The US dollar has been trading higher for the fourth consecutive session, but its strength is limited. Overall, markets are treading water in anticipation of Federal Reserve Chair Jerome Powell's testimony before the US House of Representatives, just a week after the FOMC meeting. We shouldn't expect any significant movements from currency pairs until the reason for this haste becomes clear.

Since the markets interpreted the outcome of the FOMC meeting as less hawkish, the potential for a strong USD rally is low, and Powell's speech may tilt the fragile balance in one direction or another.

Risk appetite remains weak due to concerns about the state of the Chinese economy. Asian-Pacific stock markets closed in the red on Wednesday morning, largely due to the decline in Chinese tech stocks. Europe was also trading in the red, and gold futures have dropped to a three-month low. In the current conditions, expecting an increase in risk appetite is unlikely, so commodity currencies are likely to continue declining.

NZD/USD

The New Zealand economy contracted by 0.1% in the first quarter, which was weaker than market expectations. GDP per capita declined by 0.7%, driven in part by high inflation and higher interest rates.

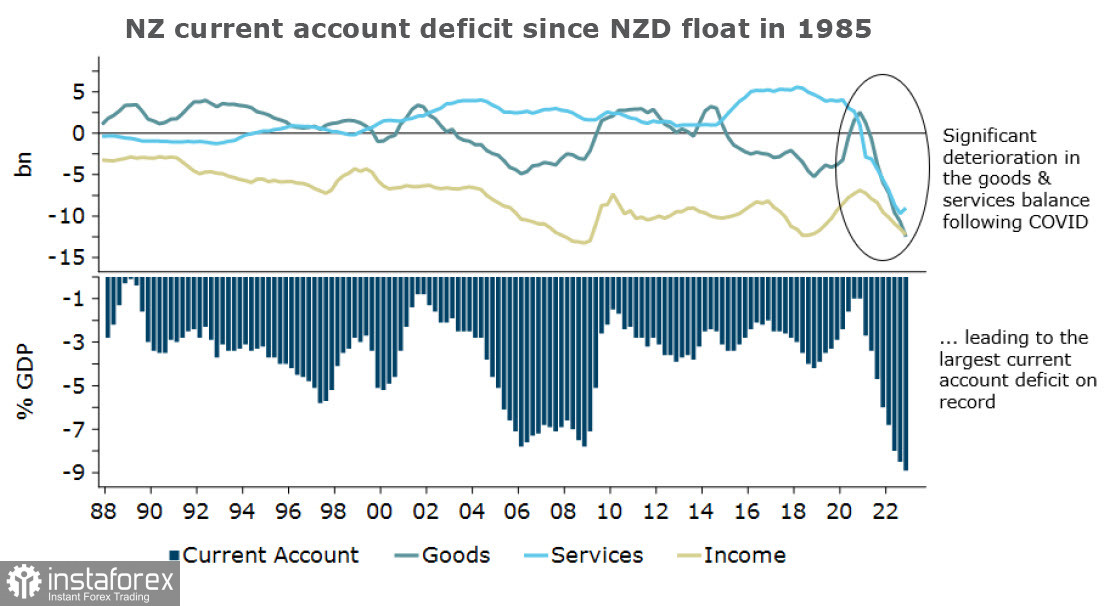

It is too early to draw negative conclusions despite the confirmation of a technical recession, as net migration is showing growth, which will have a positive impact on consumer demand. However, there is another factor that may play a more significant role in shaping the NZD exchange rate - the rapidly growing current account deficit. In the fourth quarter of 2022, it reached a record 9% of GDP, and in the first quarter of 2023, it slightly decreased to 8.5% of GDP, but there is no improvement in the situation.

A deficit is not always a negative quality for a currency exchange rate. For example, it can be driven by a high level of investment through accumulating external debt for future income growth. However, if the deficit is driven by consumption through rapid growth of domestic credit and an overvalued exchange rate, it can lead to loss of confidence in the currency and its devaluation.

Looking at the structure of New Zealand's current account, it is evident that the rapid growth of the deficit is driven by government spending, which has increased the primary income deficit and high import expenditures. These factors indicate that the accumulation of the current account deficit is primarily due to expenditures.

There is no direct correlation between the exchange rate and the current account. If the deficit grows due to positive economic factors, the exchange rate may also rise. However, if it grows due to negative factors, the exchange rate falls. In the current conditions, negative factors predominate for NZD, meaning that markets could stop ignoring the record current account deficit at any moment, and the kiwi could start weakening.

