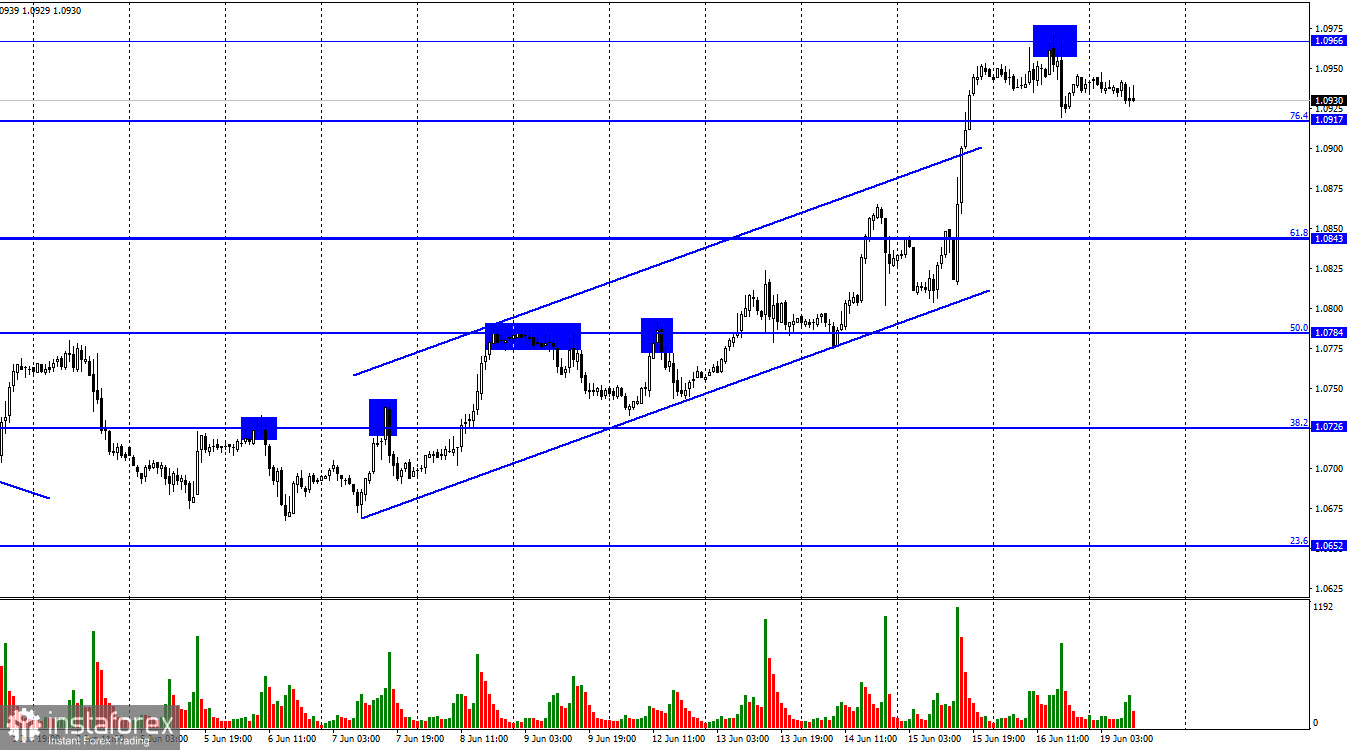

On Friday, the EUR/USD pair attempted to hold above the 1.0966 level, but a rebound from this level led to a reversal in favor of the US currency and a decline toward the corrective level of 76.4% (1.0917). A rebound from the 1.0917 level would allow traders to anticipate a return to the 1.0966 level. Closing below 1.0917 would increase the probability of further decline toward the next Fibonacci level at 61.8% (1.0843).

On Friday, the final value of inflation in the Eurozone for May became known. The consumer price index decreased to 6.1%, as indicated by the initial estimate of the indicator, which was announced two weeks ago. At the same time, core inflation slowed from 5.6% to 5.3%. Inflation has been falling in the EU for the seventh consecutive month, showing decent dynamics but exceeding the target level threefold. Further decline in inflation in June and July may lead the ECB to adjust its plans. I want to remind you that at the end of last week's meeting, the regulator allowed further tightening after the summer of 2023. However, if inflation decreases in the coming months to 4.5%, considering the less-than-ideal state of the European economy, which finished the last two quarters with a result of -0.1%, the ECB may refrain from further tightening monetary policy. We can expect one more rate hike.

