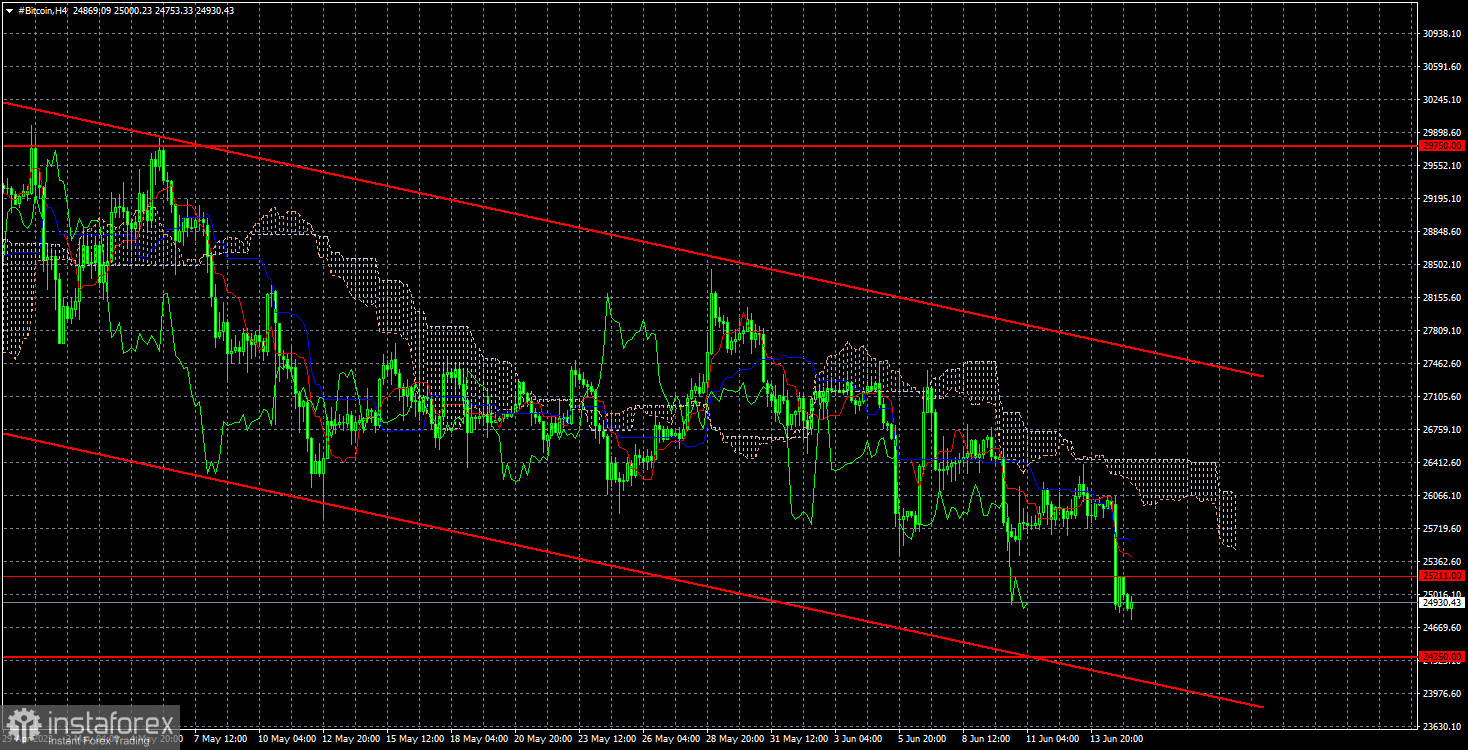

For over two months now, Bitcoin has been trading in a downward trend. The price has not made any attempts to stabilize above the channel, leaving no basis for growth expectations in the near term. We need at least some buying signals (including on the 24-hour time frame) to count on Bitcoin strengthening. The daily chart is particularly important right now, as the price approaches the ascending trend line.

As the Federal Reserve was announcing meeting results and Jerome Powell was delivering press conference comments. Binance US was losing customers, money, and trading volume. According to Kaiko, a data analytics company, Binance's share of the US market has dropped to 2.7%, its lowest since 2020. The last few months have seen trading volumes plunge to $3.5 million from $17.6 million. Interestingly, Coinbase, also in hot water with the SEC, has not faced the same issues. Its trading volumes have barely changed recently. Binance, on the other hand, has already delisted ten trading pairs and announced a pause in US dollar deposits from June 13. Major players like Wintermute and Keyrock have already left the exchange. The court ruling has not been delivered yet but customers are already leaving the exchange and withdrawing their funds. We should probably brace for the worse.

Notably, many crypto exchanges along with modern companies are maxed out on credit. Not all borrowed funds can be credited. Some might be investments. The loss of liquidity could pose serious problems for the world's biggest exchange. Not so long ago, the sizable FTX exchange crashed, prompting the SEC to start regulating crypto companies. So there is tension in the market now, as a crash or exit from the US market by Binance could have serious repercussions. So, despite the Fed's first pause in tightening monetary policy in 15 months, Bitcoin lacks substantial reasons for growth.

On the 4-hour timeframe, the cryptocurrency is trading in a downward channel. You could sell Bitcoin with each rebound from $29,750 with the target at $25,211. Now we can also add a target of $24,350. One may consider new purchases will be possible after strong buy signals form on the 24-hour time frame or the currency stabilizes above the downward channel on the 4-hour time frame. Neither is happening now and it is better to sell BTC with the mentioned targets.