Recent speeches by FOMC members, including Federal Reserve Chairman Jerome Powell, have clearly indicated that in the second half of 2023, there are more rate hikes ahead. It will depend on the pace of inflation. As I have mentioned before, there will be two more inflation reports released before the next Fed meeting, which could convince most FOMC members of the need for more tightening. However, with inflation at 4%, it seems that the Fed is inclined towards further rate hikes.

Powell appeared before the House Financial Services Committee in the United States. During his speech, he noted that the Consumer Price Index remains significantly above the target level, so it would be appropriate to continue tightening monetary policy. "Nearly all FOMC participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year," Powell said. "But at last week's meeting, considering how far and how fast we have moved, we judged it prudent to hold the target range steady to allow the Committee to assess additional information and its implications for monetary policy. In determining the extent of additional policy firming that may be appropriate to return inflation to 2% over time, we will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments."

Powell did not ignore the labor market in his speech. He noted that the labor market and unemployment are likely to react negatively to the cost of borrowing, but the extent of these consequences is currently unclear. It is worth recalling that unemployment in the United States remains near its lowest level in half a century, and the labor market consistently creates a significant number of jobs each month. Thus, the consequences are not yet evident, but we should remember that the reaction of these indicators can also be delayed. "The U.S. banking system is sound and resilient. We will continue to make our decisions meeting by meeting," Powell summarized.

The demand for the dollar slightly decreased after this speech, but not significantly. I believe it should not hinder the construction of the anticipated downward waves for both instruments. As I have mentioned in previous articles, the euro and pound only rose by 40 pips on Wednesday. Now the focus has shifted to the BoE meeting. It will be very interesting to see how the central bank responds to core inflation. I don't think the BoE will raise the rate five more times, which is what it would take to bring inflation back to at least 4-5%, let alone 2%.

