Both instruments that I regularly observe continue to rise, forming ascending waves. The wave counts may differ, but this week it doesn't matter much since the demand for the US dollar is decreasing while the demand for the euro and pound is increasing. In my opinion, this is not entirely fair, as Federal Reserve Chairman Jerome Powell did not signal the end of the monetary tightening process on Wednesday evening; on the contrary, he allowed for several more interest rate hikes. This implies a hawkish stance. What else does the market need to increase demand for the US dollar? To be fair, the EUR/USD instrument still has a good chance of declining, so it's alright for the dollar to fall right now. The question arises with the British pound, which intends to build an uptrend. This section may come to an end in the near future, and both instruments will begin to decline, but the British pound still demonstrates an incredible urge to rise.

The results of the European Central Bank meeting were just announced, which resulted in the euro's growth. The single currency pulled the pound up with it, and the pound gladly went along. In the US, the following reports were released on Thursday: retail sales volume increased by 0.3% in May (forecast was -0.1%), the Philadelphia Manufacturing Business Outlook Survey index stood at -13.7% (forecast was -13), initial jobless claims amounted to 262,000 (forecast was 249,000), and industrial production decreased by 0.2% (forecast was +0.1%). As we can see, practically all of these reports, albeit slightly, turned out to be worse than market expectations. Based on this, we can conclude that the dollar's fall was quite natural. However, we're still restless about the pound's uncontrollable growth (this does not apply to the euro).

Since the market is currently bullish, we can expect the dollar to fall further. Even if the Fed did not stop the decline, the euro and pound can still take advantage of the situation. The wave count for the euro is more convincing, so you shouldn't ignore it. As for the pound, it is currently meaningless to make predictions when the market is only buying, and the wave count does not provide clarity, as wave 3 or C can have practically any length.

There is one more day left in this week, and on Friday, another important report will be released - the inflation in the European Union for May. It's a good thing that this is the final value, which is unlikely to change compared to the preliminary figure of 6.1% YoY. We can relax a bit.

