EUR/USD

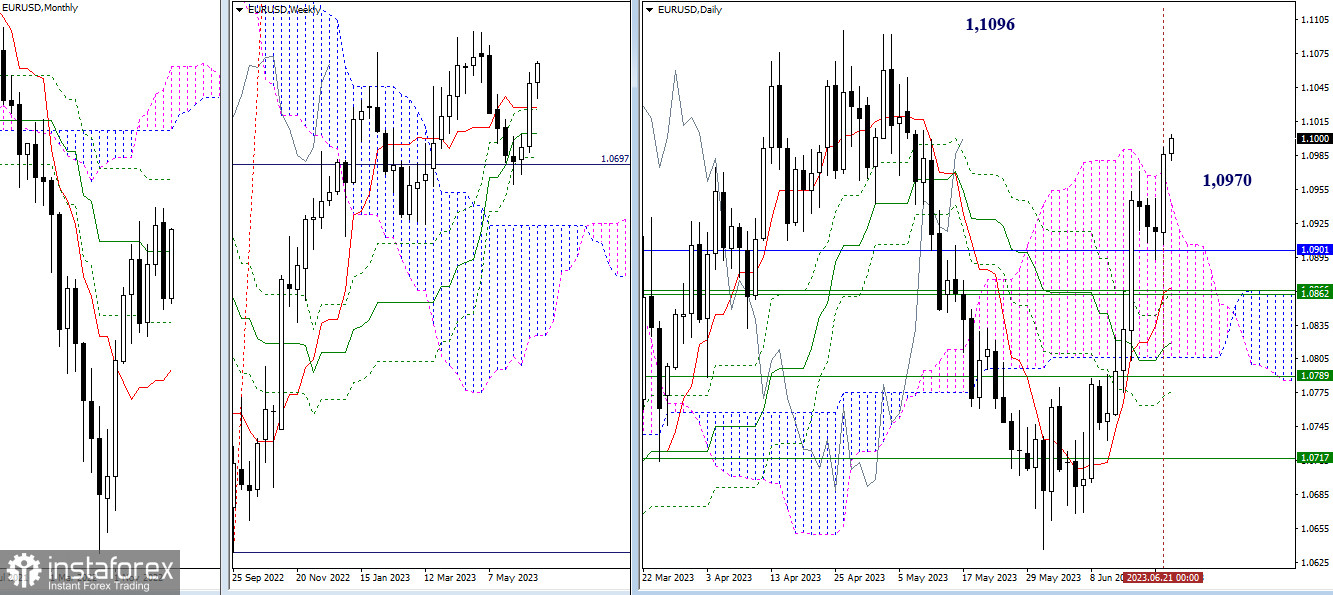

Higher timeframes

Bullish players completed the correction and updated the high, continuing the upward movement. In doing so, they entered and closed the previous day above the daily cloud. If there is consolidation in the bullish zone relative to the daily cloud, and the upward movement continues, the daily target for a cloud breakout can be added to the bullish targets. In the meantime, the immediate target is to update the high (1.1096) and the recovery of the weekly upward trend. The upper boundary of the daily cloud (1.0970), the monthly medium-term trend (1.0901), and the area of 1.0862-69, which combines daily and weekly levels, serve as support in the current conditions.