Also, the US consumer sentiment index was released on Friday evening, which increased from 59.2 to 63.9. This report slightly supported the bears but needs more desire and strength to seize the initiative. The sellers must close below at least 1.0917, or even better, below the ascending trend corridor, which would change the current market sentiment to bearish.

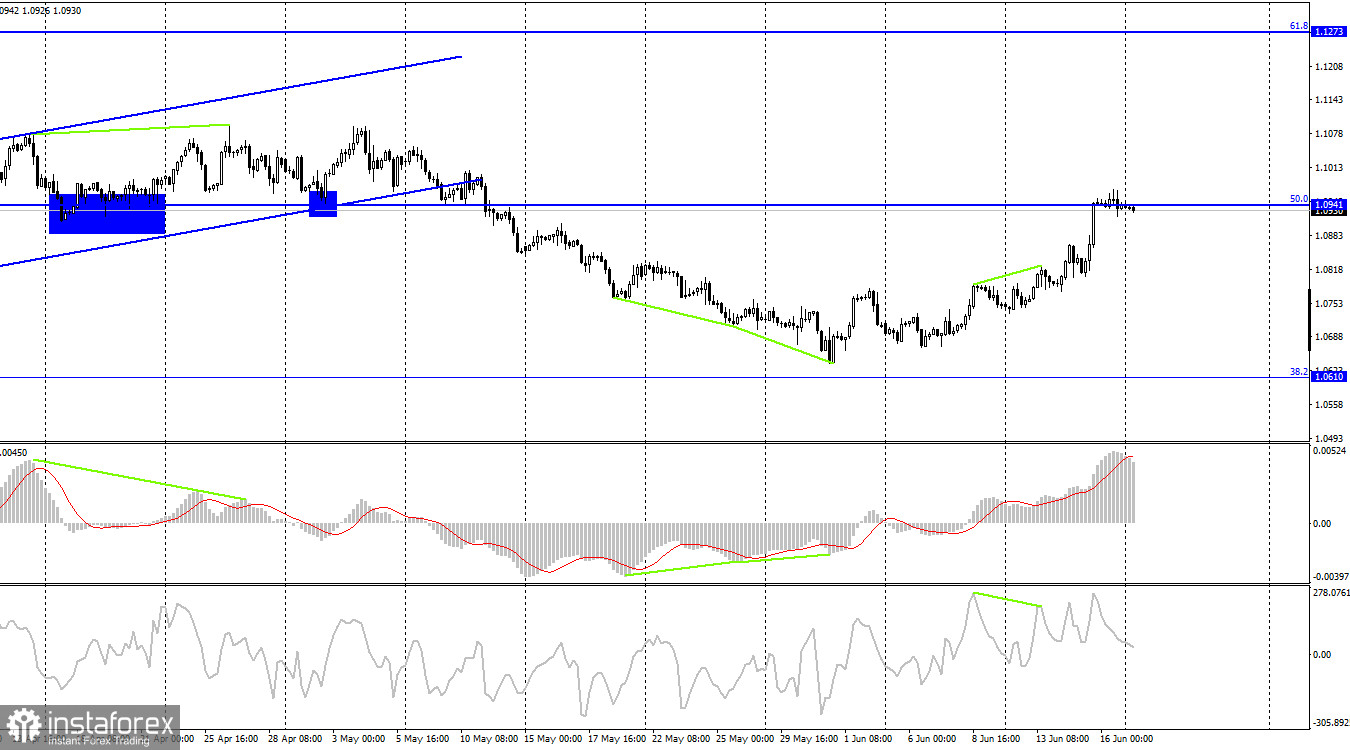

On the 4-hour chart, the pair has risen to the Fibonacci level of 50.0% (1.0941). The bearish divergence in the CCI indicator, which formed last week, has been canceled. A rebound from the 1.0941 level would favor the US currency and lead to some decline towards 1.0610. Consolidating quotes above the 1.0941 level would increase the chances of further growth towards the next corrective level of 61.8% (1.1273).