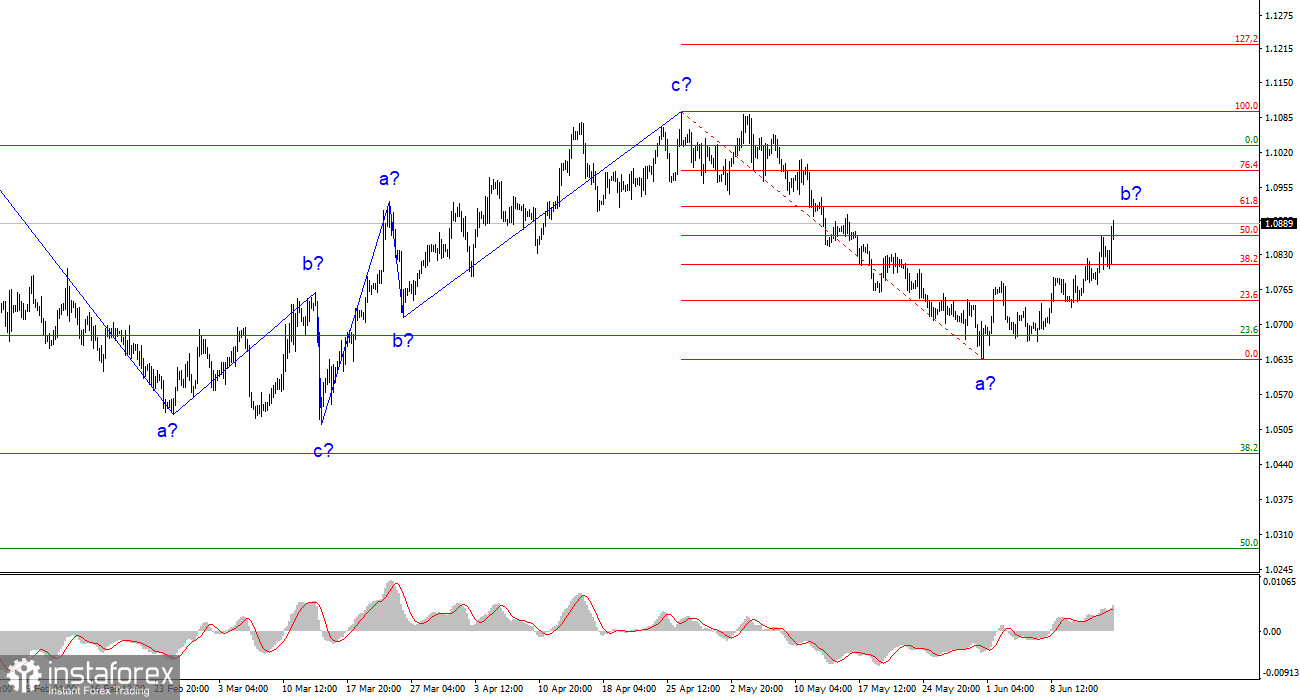

Based on the analysis conducted, I conclude that a new downtrend is currently being built. Therefore, I would recommend selling at this point, since the instrument has enough room to fall. I believe that targets around 1.0500-1.0600 are quite realistic. I advise selling the instrument using these targets. A corrective wave started from the 1.0678 level, so you can consider short positions if the pair surpasses this level or after wave b has obviously been completed. You may consider short positions above the level of 1.0866, which corresponds to the 50.0% Fibonacci retracement of wave a, and it can be done on a downward reversal of the MACD.

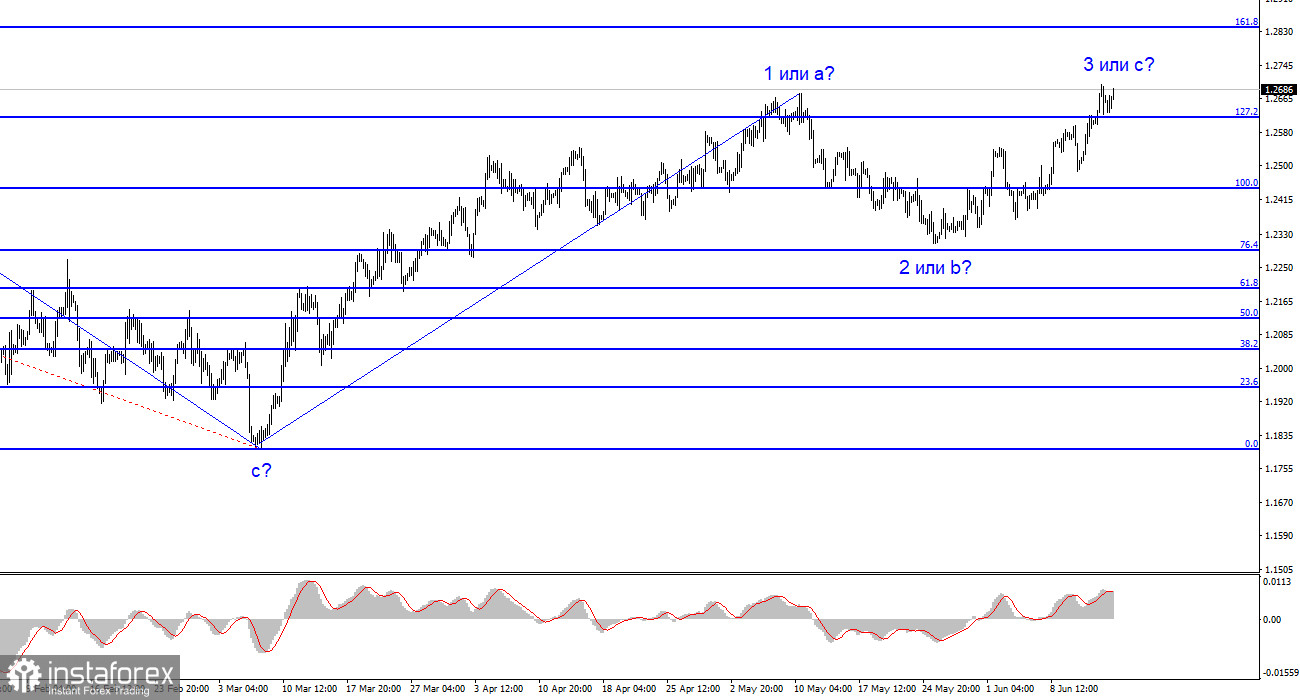

The wave pattern of the GBP/USD instrument has changed and now suggests the construction of an ascending wave, which can end at any moment. You may consider buying now, but this week's news background is strong, and the market may react to it in a sharp and ambiguous manner. Based on the analysis, I would not rush into buying or selling at this time.