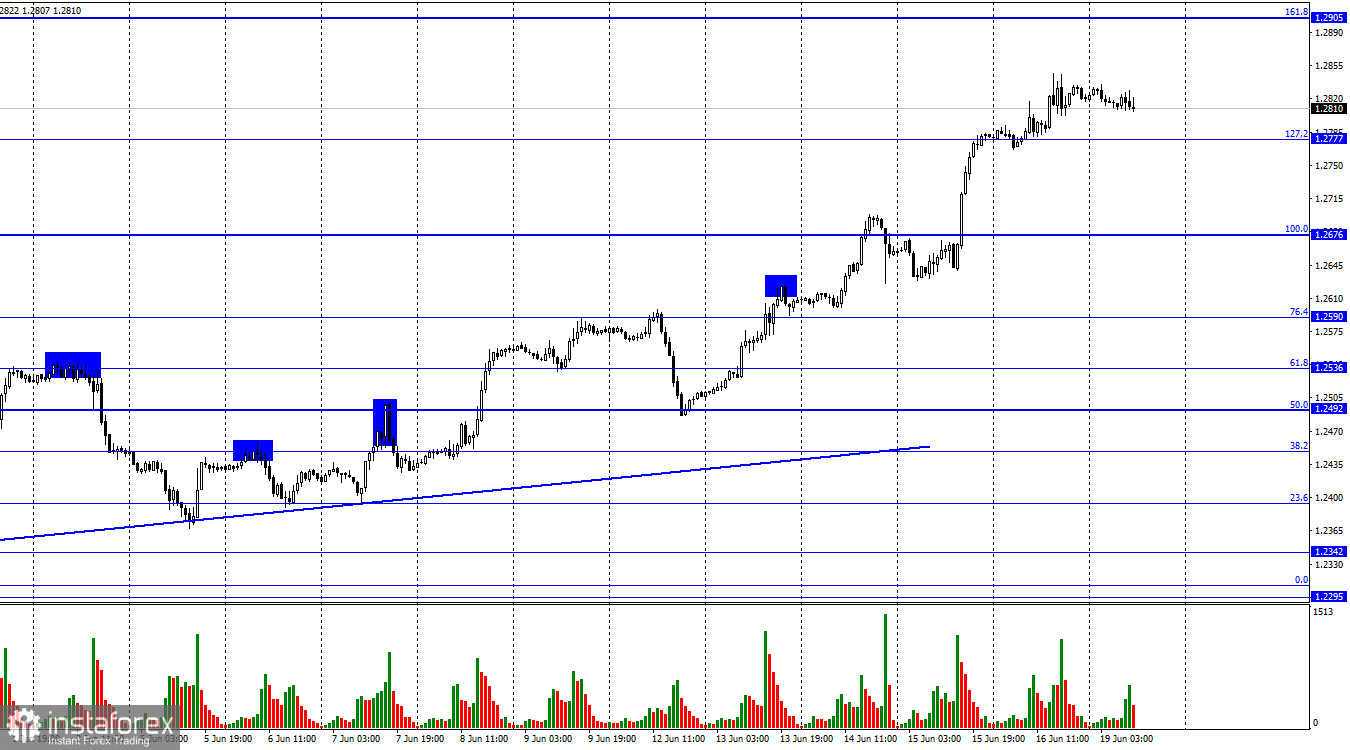

On the hourly chart, the GBP/USD pair on Friday consolidated above the Fibonacci corrective level of 127.2% (1.2777), which allows traders to anticipate further growth towards the next Fibonacci level at 161.8% (1.2905). If the pair's exchange rate closes below 1.2777, it would benefit the US currency and lead to some decline toward the corrective level of 100.0% (1.2676).

There was practically no news on Friday for the British pound, which did not prevent the bulls from continuing to exert pressure on the dollar. The ascending trendline indicates the persistence of bullish sentiment, which has strengthened recently. This week could be very eventful for the pound, just like the previous one. Last week, the Federal Reserve (Fed) held its meeting, the results of which could be considered both "moderately dovish" and "moderately hawkish." The FOMC allowed for further rate hikes, but in June, for the first time in 15 months, no tightening occurred. The market interpreted these decisions as "dovish," so we witnessed a new pound rise.

