The hawkish surprise of the FOMC meeting, which concluded on Wednesday evening, was that the dot plot showed the median end-2023 dot at 5.6%, 50 basis points higher than in March. The new dot plot shows that only two current FOMC members do not see the need for further rate hikes this year. Nine out of 18 members see the need for two more hikes, four see the need for only one, and three see the need for either three or four hikes.

Furthermore, the dollar appreciated due to Federal Reserve Chairman Jerome Powell's comments. In a surprise move, the Fed signaled that it may raise rates twice more this year. Thus, the Fed seems to be trying to create the impression that the rate will be kept at higher levels for longer than the market expects. In addition to being a bullish signal for the dollar, another objective appears to be reducing inflationary expectations.

However, the futures market did not fully believe Powell, and the rate forecast currently suggests another hike in July, reaching a range of 5.25% to 5.50%. The probability of a second hike in September or November is estimated to be only 12%. Consequently, a pronounced bullish reaction to the outcome of the meeting is unlikely to occur, as one might have expected.

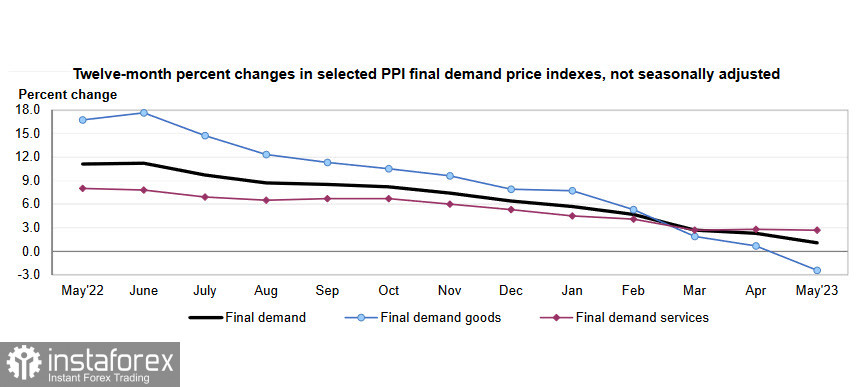

The latest data on the US Producer Price Index indicates that inflation is likely to continue declining. The index fell by 0.3% in May, and the core index decreased from 3.1% YoY to 2.8% YoY.

The European Central Bank meeting proceeded as expected, with a 25 basis points rate hike and the end of the Asset Purchase Program (APP) reinvestment from July. The projections have been revised upward for both core and overall inflation, with the important note that the 2025 forecast stands at 2.2%, above the ECB's target. It is more likely that the ECB will continue raising rates, and the forecasts are becoming increasingly hawkish, providing undeniable support to the euro in the short term.

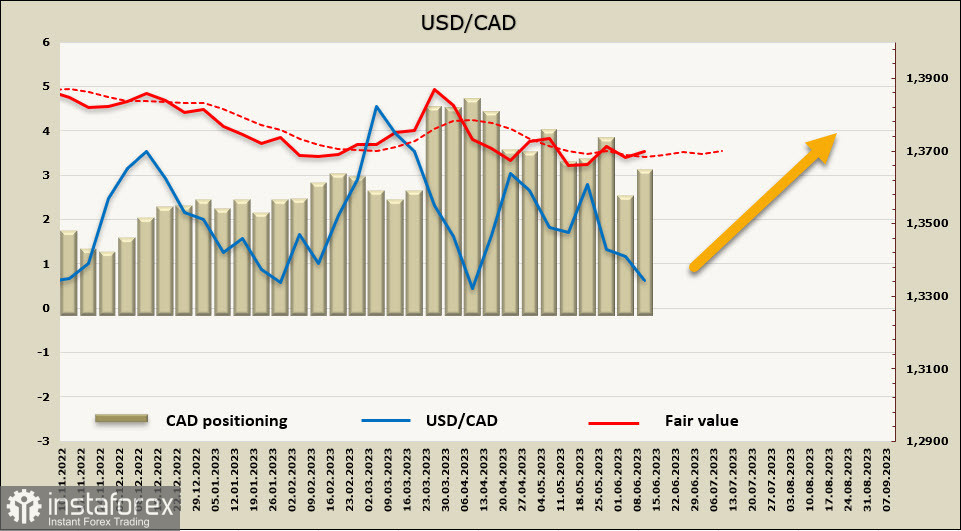

USD/CAD

The Bank of Canada's interest rate hike was the main driver behind the Canadian dollar's appreciation. This decision was motivated by sustained consumer demand and persistent inflationary pressures.