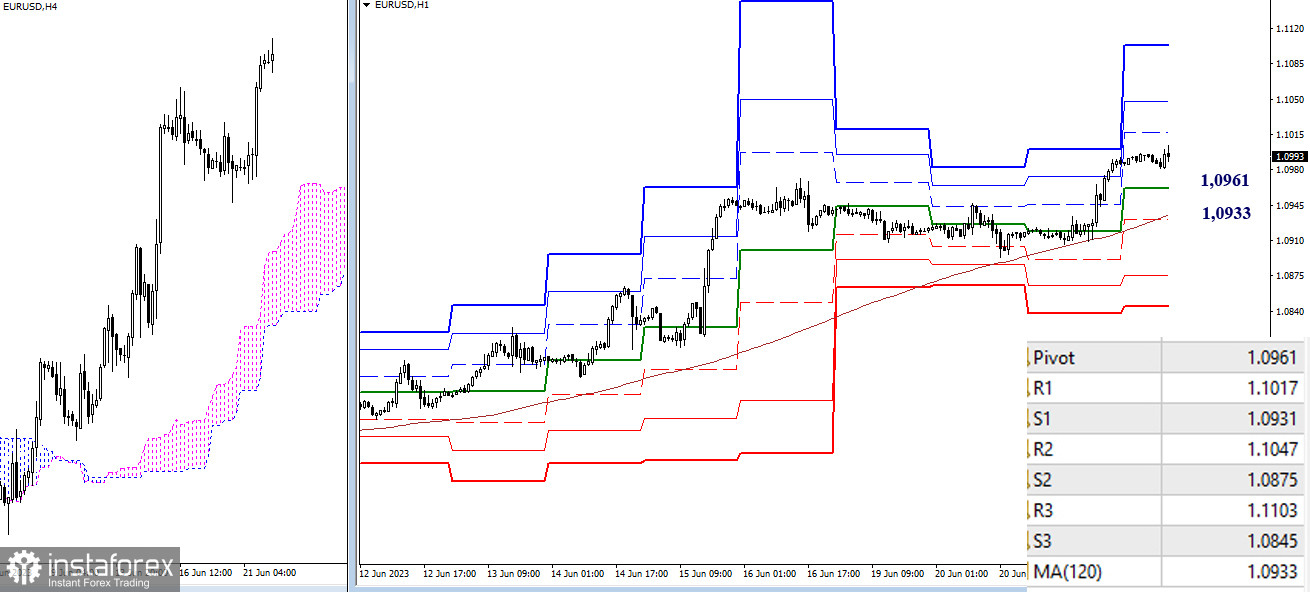

H4 - H1

Yesterday, the weekly long-term trend accomplished its task and prevented the market from continuing the decline, maintaining the bullish advantage. Today, on lower timeframes, we see the development of an upward trend, and the classic pivot points (1.1017 - 1.1047 - 1.1103) serve as targets. Key levels still form the most significant support zone, defending bullish interests at the levels of 1.0961 (central pivot point of the day) and 1.0933 (weekly long-term trend).