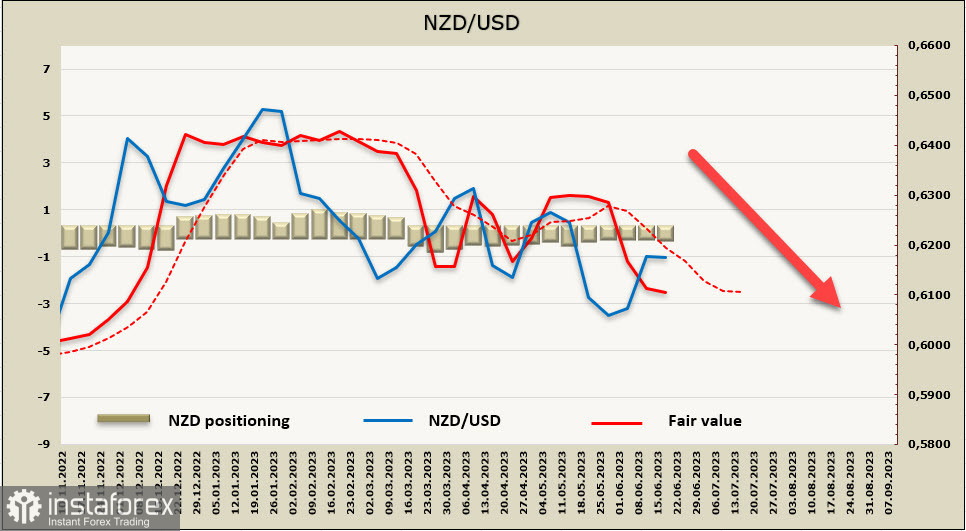

Positioning on NZD continues to stay near neutral levels, indicating that investors do not currently perceive significant risks of a rapid decline in the kiwi exchange rate. The weekly change is -8 million, with a net bearish bias of -51 million. The estimated price is noticeably below the long-term average and we are currently seeing a downtrend.

NZD/USD continues to trade within a bearish channel. The attempted rally was short-lived and the pair reversed back to the middle of the channel following the release of the FOMC meeting minutes last week. The probability of renewing the rally is low. The nearest target is a retest of the support zone at 0.5980/6020, followed by the lower band of the bearish channel at 0.5890/5910.

AUD/USD

The minutes of the Reserve Bank of Australia meeting appeared hawkish, but this did not result in the aussie's growth, and there are reasons for that.

Firstly, the phrase "some further tightening" disappeared from the minutes, which had been present in every set of minutes since May 2022 when the RBA first raised rates. However, although the phrase was removed, it remained in the accompanying statement and was later confirmed in RBA Governor Lowe's speech.

Secondly, the minutes contain several ambiguous formulations, such as "the possibility of holding the cash rate unchanged at this meeting and then reviewing it at subsequent meetings," which can be interpreted as "close the door for now but leave it open."

Without these amendments, the minutes would have been very hawkish, as the risks of inflation expectations moving beyond the previously indicated limits, caused by record wage growth as well as the tendency to automatically index spending that is gaining traction among firms and corporations.

Currently, the market forecast for the RBA's peak rate is 4.60%, which is lower than most other countries, creating a yield deficit and not contributing to an increase in demand for the aussie.

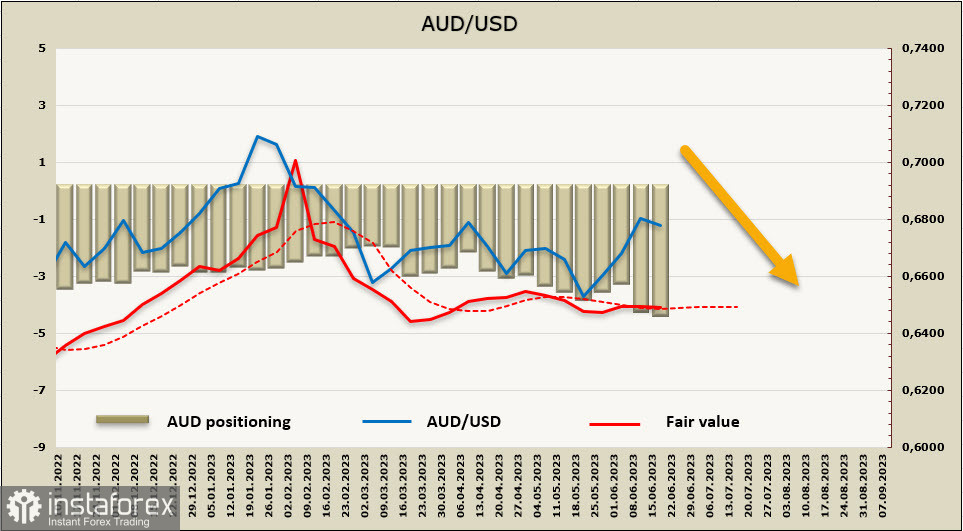

Net short positions on AUD increased by 411 million to -4.178 billion over the reporting week. The positioning remains predominantly bearish, but the estimated price direction is inconclusive.

AUD/USD

The FOMC meeting triggered a breakout above the resistance line at 0.6817, which the market perceived as ambiguous for the USD despite the aggressive rhetoric. The upward move failed to gain momentum, and at the moment, there's a higher probability of a decline. The nearest target is the technical resistance at 0.6732, with the main target seen in the support zone at 0.6630/50. There are currently no clear reasons for the decline to gain traction.