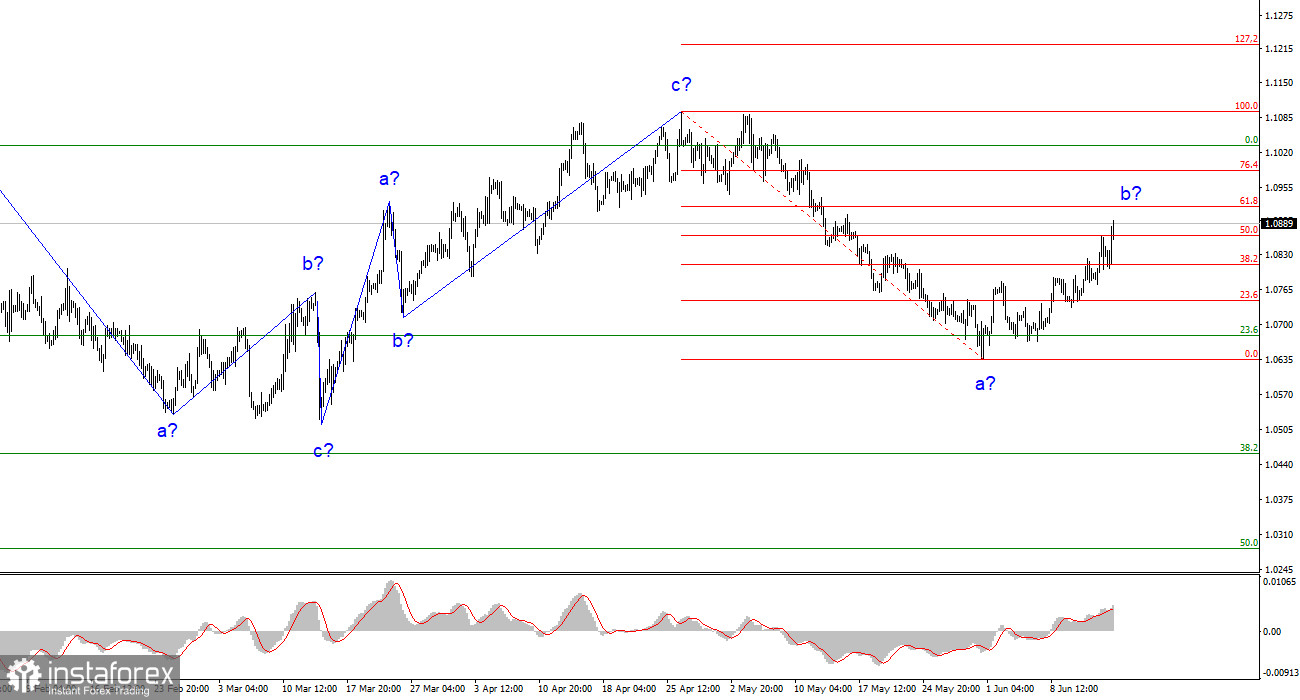

The wave analysis of the 4-hour chart for the euro/dollar pair continues to remain non-standard but understandable. The quotes continue to move away from the previously reached lows, presumably within wave b. The entire ascending trend that started on March 15 may still theoretically take on a more complex structure, but at the moment, I expect the formation of a descending segment of the trend, which is likely to be three-wave as well. Recently, I have regularly mentioned that I expect the pair to be near the 5th figure, from where the upward three-wave structure began.

The top point of the last segment of the trend was only a few dozen points above the peak of the previous upward segment. Since December of last year, the pair's movement can be considered horizontal, and such a character of movement will continue. The presumed wave b, which could have started its formation on May 31, currently has a convincing appearance and could end at any moment, as it exhibits three waves within it.

The ECB's decision to raise rates increased the demand for the euro

The euro/dollar exchange rate increased by 65 basis points on Thursday after the ECB raised rates by 25 basis points each. This decision was expected, and the market did not anticipate any other outcome. Therefore, we witnessed a logical increase in demand for the European currency. Thus, the presumed wave b continues to form, and after its completion, the pair should resume its decline. I have repeatedly mentioned that the market had sufficient opportunities to anticipate the ECB's rate hike in June. This often happens, and there is nothing extraordinary about it. If this assumption is correct, the formation of wave b could already be completed today. Two important central bank meetings are now behind us; we have obtained the information and made the conclusions.