Now it's the Bank of England's turn, which will undoubtedly raise the rate again. However, if its statement allows for the end of tightening monetary policy in the near future, it may play a nasty trick on the pound. The market is attacking the pair as if the Bank of England is beginning the tightening process, with many "hawkish" decisions ahead. In reality, it is approaching a point where further tightening would be impractical and dangerous for an economy that has stagnated for the past four quarters. While it is merely stagnant, showing zero growth, further rate hikes would lead to a recession. Furthermore, until the rate starts to decrease, dreaming of an economic acceleration is futile. Meanwhile, inflation in the UK continues to decline very slowly. This week, the report for May will be released, which suggests a decrease in the Consumer Price Index by 0.2-0.3% month-on-month.

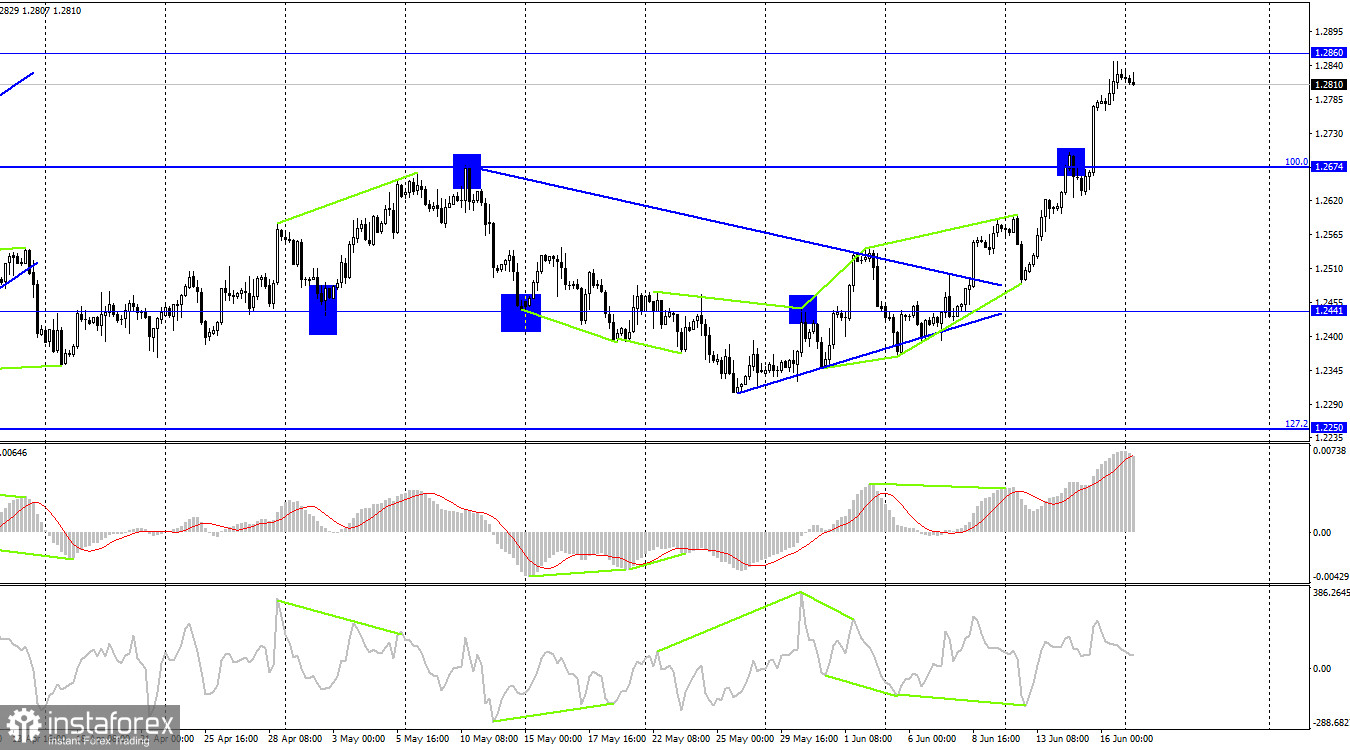

On the 4-hour chart, the pair consolidated above the Fibonacci corrective level of 100.0% (1.2674). Thus, the upward process can continue toward the next level at 1.2860. There are currently no emerging divergences observed in any indicator. A rebound of the pair's exchange rate from 1.2860 would benefit the US currency and lead to some decline towards 1.2674. Consolidation above 1.2860 would allow for an expectation of further growth towards the next corrective level of 76.4% (1.3044).