Weaker-than-expected labor market data for May halted the loonie's rise, but they still show indicators that the labor market remains tight, and wage growth remains strong, which is inconsistent with the Bank of Canada's inflation goals. Accordingly, the probability of another rate hike in July is quite high. In addition, improved external trade supports further strengthening of the CAD.

The net short position on CAD increased by 660 million over the reporting week to -2.86 billion, indicating a stable bearish positioning. The calculated price does not show a clear direction but is above the long-term average with a tendency for further growth.

A week earlier, we expected the loonie to fall, and this forecast has been confirmed as it reached the 1.3295/3305 target, and the downward movement is intensifying. Since the calculated price is turning upward, we assume that the most likely scenario will be the formation of a local base near current levels and a return to the middle of the sideways range, with a target of 1.3520/50. A less probable scenario is another downward movement and a breakthrough of the lower boundary of the horizontal channel at 1.3225, followed by an attempt to move out of the channel below. However, additional foundations are necessary for such a development. If the Canadian dollar manages to establish itself below 1.3225, the next target will be 1.3060, but it may take some time for an upward reversal.

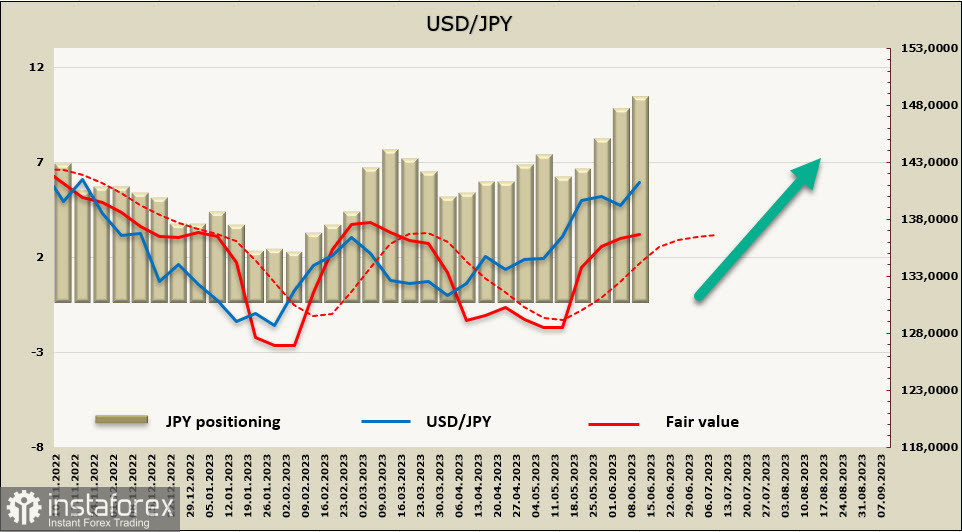

USD/JPY

On Friday morning, the Bank of Japan will announce the outcomes of its latest monetary policy meeting. The market consensus is that the Bank's leadership will unanimously vote to maintain the current ultra-soft policy. The BoJ governor has made it clear that he holds a dovish stance and sees no need for hasty actions regarding consumer price growth.

Furthermore, the BOJ does not feel any pressure that would prompt a reconsideration of yield curve control parameters. The bond market is functioning noticeably better than it was six months ago.

Another argument against policy changes is that the BOJ will not release a forecast report, which means that the board members will not provide specific predictions for improving core inflation.

As for the current depreciation of the yen, it is largely explained by the rapid increase in demand for Japanese stocks from global investors, and any tightening measures could lead to a significant correction in the stock market.

The net short position on the yen increased again during the reporting week, adding 782 million to reach -9.393 billion. The positioning remains consistently bearish, and the calculated price is above the long-term average, with an upward direction.

As expected, USD/JPY is moving higher, as the pair reached the nearest target of 140.91 and a new local high was established. There is a high probability of sustained growth. The next target is the technical level of 142.50. Reaching and staying above the channel boundary could contribute to further upward movement.