And the conclusions are as follows. The ECB may raise rates 1-2 more times, and the Fed may raise rates 1-2 more. The ECB will raise rates once more by 25 basis points with a 100% probability, while the Fed's actions will depend on the pace of inflation reduction. Overall, in the remaining half of 2023, we can expect approximately the same decisions from the central banks of the European Union and the United States. However, I want to remind you that the ECB's rate has now increased to 4%, while the Fed's rate did not increase yesterday but stands at 5.25%. This is a significant reason for the current wave analysis, assuming the formation of a descending wave c, to remain valid and effective in the coming weeks. Additionally, several important reports were released in the US today, which we will discuss in future reviews.

General conclusions.

Based on the conducted analysis, a new descending segment of the trend continues. Therefore, selling positions can be recommended now, as the pair has significant room for decline. I still consider the targets around 1.0500-1.0600 quite realistic, and I advise selling the pair with these targets in mind. New sales are recommended after the clear completion of wave b, which started from the 1.0678 level. I consider selling above the 1.0866 level, corresponding to the 50.0% Fibonacci retracement of wave a when MACD reversals occur.

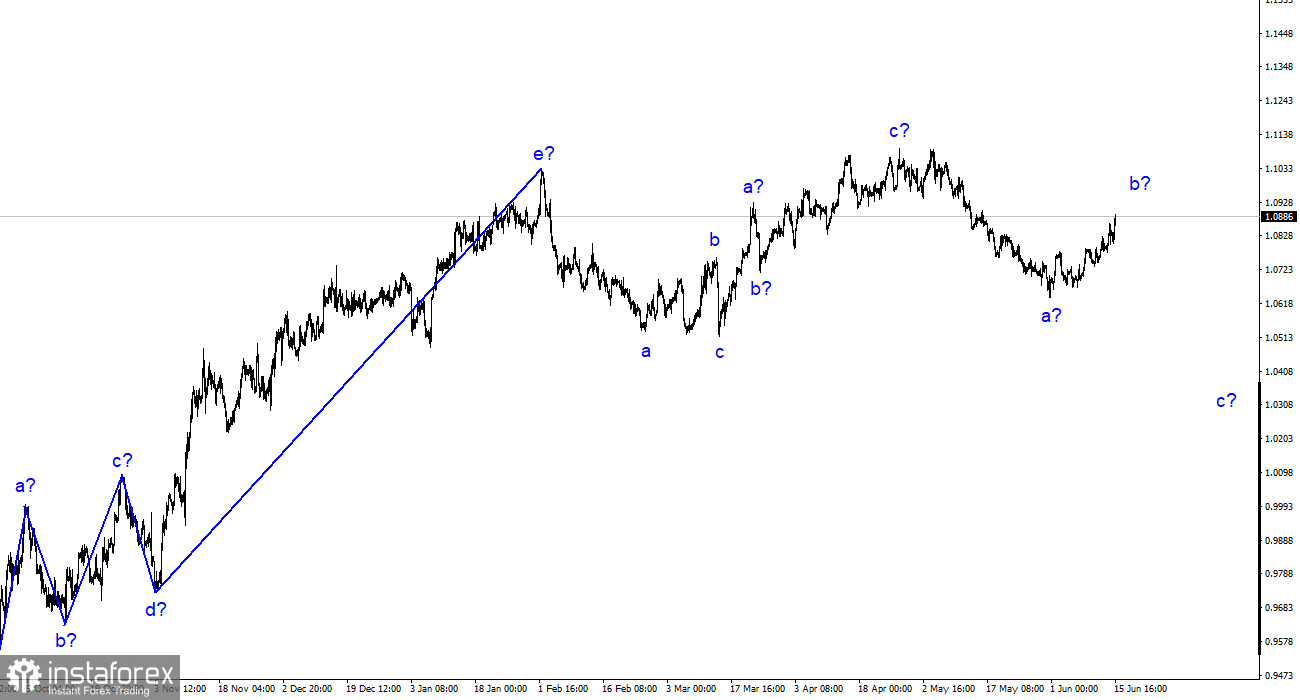

On a larger wave scale, the wave analysis of the ascending segment of the trend has taken on an extended form but is likely completed. We have seen five upward waves, which most likely form the structure of a-b-c-d-e. The pair then constructed two three-wave structures, downward and upward. It is likely in the process of forming another descending three-wave structure.