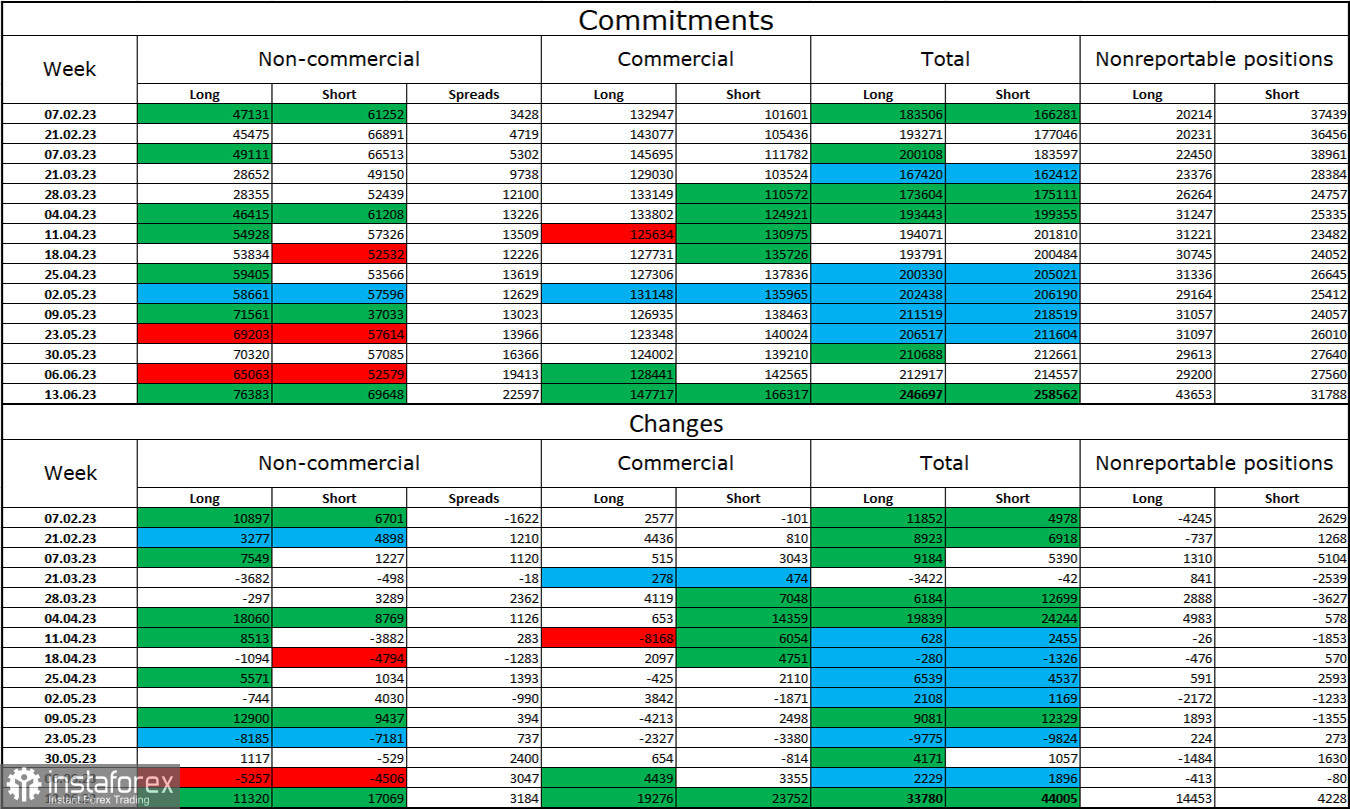

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" trader category became slightly less bullish during the last reporting week. The number of long contracts held by speculators increased by 11,320 units, but the number of short contracts increased by 17,069. The overall sentiment of major players remains predominantly bullish, but the number of long and short contracts is now almost equal - 76,000 and 69,000, respectively. The British pound has good prospects for further growth, and the current information background supports it more than the dollar. However, I do not expect a strong surge in the pound sterling in the coming months. This week's results of the Bank of England's meeting will help clarify the pound's prospects.

News calendar for the US and the UK:

Monday's economic events calendar contains only some important entries. The influence of the information background on trader sentiment will be absent today.

Forecast for GBP/USD and trader recommendations:

Sales of the pound can now be considered in case of a close below the 1.2777 level on the hourly chart, with a target of 1.2676. Purchases of the pound were possible on a close above the 1.2546 level, with targets at 1.2623, 1.2676, and 1.2810. All targets have been hit. New purchases on the hourly chart can be made on a close above the 1.2777 level, with targets at 1.2860 and 1.2905.