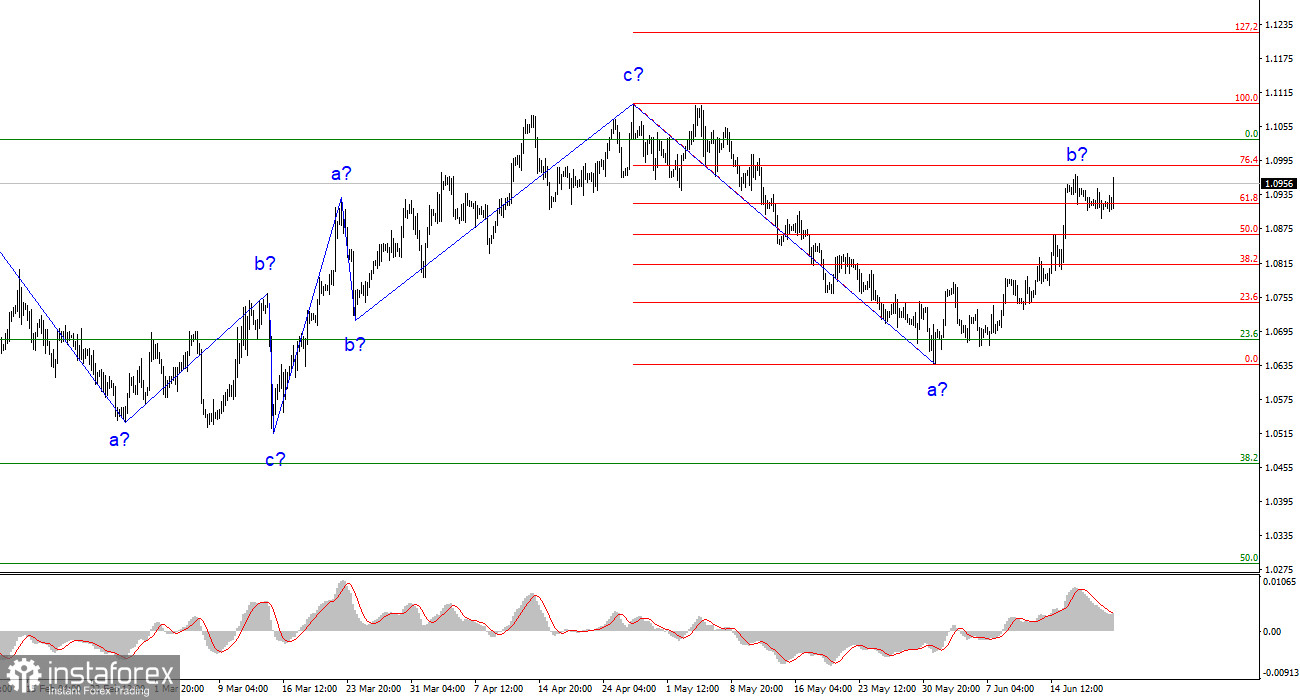

Based on the analysis conducted, I conclude that a new downtrend is currently being built. The instrument has enough room to fall. I believe that targets around 1.0500-1.0600 are quite realistic. I advise selling the instrument using these targets. I believe that there is a high probability of completing the construction of wave b, and the MACD indicator has formed a "downward" signal. You can sell with a stop loss placed above the current peak of the presumed wave b.

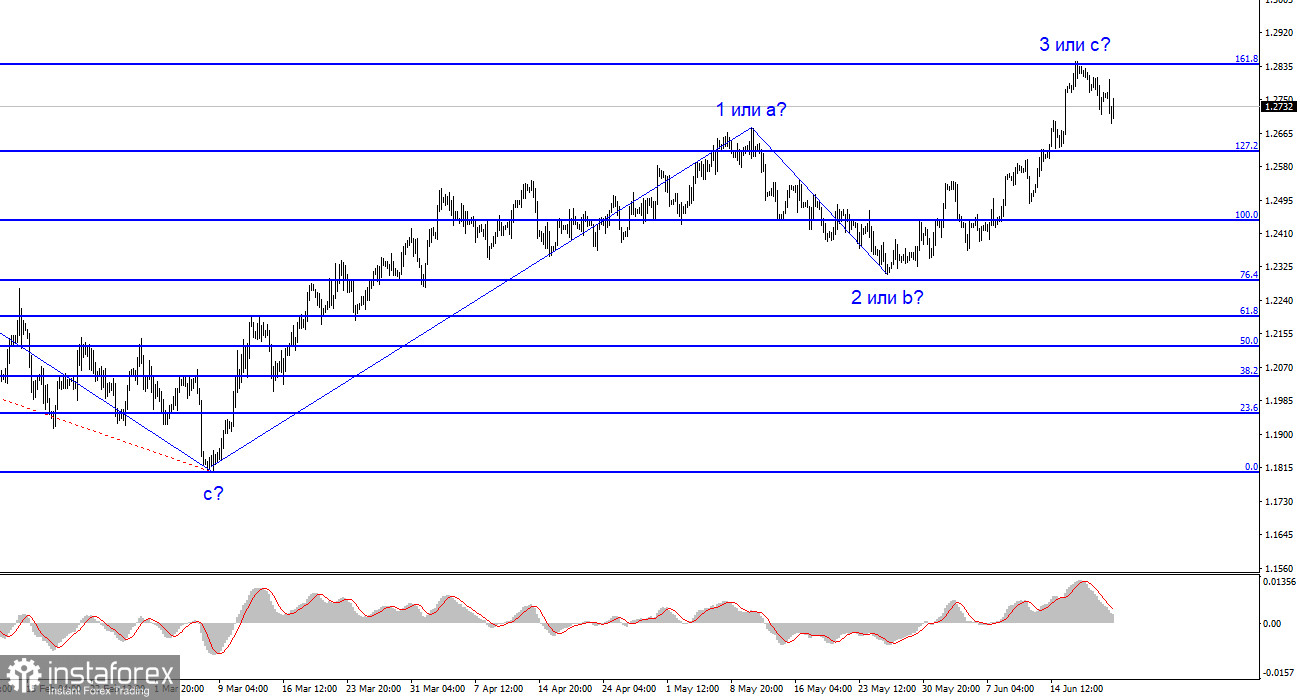

The wave pattern of the GBP/USD instrument has changed and now it suggests the formation of an upward wave that can end at any moment. You may consider buying the instrument only if there is a successful attempt to break above the 1.2842 level. You can also sell since the first attempt to break through this level was unsuccessful, and a stop loss can be set above it.