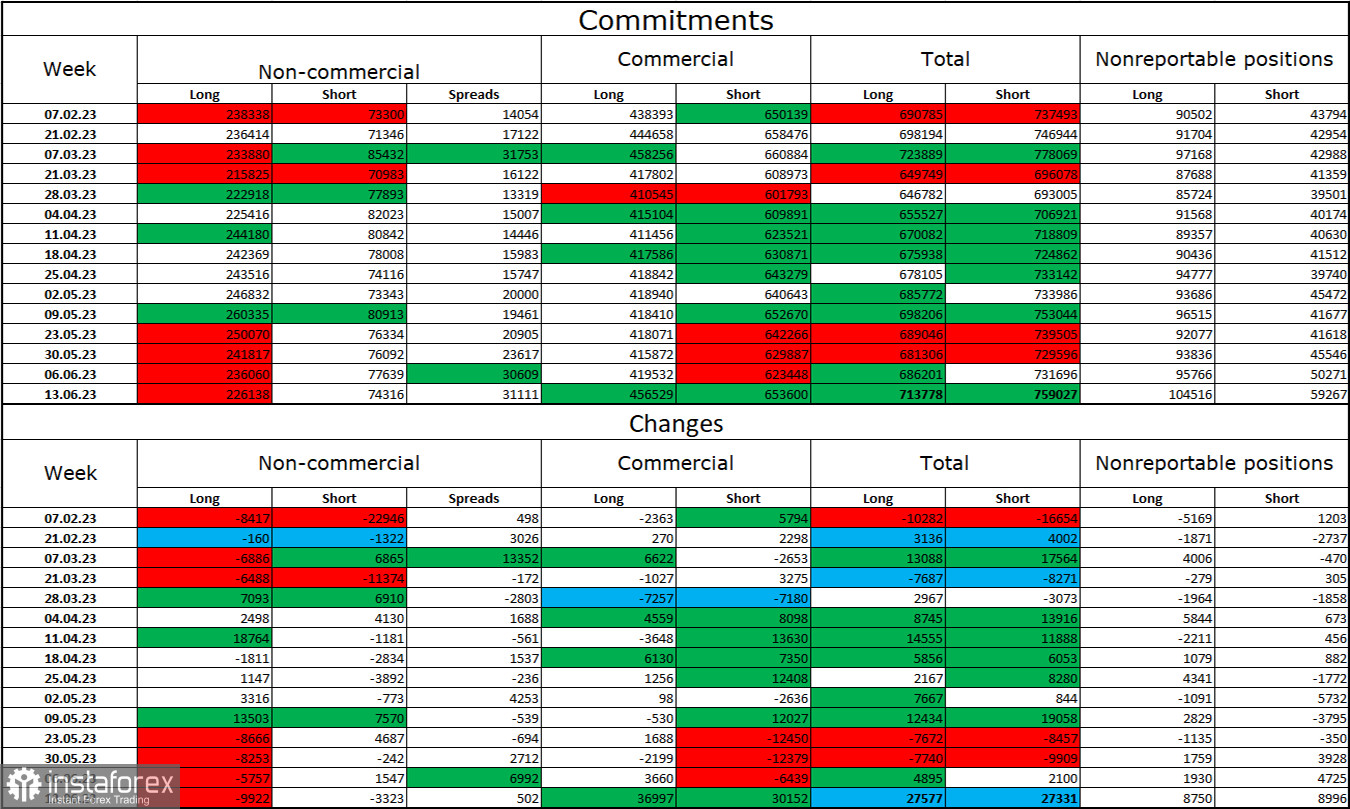

Commitments of Traders (COT) report:

In the last reporting week, speculators closed 9,922 long contracts and 3,323 short contracts. The sentiment of large traders remains bullish but is gradually weakening. The total number of long contracts held by speculators now stands at 226,000, while short contracts amount to only 74,000. Strong bullish sentiment is still present, but the situation will continue to change soon. The euro has been experiencing slightly more declines than increases in the past two months. The high value of open long contracts suggests that buyers may start closing them soon (or have already started, as indicated by the recent COT reports). There is currently an imbalance heavily skewed toward the bulls. The current figures allow for a potential further decline in the euro soon.

News calendar for the US and the Eurozone:

On June 19th, the economic events calendar includes only a few noteworthy entries except for a few speeches by ECB members. The impact of the news background on trader sentiment in the remaining part of the day may be weak.

Forecast for EUR/USD and trader advice:

I recommended selling the pair on a rebound from the 1.0966 level on the hourly chart, with targets at 1.0917 and 1.0843. The first target has been reached. I advise buying the pair on a rebound from the 1.0917 level, with targets at 1.0966 and 1.1035. Trading volumes have declined after last week, and today traders' activity is expected to be low.