***

GBP/USD

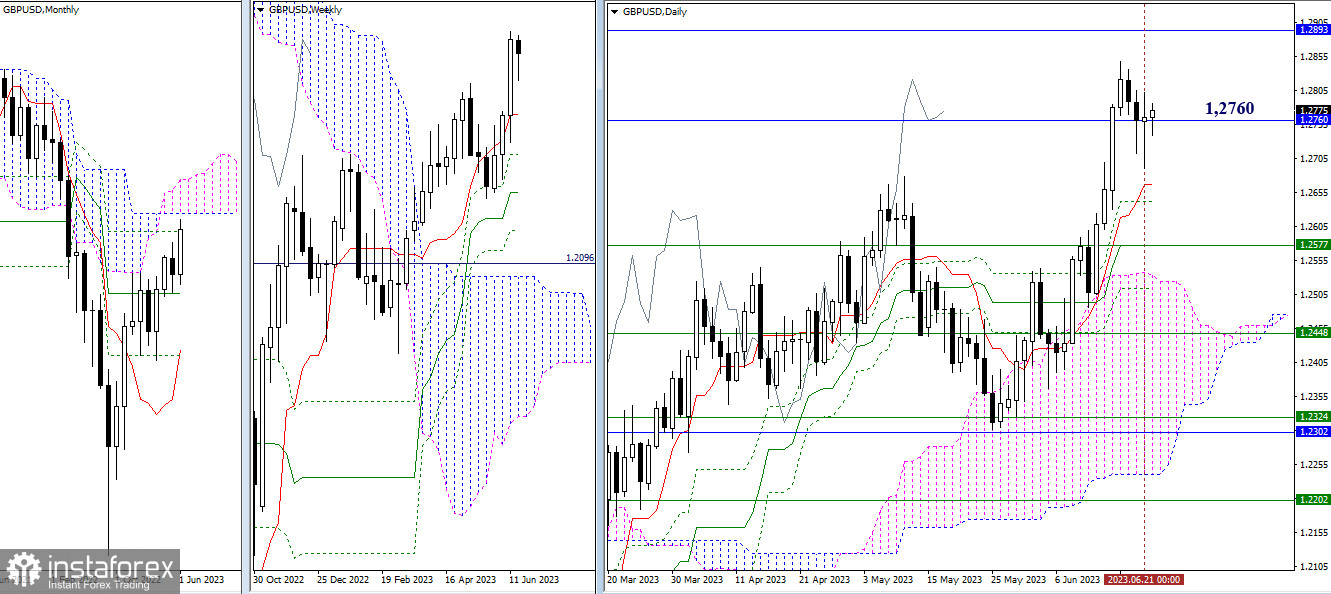

Higher timeframes

The monthly level of 1.2760 on this segment restrains the bearish pressure, preserving the opponent's achievements. When bullish activity returns and the high of the current correction is updated, the main focus will be on the result of testing the lower boundary of the monthly cloud (1.2893). In the case of breaking through 1.2760, bears will encounter support from the daily short-term trend, which is currently at 1.2666.

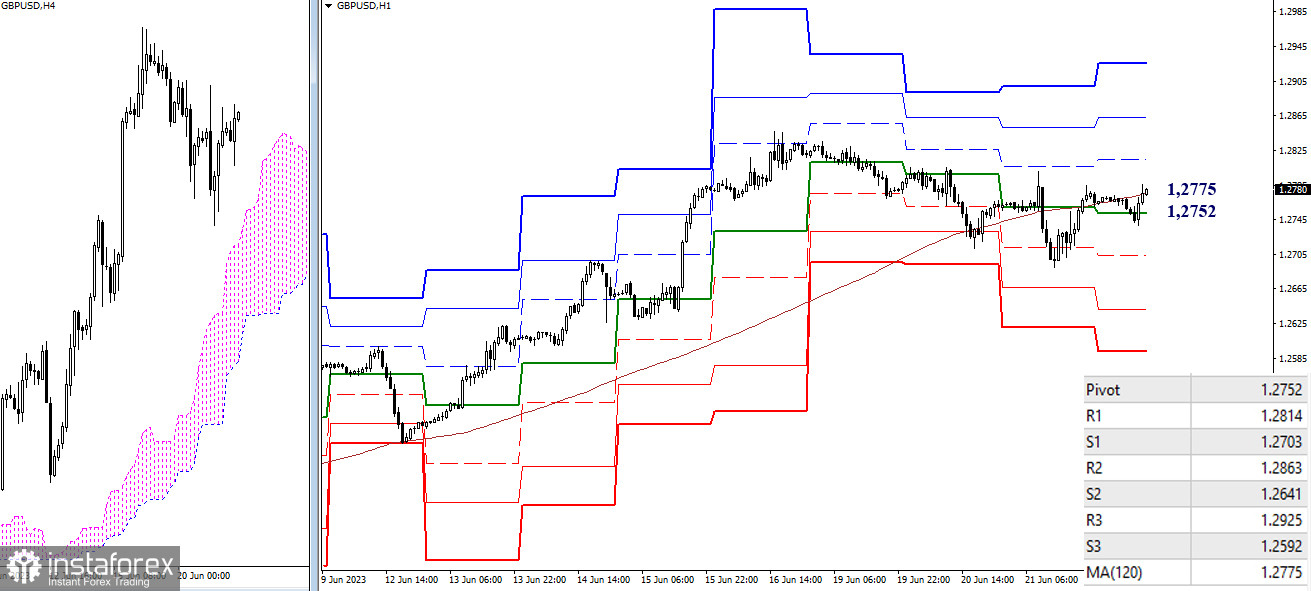

H4 - H1

On lower timeframes, bulls lost their main advantage yesterday. Therefore, they are again fighting for the control of key levels, which are now joining forces in the area of 1.2752 - 1.2775 (central pivot point of the day + weekly long-term trend). For bulls, the resistance levels of the classic pivot points (1.2814 - 1.2863 - 1.2925) serve as targets within the day. For bears, the support levels of the classic pivot points (1.2703 - 1.2641 - 1.2592) may be significant.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)